The IRM Advantage: How Boards Can Navigate Digital Risks and Regulations

In the relentless tide of digital innovation, board members find themselves grappling with a new business challenge - digital risk. Defined as the risk manifested through technology and integrated into business operations, digital risk, including cybersecurity, has become a pivotal concern in the age of accelerated digital transformation. The investment in digital initiatives is at an all-time high, with IDC forecasting $3.6 trillion in worldwide digital spending by 2026. Concurrently, the global value of digital/IoT products and services is projected to surge to $12.6 trillion by 2030, according to McKinsey.

As companies weave digital technology more intimately into their fabric, the potential for cyber threats amplifies, necessitating robust cybersecurity protocols. Regulators, too, have responded to this evolving landscape. The forthcoming U.S. Securities and Exchange Commission's (SEC) cybersecurity disclosure requirements for public companies demonstrate a major shift towards transparency and immediate disclosure of material cybersecurity incidents.

Board members, CEOs, and CFOs must take heed of these regulatory changes, given the growing digital risk. Beyond the operational and financial repercussions, non-compliance can tarnish a reputation, while effective compliance can bolster stakeholder trust. The proposed requirements also emphasize the importance of comprehensive risk management strategies, and here's where integrated risk management (IRM) technology shines.

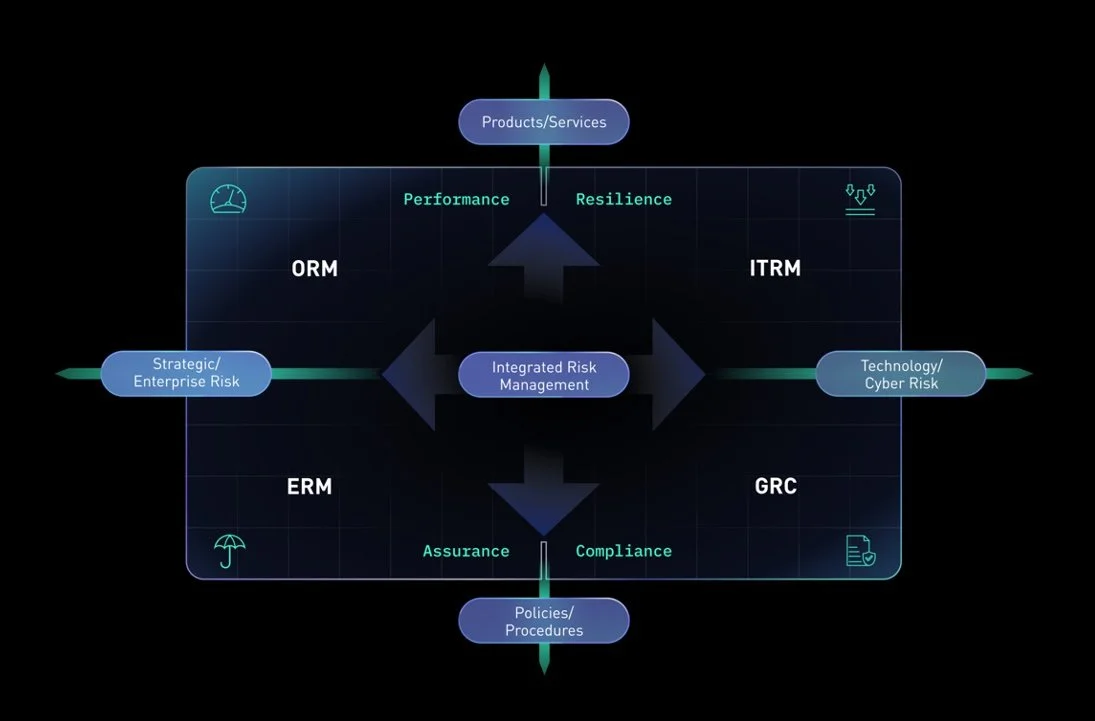

The IRM approach is ideally suited to address the four key objectives essential for increasing board members’ visibility and understanding of digital risks - performance, resilience, assurance, and compliance.

Performance: IRM provides a holistic view of the organization's risk landscape, allowing for strategic risk-based decision-making that can enhance performance. With real-time visibility into operational risk and its potential impact on strategic objectives, boards can better steer the organization toward its goals.

Resilience: IRM technologies foster resilience by enabling the early detection of potential threats and swift response to incidents. This robustness reduces the likelihood of operational disruption, ensuring business continuity even in the face of unexpected cyber incidents.

Assurance: The advanced analytics provided by IRM technology supports accurate risk forecasting and effective control measures. This, in turn, can give boards greater confidence in the organization’s risk management capabilities, providing assurance to stakeholders.

Compliance: IRM automates and streamlines compliance processes, making it simpler to adhere to new regulations like the SEC's proposed cybersecurity disclosure requirements. This means quicker, more accurate reporting, ensuring regulatory compliance, and avoiding penalties.

So how can organizations adapt to the emerging disclosure requirements using an IRM approach? We suggest the following strategies:

Perform a Gap Assessment: Utilize IRM to evaluate your existing risk management measures against the SEC's proposed requirements, spotlighting areas for enhancement.

Integrate Disclosure Processes: Align your cybersecurity and existing disclosure processes within your IRM framework to enable a coordinated and inclusive approach to risk management.

Refine Incident Management Process: Use the insights generated by IRM to tailor your incident management process, accommodating the requirement for ongoing reporting.

Engage the Board Early: Utilize IRM's comprehensive reporting capabilities to keep your board informed about the proposed requirements and aid in developing effective governance strategies.

Leverage IRM Technology: Harness the power of IRM technology to consolidate risk management efforts and streamline disclosures, providing a robust foundation for regulatory compliance and effective digital risk mitigation.

The goal isn't merely to meet compliance but to craft a resilient, high-performing business environment that adeptly navigates the complexities of digital risk. IRM technology is not just a tool for this journey - it is a compass guiding organizations through the choppy waters of the digital age.