S5E7: Stop Buying Better Silos: How the IRM Navigator™ Curve Exposes RiskTech Hype

In this episode of The Risk Wheelhouse, Ori Wellington and Sam Jones tackle one of the most expensive mistakes in risk management today: buying impressive tools that quietly deepen silos instead of advancing your program. If you have ever sat through a RiskTech demo and wondered whether you are truly moving forward or just spending more, this conversation is your roadmap.

Ori and Sam unpack the IRM Navigator™ Curve, a visual model that traces the journey from fragmented Risk Dysfunction to unified Risk Agency, where human and machine agency work together inside validated guardrails. They explain the five maturity levels and four investment domains, then show why you cannot simply “skip ahead” by buying an advanced TRM or AI platform before your GRC, ERM, and ORM foundations are in place.

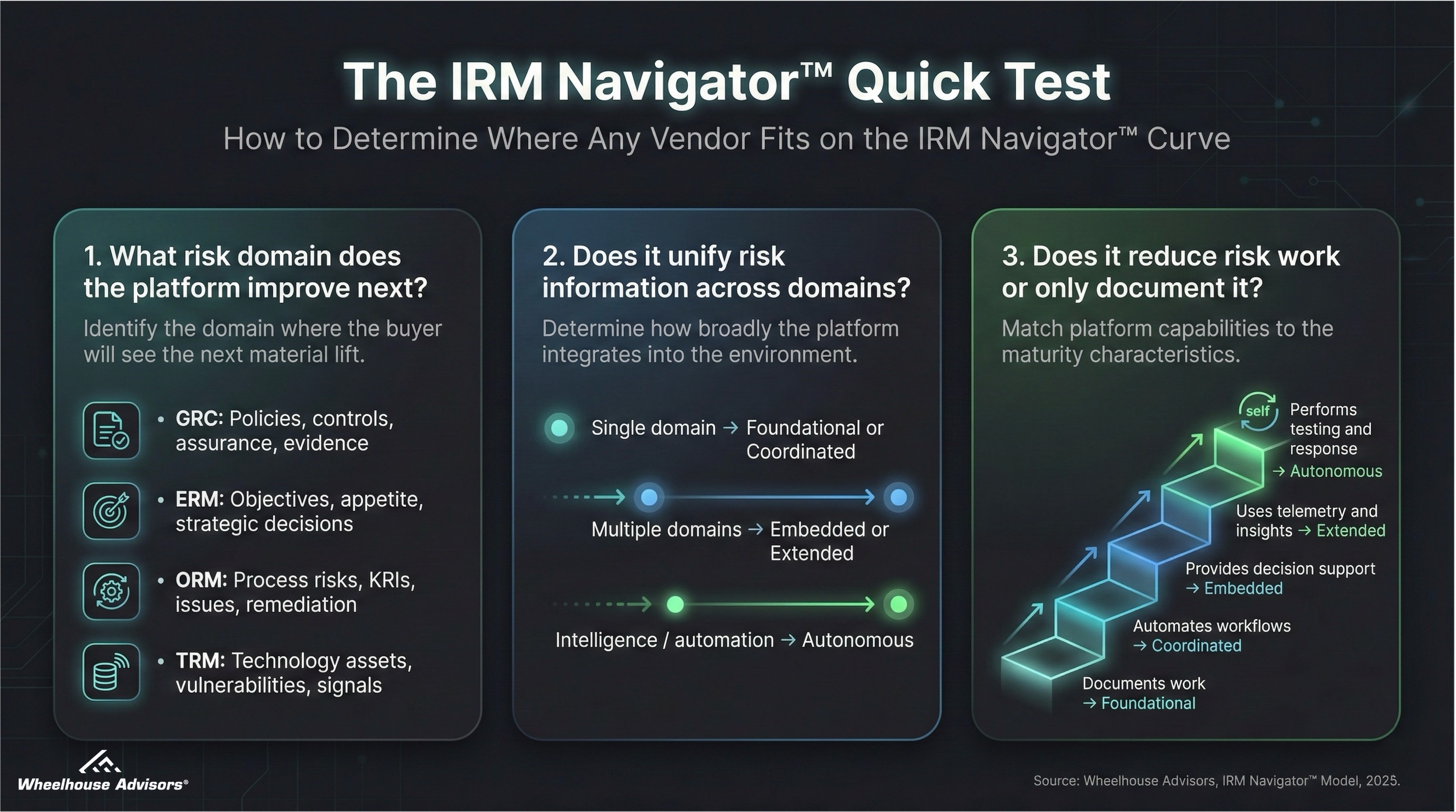

The heart of the episode is a practical three-question, two-minute diagnostic any buyer can use to slot a vendor on the curve:

Which risk domain does this platform improve next?

Does it unify information across domains, or deepen a silo?

Does it reduce real risk work, or only document it?

The hosts then connect the curve to Wheelhouse Advisors’ Vendor Compass and Sonar research, showing how the model is applied to leaders like Riskonnect, ServiceNow, OneTrust, Archer, KPMG, EY, and emerging AI innovators.

If you are preparing a board deck, building a RiskTech roadmap, or facing a wall of “next gen GRC” pitches, this episode will help you turn vendor selection from a feature comparison into a disciplined step toward Risk Agency.

Podcast Episode Chapters

0:00 - Drowning In Risk Tech Noise

2:53 - Introducing The IRM Navigator Curve

4:53 - Defining Dysfunction And Risk Agency

8:53 - Two Required Realignments For Progress

10:45 - The Five Maturity Levels Explained

16:43 - The Four Investment Domains

22:43 - The Two‑Minute Three‑Question Vendor Test

30:13 - Vendor Profiles Mapped To The Curve

35:03 - Why Executives Must Use The Model

To discover more, check out Wheelhouse Advisors’ YouTube channel. It delivers fast, executive-ready insights on Integrated Risk Management. Explore short explainers, IRM Navigator research highlights, RiskTech Journal analysis, and conversations from The Risk Wheelhouse Podcast. We cover the issues that matter most to modern risk leaders. Every video is designed to sharpen decision making and strengthen resilience in a digital-first world. Subscribe at youtube.com/@wheelhouseadv.

Don't forget to subscribe on your favorite podcast platform—whether it's Apple Podcasts, Spotify, or Amazon Music.

Please contact us directly at info@wheelhouseadvisors.com or feel free to connect with us on LinkedIn and X.com.

Visit www.therisktechjournal.com and www.rtj-bridge.com to learn more about the topics discussed in today's episode.