Click here to access subscription content at The RTJ Bridge - The Premium Version of The RiskTech Journal

〰️

Click here to access subscription content at The RTJ Bridge - The Premium Version of The RiskTech Journal 〰️

The RiskTech Journal

The RiskTech Journal is your premier source for insights on cutting-edge risk management technologies. We deliver expert analysis, industry trends, and practical solutions to help professionals stay ahead in an ever-changing risk landscape. Join us to explore the innovations shaping the future of risk management.

Why Data Streaming Is the Hidden Backbone of Autonomous IRM

Data streaming has become a foundational capability for modern enterprises. As organizations move away from periodic reporting and manual control cycles, the emphasis has shifted to continuous sensing, real time telemetry, and rapid mitigation. These operational patterns depend on data in motion, not data at rest. Streaming architectures now sit at the center of this shift.

The acquisition of Confluent announced today by IBM reinforces this point. Confluent is the leading commercial platform built on Apache Kafka, one of the most widely adopted streaming technologies worldwide. The acquisition signals that streaming has moved from a niche data engineering function to a strategic capability that enables AI operations, continuous controls, and integrated risk programs. Enterprises are recognizing that autonomous risk management depends on steady, reliable streams of operational signals that can be sensed, analyzed, and acted upon in real time.

Petri and the Rise of Autonomous Risk Auditing

On October 6, 2025, Anthropic introduced Petri, the Parallel Exploration Tool for Risky Interactions, an open-source auditing agent that automatically probes large-language models to detect and score risky behaviors. The release, while modest in presentation, may prove pivotal in how enterprises manage risk across autonomous systems.

Petri represents the maturation of AI safety research into a tangible, operational capability that bridges technology risk, assurance, and governance. More importantly, it signals the emergence of autonomous auditing as a new functional layer within Integrated Risk Management (IRM).

Autonomous IRM, Investor Confidence, Cyberinsurance Risks, and Analyst Failures: Exclusive Insights from The RTJ Bridge

The landscape of risk management technology is undergoing rapid transformation, driven by advanced artificial intelligence, shifting investor priorities, and increasingly sophisticated cybersecurity threats. While many risk professionals rely on general market reports and commentary, actionable and forward-looking insights remain scarce. Subscribers to The RTJ Bridge, the premium insights platform from Wheelhouse Advisors, have early and exclusive access to proprietary analysis, data-driven recommendations, and strategic perspectives unmatched elsewhere.

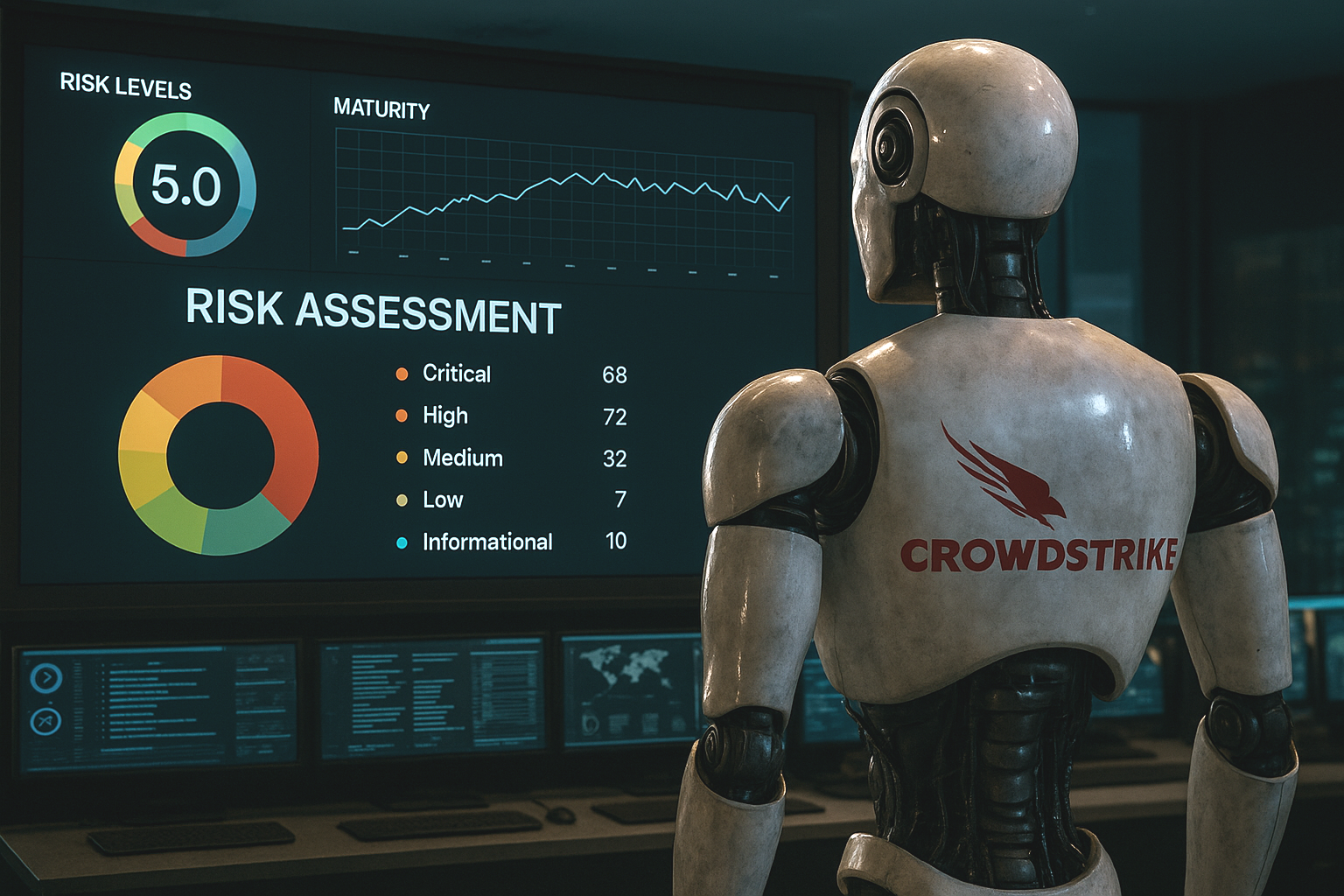

How CrowdStrike’s Agentic AI Accelerates Autonomous IRM

CrowdStrike’s launch of Charlotte AI—its agentic AI architecture now embedded within the Falcon platform—marks a decisive shift in how risk is not only detected, but addressed. With its triad of capabilities (Agentic Detection Triage, Agentic Response, and Agentic Workflows), Charlotte introduces a new operating model: one where AI systems autonomously assess, act, and learn within predefined parameters.

The implication for Integrated Risk Management (IRM) is profound. These are not just smarter alerts or faster forensics. They are machine-initiated decisions with immediate governance, compliance, and operational consequences. And that demands a new framework—one that aligns autonomous action with enterprise risk oversight.

The Coming Wave: Why AI-Fueled Cyber Crime Demands a New Layer of Risk Management

In June 2024, a ransomware attack on Synnovis—an NHS diagnostics provider—led to thousands of canceled surgeries, long-term patient harm, and yet barely registered in the headlines. A year later, an attack on Marks & Spencer, which temporarily left Percy Pig sweets and Colin the Caterpillar cakes off supermarket shelves, wiped £600 million off the company’s market cap and triggered nationwide panic.

This juxtaposition, as Misha Glenny eloquently observes in his Financial Times Weekend article, reveals something uncomfortable about both society’s perception of cyber risk and our structural ability to respond to it. But it also points to a larger and more pressing reality: AI is about to turn every cyber threat vector into a force multiplier—and the defensive tools most organizations rely on are no longer fit for purpose.

As AI matures into autonomous, agentic forms, we’re not just dealing with more attacks—we’re dealing with smarter, faster, and more scalable ones. The solution isn’t just better cybersecurity. It’s Integrated Risk Management (IRM)—and it must evolve as rapidly as the threat landscape.

Where Autonomous IRM Begins—And Where It Must Go Next

The Quiet Rise of Autonomous IRM—From the Middle Out

Autonomous IRM is no longer theoretical. AI-powered platforms are starting to deliver tangible value: agentic systems that simulate attacker behavior, validate control effectiveness, and recommend mitigation actions—often autonomously.

The June 5 announcement from Tuskira, integrating directly with ServiceNow’s Vulnerability Response and SecOps modules, is a prime example. By embedding simulation-backed scoring and posture-aware mitigation into operational workflows, Tuskira is delivering intelligence in real time.

But there’s something missing: the announcement doesn’t mention Integrated Risk Management (IRM) at all.

That silence is a signal. Tuskira operates in what Wheelhouse Advisors defines as Layer 3: Intelligence & Validation—the middle of the risk architecture. And while this layer is where automation is gaining traction, it’s also where many organizations are managing in isolation, without input from either end of the enterprise risk stack.

From Permit to Platform—How CTRL WRK Turns Lockout/Tagout into an Autonomous IRM Use Case

A high-risk, paper-bound safety workflow finds new life on the ServiceNow platform—signaling a broader shift toward AI-enabled operational risk intelligence.

What was once a clipboard-bound safety task has now become a signal of something larger: the acceleration of Autonomous Integrated Risk Management (Autonomous IRM) through purpose-built, domain-native micro-apps. On June 2, CTRL WRK—a GenAI-powered “Control of Work” (CoW) application focused on lockout/tagout (LOTO) permitting—launched on the ServiceNow Store. While its function is precise, the implications are far-reaching.

This is more than digitization. It’s the embodiment of a broader market shift: from static compliance toward dynamic, AI-enabled risk management embedded directly into operational workflows.

Generative AI Is Steering Banks Toward Autonomous IRM—But the Bridge Isn’t Finished Yet

When McKinsey & Company published “How generative AI can help banks manage risk and compliance” in March 2024, it put blue-chip credibility behind a growing consensus: large-language models and related GenAI tools will automate swaths of the three-lines-of-defense and up-end conventional governance, risk, and compliance (GRC) workflows. What McKinsey did not say—but unmistakably implied—is that the old compliance-first paradigm is now on borrowed time. The firm’s use-case catalogue—from virtual regulatory advisors to code-generating “risk bots”—maps neatly onto the early layers of Autonomous Integrated Risk Management (IRM): continuously sensing risk, generating controls, and feeding decision-grade insight back into the business.

Yet the report also reveals a tension. McKinsey still frames GenAI as a helper inside discrete risk silos, guarded by human-in-the-loop checkpoints. Autonomous IRM envisions something bolder: an AI-directed control fabric that dissolves those silos, embeds itself in front-line processes, and—over time—lets the machine take the first swing at routine risk decisions while humans govern the exceptions.

Live from RSA: Autonomous IRM Moves from Vision to Reality

The RSA Conference is renowned for highlighting significant shifts in cybersecurity and risk management. This year, alongside familiar conversations about persistent cybersecurity threats and regulatory pressures, a deeper transformation is occurring: the rise of Autonomous Integrated Risk Management (Autonomous IRM). Vendors at RSA 2025 are showcasing solutions that go beyond merely automating routine tasks, moving toward independently identifying, assessing, and mitigating risks across enterprise ecosystems without constant human intervention.

Autonomous IRM: How AI Agents Are Redefining Risk Management for the Future

AI agents transcend traditional tools, evolving into intelligent systems capable of perceiving, predicting, and proactively responding to risks in a complex, interconnected world. This article explores the transformative potential of AI agents within IRM, including innovations such as dynamic internal controls, the challenges they introduce, and the implications for the future of risk management.

The Key to the RiskTech Kingdom: How the Model Context Protocol (MCP) Unlocks Autonomous IRM

The risk management landscape is transforming as technology evolves to meet the demands of increasingly complex business environments. A new open-source tool from Anthropic, the Model Context Protocol (MCP), could represent the pivotal technology that unlocks the potential of autonomous Integrated Risk Management (IRM) systems. MCP may revolutionize how organizations deploy AI-driven IRM solutions by providing seamless, universal connectivity to diverse datasets. At the heart of this transformation is the emergence of AI agents, which stand to benefit significantly from MCP's capabilities.

AI's Transformative Economic Potential and the Accelerated Evolution of Integrated Risk Management

Artificial intelligence (AI) is ushering in a new era that promises to redefine the global economy and risk management landscape. Recent projections by IDC estimate that AI will contribute a staggering $19.9 trillion to the global economy by 2030, driving 3.5% of the worldwide GDP. For every dollar invested in AI, an impressive $4.60 is expected in economic returns. Simultaneously, KPMG International's 2024 Future of Risk report reveals that 61% of executives anticipate a significant increase in risk levels over the next three to five years.

ServiceNow and Salesforce Enter the AI Agent Arena: Paving the Way for Autonomous IRM

In my previous article on Autonomous Integrated Risk Management (IRM), I explored how AI agents are driving IRM into a new era of automation. With industry leaders like ServiceNow and Salesforce making significant strides in the AI agent market, we are witnessing a transformative moment for business technology. These advancements signal a shift in automation capabilities and present a massive opportunity to develop AI agents specifically for autonomous IRM capabilities.