Image 1 of 1

Image 1 of 1

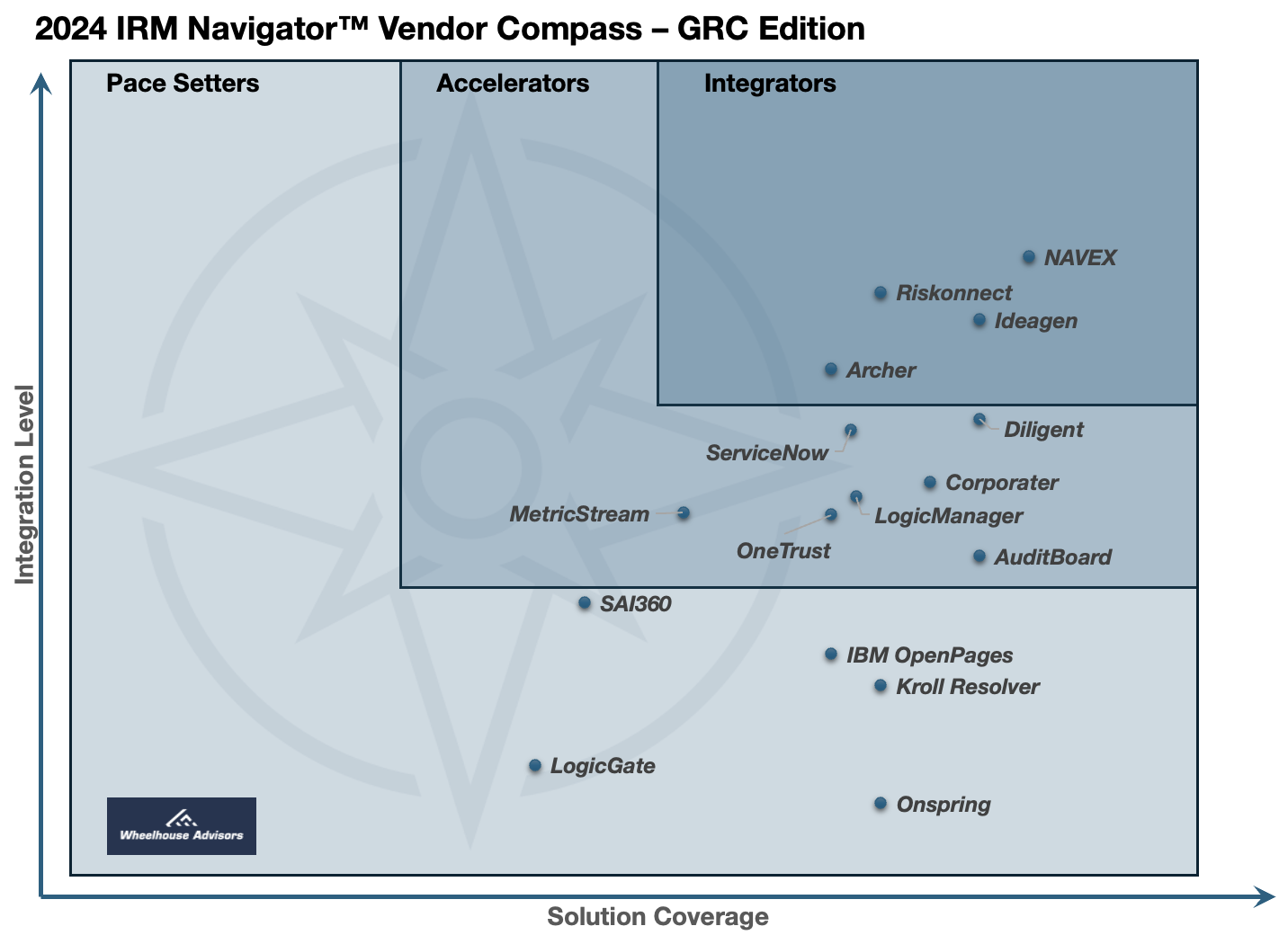

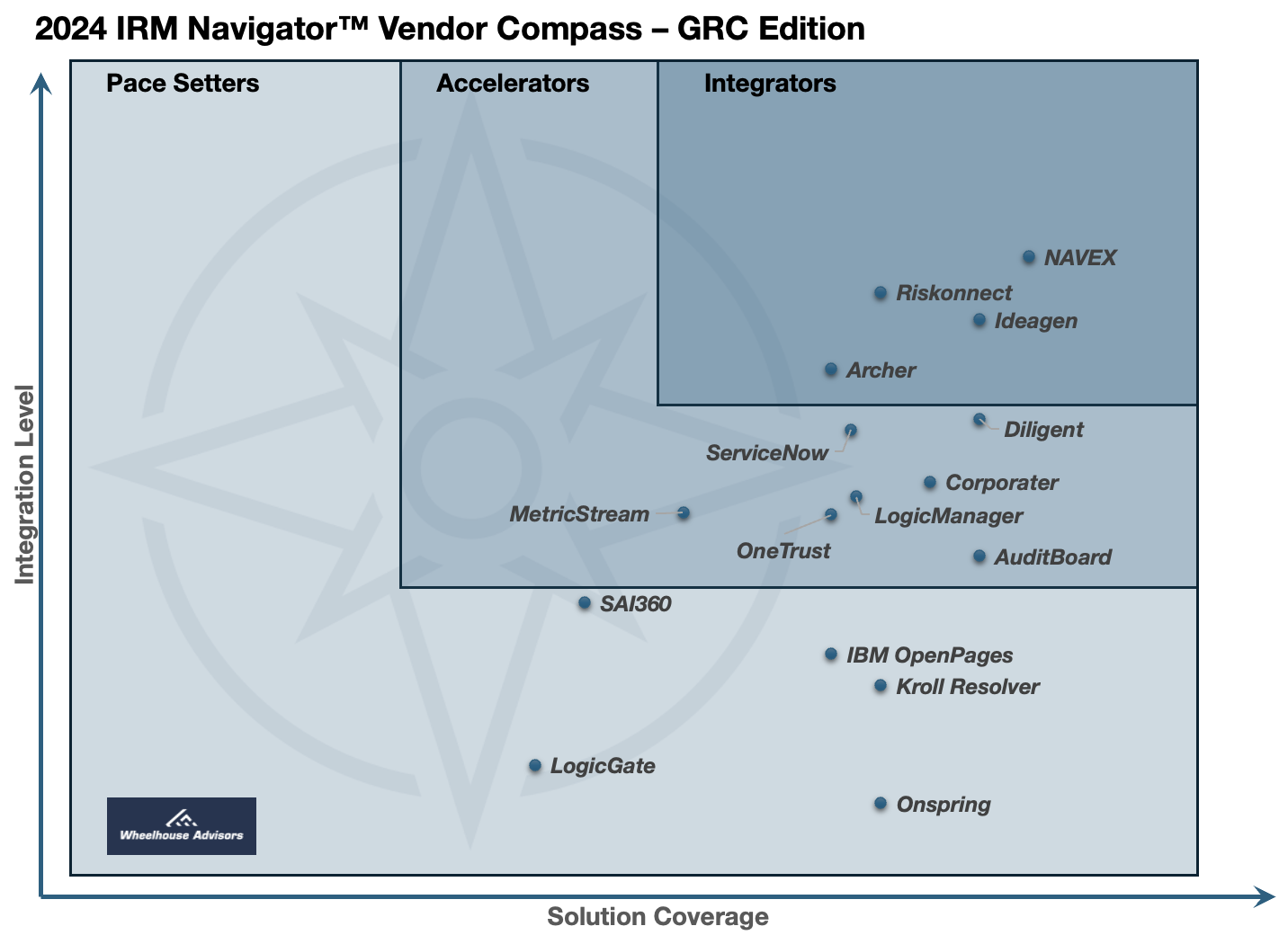

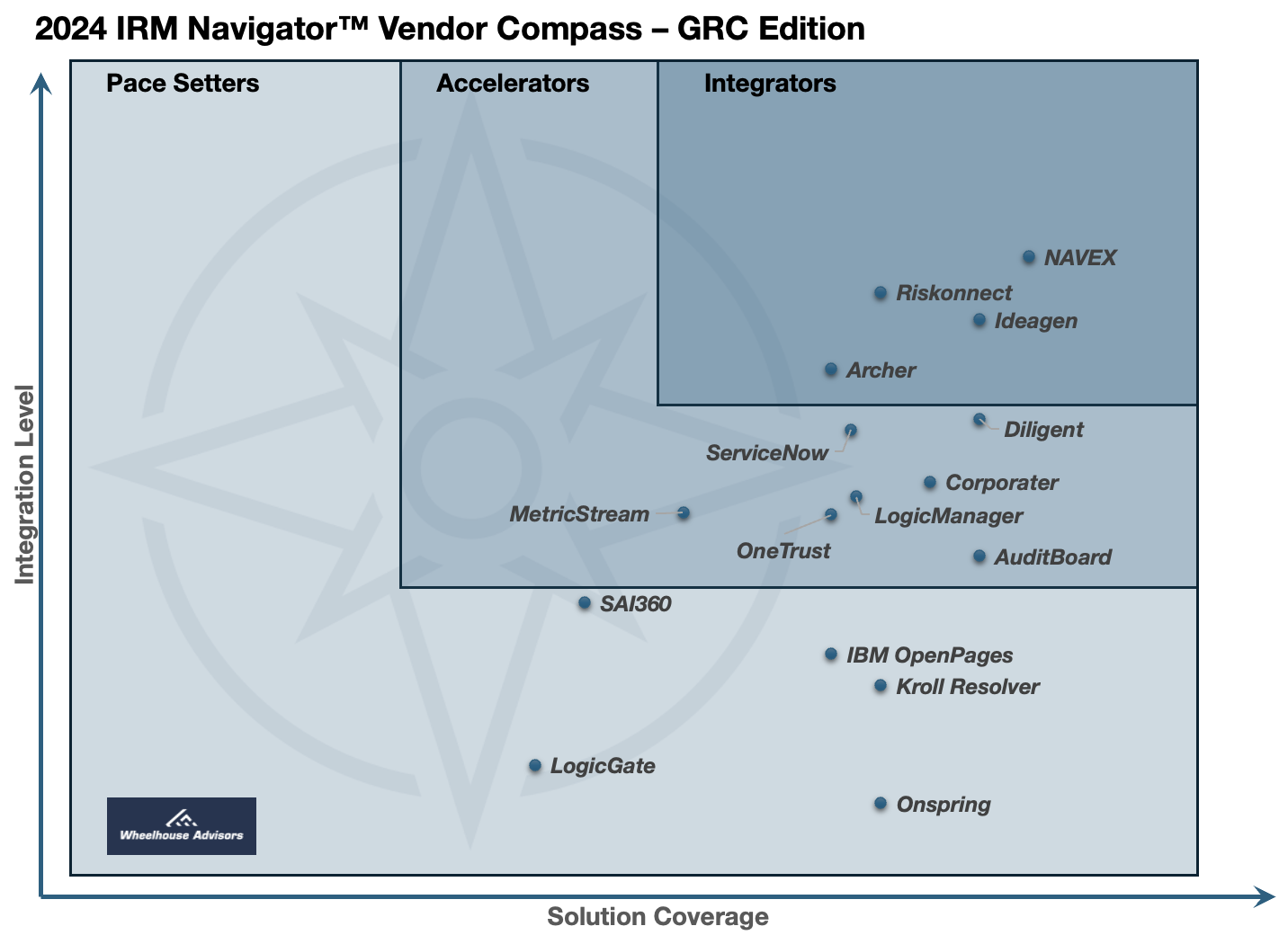

IRM Navigator™ Vendor Compass for GRC - 2024

The Governance, Risk, and Compliance (GRC) market segment has undergone significant transformation over the past two decades, evolving beyond its traditional confines to become an integral component of the broader Integrated Risk Management (IRM) technology market. This section provides an in-depth overview of the GRC segment’s evolution, the importance of GRC within the IRM Navigator™ Framework, and the benefits of integrating GRC applications into a unified IRM platform.

The Evolution of GRC

The concept of GRC, introduced in 2002 by Forrester Research, changed how organizations approached risk management, compliance, and governance. Initially, GRC provided a structured methodology for managing compliance risks and related activities. However, as the business environment grew more complex and interconnected, the limitations of the traditional GRC model became evident. GRC's focus on specific controls and compliance-related risks failed to provide a comprehensive view of an organization's overall risk landscape.

Importance of GRC in the IRM Navigator™ Framework

John A. Wheeler, CEO and founder of Wheelhouse Advisors, coined "Integrated Risk Management" in 2017 while at Gartner. IRM represents a connected approach to risk management that goes beyond compliance and controls, addressing an organization's entire spectrum of risks. This spectrum includes emerging strategic, operational, sustainability, and digital risks. By fostering a proactive, risk-aware culture, IRM enables organizations to leverage risk analysis to drive business strategy and performance.

GRC remains a critical component within the IRM Navigator™ Framework. It ensures that governance and compliance activities are not isolated but integrated into the overall risk management strategy. This integration is essential for maintaining regulatory compliance, managing reputational risks, and ensuring organizational resilience.

The Governance, Risk, and Compliance (GRC) market segment has undergone significant transformation over the past two decades, evolving beyond its traditional confines to become an integral component of the broader Integrated Risk Management (IRM) technology market. This section provides an in-depth overview of the GRC segment’s evolution, the importance of GRC within the IRM Navigator™ Framework, and the benefits of integrating GRC applications into a unified IRM platform.

The Evolution of GRC

The concept of GRC, introduced in 2002 by Forrester Research, changed how organizations approached risk management, compliance, and governance. Initially, GRC provided a structured methodology for managing compliance risks and related activities. However, as the business environment grew more complex and interconnected, the limitations of the traditional GRC model became evident. GRC's focus on specific controls and compliance-related risks failed to provide a comprehensive view of an organization's overall risk landscape.

Importance of GRC in the IRM Navigator™ Framework

John A. Wheeler, CEO and founder of Wheelhouse Advisors, coined "Integrated Risk Management" in 2017 while at Gartner. IRM represents a connected approach to risk management that goes beyond compliance and controls, addressing an organization's entire spectrum of risks. This spectrum includes emerging strategic, operational, sustainability, and digital risks. By fostering a proactive, risk-aware culture, IRM enables organizations to leverage risk analysis to drive business strategy and performance.

GRC remains a critical component within the IRM Navigator™ Framework. It ensures that governance and compliance activities are not isolated but integrated into the overall risk management strategy. This integration is essential for maintaining regulatory compliance, managing reputational risks, and ensuring organizational resilience.