Risk Management Reinvented: The Bold Leap from GRC to IRM and the Masterminds Behind It

The landscape of risk management is continuously evolving, with Integrated Risk Management (IRM) emerging as the successor to traditional Governance, Risk, and Compliance (GRC) approaches. In this article, we will discuss the evolution beyond GRC to IRM, explore the broader applications of IRM, and highlight the contributions of John A. Wheeler, the "Godfather of IRM," and Michael Rasmussen, the "Father of GRC."

The GRC Era and Its Limitations

GRC, championed by Michael Rasmussen when he was at Forrester in 2002, provided organizations with a structured approach to managing their compliance risks, requirements, and related activities. However, as the business environment became increasingly complex and interconnected, the traditional GRC model revealed its limitations. Focused on concrete, specific controls, GRC mainly addressed technical or compliance-related downsides, failing to provide a full view of an organization's risks and opportunities. Norman Marks, a thought leader in risk management and internal audit, describes the ineffectiveness of GRC in this way. “Very few self-described GRC solutions and platforms have any significant functionality around setting and communicating objectives and strategies, let alone integrating risk into the measurement of performance against those objectives and strategies,” Marks observes.

The Emergence of IRM: A Connected Approach

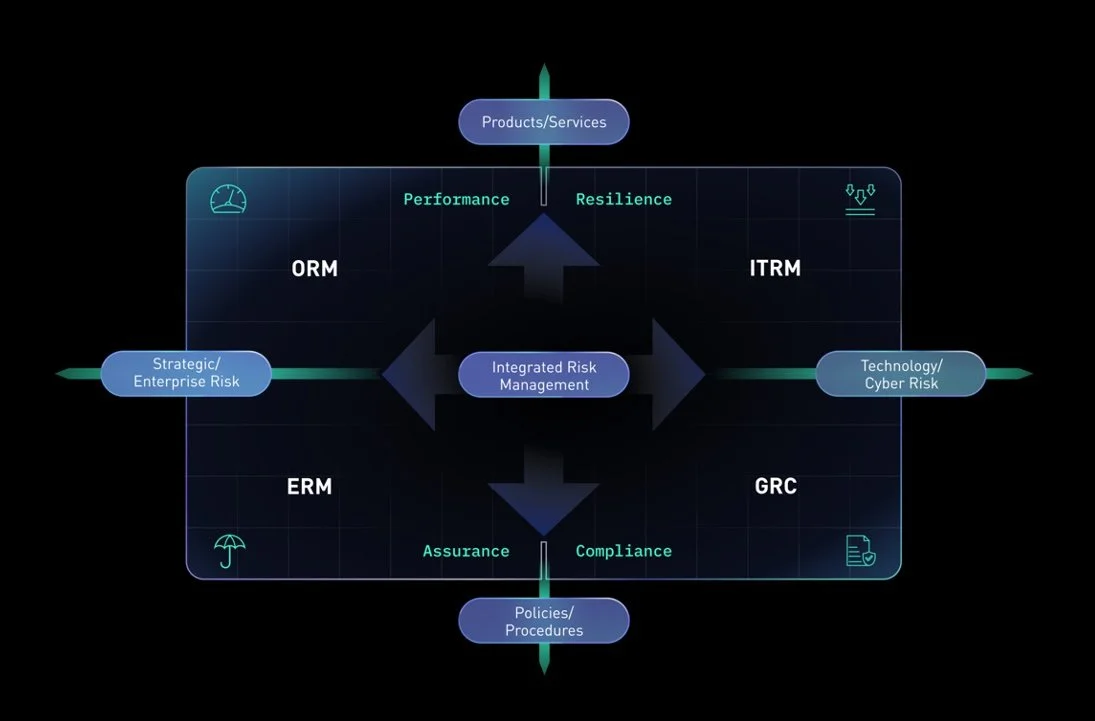

John A. Wheeler, while at Gartner in 2017, coined the term "Integrated Risk Management" and is often referred to as the "Godfather of IRM." He recognized the need for a more integrated and comprehensive approach to managing risk, including compliance. IRM goes beyond compliance and controls, addressing the entire spectrum of risks a company faces, such as strategic, operational, sustainability, and digital risks. By creating a proactive, risk-aware culture, IRM enables organizations to leverage risk analysis to drive business strategy. IRM also bridges the gap between GRC and other risk disciplines, such as information technology risk management (ITRM), operational risk management (ORM), and enterprise risk management (ERM).

IRM's Broader Applications

Strategy and decision-making: IRM's comprehensive approach allows organizations to use risk analysis to identify opportunities, develop strategies, and make informed decisions in a rapidly changing business environment.

Operational efficiency: By fostering collaboration and communication across all departments, IRM helps businesses optimize processes and identify potential risks, thereby increasing operational efficiency.

Performance management: IRM enables organizations to set key performance indicators (KPIs) related to risk management, monitor progress, and make data-driven adjustments to achieve their objectives.

Regulatory compliance: An integrated risk management approach ensures that organizations maintain compliance with evolving regulations, reducing the risk of penalties and reputational damage.

Reputation management: By proactively identifying and mitigating risks, IRM helps businesses protect and enhance their reputation in the market.

The Legacies of John A. Wheeler and Michael Rasmussen

Both Wheeler and Rasmussen have left indelible marks on the field of risk management as trailblazers. While Rasmussen's GRC model provided a foundation for organizations to manage compliance risks and requirements, Wheeler's IRM framework represents the next step in the evolution of risk management. The IRM model is much better suited to address the increasingly complex and interconnected risks organizations face today, offering a more comprehensive and proactive approach.

You can hear directly from the risk trailblazers as they debate the uses of IRM and GRC in a recent webinar “Navigating the Coming Regulatory Tsunami: Which Risk Management Approach Is Best?”

IRM: A Better Way Forward

As the business landscape continues to evolve, organizations must adapt their risk management strategies to stay ahead. The evolution from GRC to IRM signifies a necessary evolution in risk management, offering a more holistic and integrated approach that extends beyond the necessary but rigid compliance and control frameworks. With trailblazers like John A. Wheeler and Michael Rasmussen leading the way, organizations can now better identify, assess, and mitigate risks, harnessing the power of IRM to drive business strategy and growth.