Click here to access subscription content at The RTJ Bridge - The Premium Version of The RiskTech Journal

〰️

Click here to access subscription content at The RTJ Bridge - The Premium Version of The RiskTech Journal 〰️

The RiskTech Journal

The RiskTech Journal is your premier source for insights on cutting-edge risk management technologies. We deliver expert analysis, industry trends, and practical solutions to help professionals stay ahead in an ever-changing risk landscape. Join us to explore the innovations shaping the future of risk management.

The 2026 Convergence: Integrated Risk Management In a New Era

The 2026 global risk survey cycle marks an inflection point in how risk is understood, prioritized, and operationalized by large organizations. For the first time in several years, leading surveys from Aon, Allianz, the World Economic Forum, Protiviti, PwC, Marsh, Zurich, and Eurasia Group are not merely aligned on top risks, they are aligned on why those risks are proving so difficult to manage with legacy approaches.

Cyber remains the top-ranked risk globally. Geopolitical volatility has become a structural operating condition rather than a periodic shock. Artificial intelligence has moved decisively from emerging concern to material enterprise exposure. Third-party dependency is now treated as a first-order risk category. Across these themes, one signal is clear: risk is no longer behaving as a set of discrete domains. It is behaving as an interconnected system of dependencies, amplifiers, and cascading impacts.

This convergence explains why Integrated Risk Management (IRM) is shifting from an architectural aspiration to an execution requirement.

IRM Navigator: The Operating Model for Integrated Risk Management

Many organizations have adopted ERM standards and clarified accountability, yet risk still fails to shape planning, capital allocation, and operational decisions. The gap is not conceptual. It is operational. Most programs have guidance on what effective risk management should achieve and who should perform key activities, but they lack an operating model that specifies how risk work is unified across domains and instrumented through business processes and technology.

WEF Claims AI Governance is a Growth Strategy

The recent World Economic Forum argument that “effective AI governance” is now a growth strategy is directionally correct, and also incomplete in a way that will matter for buyers in 2026. The claim is correct because governance reduces friction, clarifies accountability, and increases repeatability as AI moves from pilots to enterprise scale. The claim is incomplete because many organizations are calling the entire operating model “AI governance,” when the value is realized only when governance is translated into management execution.

RiskTech Buyer Trap - When “Next Gen SaaS” Signals Foundation Rebuild, Not Integration Maturity

The GRC and broader RiskTech platform landscape is in a visible transition cycle. Several large vendors are rebranding portfolios, introducing AI capabilities, and emphasizing SaaS-first delivery and modern user experiences. Buyers often interpret these moves as a direct signal of near-term integration maturity, faster operational embedding, and “out of the box” IRM outcomes.

That interpretation can be costly.

The more reliable buyer lens is to recognize that platform modernization usually follows a sequenced transformation path, and integration maturity tends to become repeatable only after the new baseline stabilizes across SaaS delivery, experience, and extensibility.

Why DORA Metrics Belong in the Risk Committee Packet

Boards increasingly receive dashboards showing deployment speed, incident counts, and technology uptime. What is often missing is the recognition that software delivery performance is now a primary driver of enterprise risk. Every material change to products, services, data flows, and controls is executed through software delivery pipelines.

DORA metrics were created to measure delivery performance, but when viewed through an integrated risk lens, they function as early-warning indicators of change risk, operational resilience, and assurance quality. Boards that treat these metrics as engineering detail miss one of the clearest signals of whether risk controls are embedded or cosmetic.

Governance and Management: The Distinction That Determines Risk Effectiveness

Executives often use “governance” and “management” interchangeably, but they are distinct disciplines. Without a clear line between them, policies never translate into behavior.

The difference is structural. Governance defines expectations. Management delivers outcomes.

This is the biggest blind spot in AI. Companies mistake principles and checklists for control. But governance is only the guardrails. It cannot catch model drift or detect bias. That is the job of management.

Governance does not scale by adding more rules. Management does not scale by adding more meetings.

[Read the full article to stop confusing documentation with execution.]

The IRM Navigator™ Curve: A Faster Way to Classify Vendors and Clarify Your Risk Technology Roadmap

Most organizations still evaluate risk technology using surface features or maturity labels that do not reveal where a solution truly fits in the broader risk ecosystem. The IRM Navigator™ Curve provides a more reliable assessment. It combines the five IRM maturity levels with the four underlying investment domains to show how organizations advance from Risk Dysfunction to Risk Agency. This article introduces the curve in plain terms and provides a quick test that allows buyers to slot any vendor on the curve in less than two minutes.

Why Data Streaming Is the Hidden Backbone of Autonomous IRM

Data streaming has become a foundational capability for modern enterprises. As organizations move away from periodic reporting and manual control cycles, the emphasis has shifted to continuous sensing, real time telemetry, and rapid mitigation. These operational patterns depend on data in motion, not data at rest. Streaming architectures now sit at the center of this shift.

The acquisition of Confluent announced today by IBM reinforces this point. Confluent is the leading commercial platform built on Apache Kafka, one of the most widely adopted streaming technologies worldwide. The acquisition signals that streaming has moved from a niche data engineering function to a strategic capability that enables AI operations, continuous controls, and integrated risk programs. Enterprises are recognizing that autonomous risk management depends on steady, reliable streams of operational signals that can be sensed, analyzed, and acted upon in real time.

GRC Without Visionaries: What the 2025 Gartner® Magic Quadrant™ Reveals About the Future of Risk

The release of the “2025 Gartner® Magic Quadrant™ for Governance, Risk and Compliance (GRC) Tools, Assurance Leaders” marks an important turning point in the evolution of enterprise risk technology. For the first time in nearly two decades of coverage, Gartner has explicitly defined the GRC category around assurance leaders rather than enterprise risk or governance audiences.

Equally significant is the visual structure of the 2025 quadrant, which contains an entirely empty Visionaries section. While some may interpret this as a sign of stagnation, it more accurately reflects a market that has entered its integration phase. The GRC segment has reached functional maturity and operational stability, creating the foundation upon which the next generation of Integrated Risk Management (IRM) and Autonomous IRM capabilities will develop.

Here, we analyze the implications of the 2025 Magic Quadrant through the lens of the IRM Navigator™ Model and the recent IRM Navigator™ Vendor Compass for Governance, Risk and Compliance (GRC) - 2025 Edition. Our research concludes that the absence of Visionaries does not indicate a failure of innovation, but rather the outcome of successful specialization. GRC has become the operational core of enterprise assurance, while IRM now defines the broader architecture of enterprise confidence and decision intelligence.

AWS Outage, What Happened And How To Prepare With Integrated Risk Management

On Monday, October 20, a fault in Amazon Web Services’ US-EAST-1 region disrupted Domain Name System (DNS) resolution for the Amazon DynamoDB regional endpoint. The failure propagated into other AWS subsystems that rely on that endpoint and produced widespread service degradation across many internet applications. AWS reported that services stabilized by late afternoon Pacific time, with some services clearing backlogs afterward. These facts are supported by AWS service updates and independent internet measurement reports.

The Real AI Test: How to Tell a Platform from a Chat Overlay

Most vendors now claim to have “AI platforms,” but many are just chat interfaces placed on top of disconnected systems. The difference is more than marketing. Without the right controls, these overlays can leak data, bypass policies, and mislead buyers into thinking they are getting enterprise-grade AI governance when they are not.

Petri and the Rise of Autonomous Risk Auditing

On October 6, 2025, Anthropic introduced Petri, the Parallel Exploration Tool for Risky Interactions, an open-source auditing agent that automatically probes large-language models to detect and score risky behaviors. The release, while modest in presentation, may prove pivotal in how enterprises manage risk across autonomous systems.

Petri represents the maturation of AI safety research into a tangible, operational capability that bridges technology risk, assurance, and governance. More importantly, it signals the emergence of autonomous auditing as a new functional layer within Integrated Risk Management (IRM).

October 6: The Day U.S. Data Security Rules Get Real

Today marks a turning point for every organization that handles large volumes of U.S. personal or government-related data. The Department of Justice’s Data Security Program (DSP), authorized under Executive Order 14117, officially moves from guidance to enforcement. Starting October 6, 2025, companies that share sensitive U.S. data with foreign partners must have a written compliance program in place or face potential penalties. The rule is designed to stop bulk transfers of Americans’ sensitive information to countries that the U.S. deems national security risks.

Executive Comparison of AI Governance Frameworks for Risk & Compliance

Artificial Intelligence (AI) is becoming integral to enterprise operations and risk management, including emerging Autonomous IRM (Integrated Risk Management) initiatives where AI agents autonomously assist in identifying and managing risks. Executives and boards need to ensure such AI deployments are trustworthy, compliant, and aligned with business objectives. Several frameworks have emerged to govern AI risk and compliance. Below is a comparison of three key frameworks – ISO/IEC 42001 (the new AI Management System standard), the EU AI Act (forthcoming European regulation), and the NIST AI Risk Management Framework (RMF) (a U.S. voluntary guideline) – focusing on what executives should understand, monitor, and prioritize in each.

When Tokens Turn Toxic: How the Salesforce Supply Chain Breach Exposed the SaaS Domino Effect

A coordinated campaign has exploited a popular integration between Salesloft, Drift, and Salesforce, resulting in unauthorized access across some of the world’s most trusted enterprises. Palo Alto Networks, Zscaler, Cloudflare, and Proofpoint have all confirmed impacts to their Salesforce environments, while Okta reported blocking the attack through network restrictions.

Palo Alto Networks CEO Warns of AI Agent Risks

On CNBC yesterday, Palo Alto Networks CEO Nikesh Arora issued one of the most direct warnings yet about the risks of enterprise AI agents. He noted that in the near future, “there’s gonna be more agents than humans running around trying to help you manage your enterprise.” If true, that represents not only an IT transformation, but a fundamental shift in the risk surface of every large organization.

Autonomous IRM, Investor Confidence, Cyberinsurance Risks, and Analyst Failures: Exclusive Insights from The RTJ Bridge

The landscape of risk management technology is undergoing rapid transformation, driven by advanced artificial intelligence, shifting investor priorities, and increasingly sophisticated cybersecurity threats. While many risk professionals rely on general market reports and commentary, actionable and forward-looking insights remain scarce. Subscribers to The RTJ Bridge, the premium insights platform from Wheelhouse Advisors, have early and exclusive access to proprietary analysis, data-driven recommendations, and strategic perspectives unmatched elsewhere.

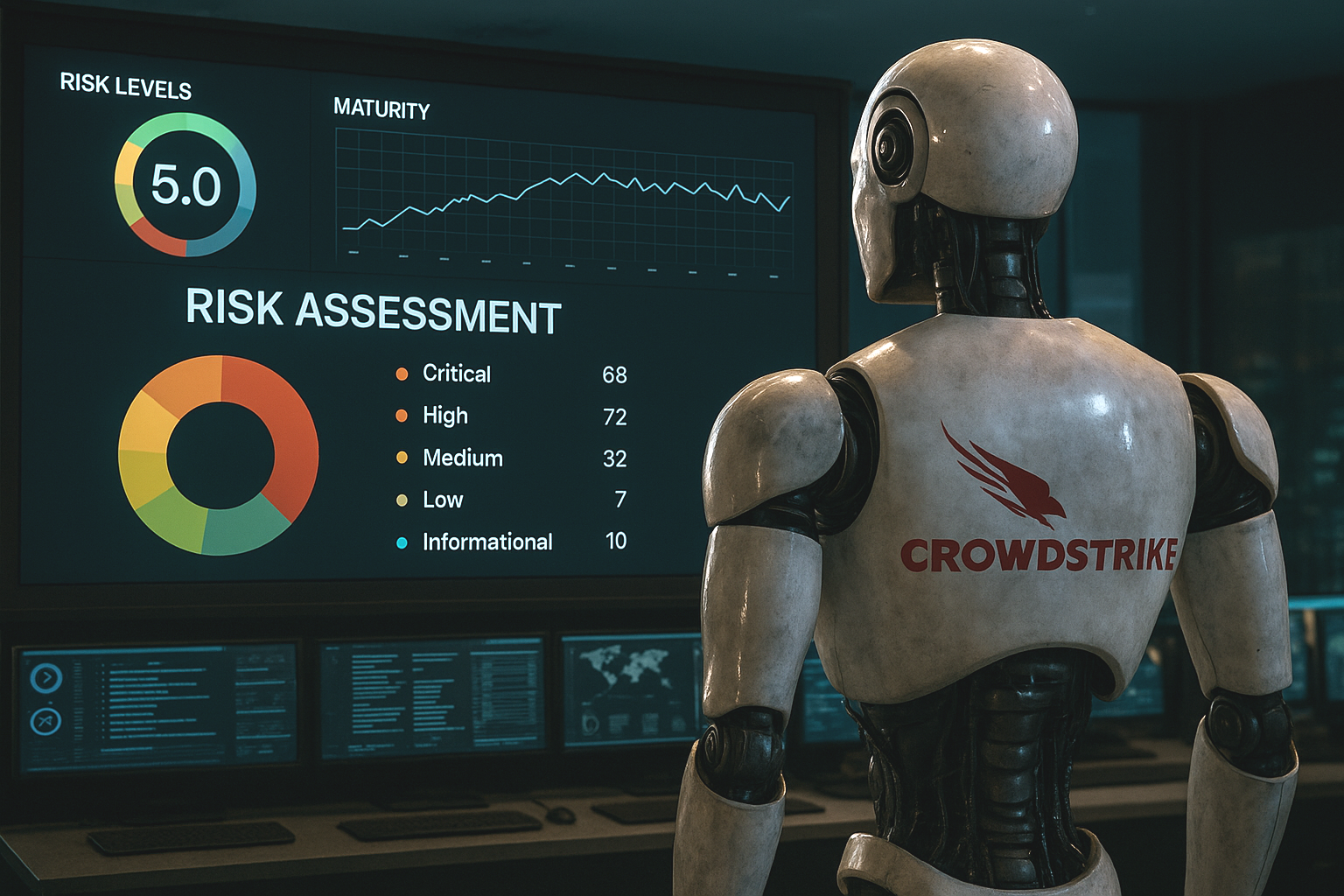

How CrowdStrike’s Agentic AI Accelerates Autonomous IRM

CrowdStrike’s launch of Charlotte AI—its agentic AI architecture now embedded within the Falcon platform—marks a decisive shift in how risk is not only detected, but addressed. With its triad of capabilities (Agentic Detection Triage, Agentic Response, and Agentic Workflows), Charlotte introduces a new operating model: one where AI systems autonomously assess, act, and learn within predefined parameters.

The implication for Integrated Risk Management (IRM) is profound. These are not just smarter alerts or faster forensics. They are machine-initiated decisions with immediate governance, compliance, and operational consequences. And that demands a new framework—one that aligns autonomous action with enterprise risk oversight.

The GRC Blind Spot: What the SharePoint Cyberattack Reveals About Risk Management Vulnerabilities

This past weekend, Microsoft confirmed that attackers exploited a critical zero-day vulnerability in on-premises SharePoint servers—a breach that quickly escalated into a global cybersecurity incident. Governments, universities, energy providers, and private enterprises were affected. At least 85 servers were confirmed compromised within 48 hours, with analysts warning that tens of thousands remained at risk.

The IRM50 All-Stars Take the Field

Wheelhouse Advisors Releases 2025 Lineup on MLB's Biggest Stage

On the same day baseball's best step up to the plate at the 95th MLB All-Star Game in Atlanta, Wheelhouse Advisors has released its all-star roster: the 2025 IRM50.

And just like the Midsummer Classic, this announcement celebrates top-tier talent, position-specific excellence, and strategic versatility—only this time, the field is Integrated Risk Management (IRM), not Truist Park. Wheelhouse's IRM50 recognizes the 50 most influential technology and consulting providers driving the future of IRM. The timing isn't just symbolic—Wheelhouse Advisors is also headquartered in Atlanta, and this year's report marks the broadest, most globally representative IRM50 to date.