Board Priorities 2026: The Integration Trap

Executive summary

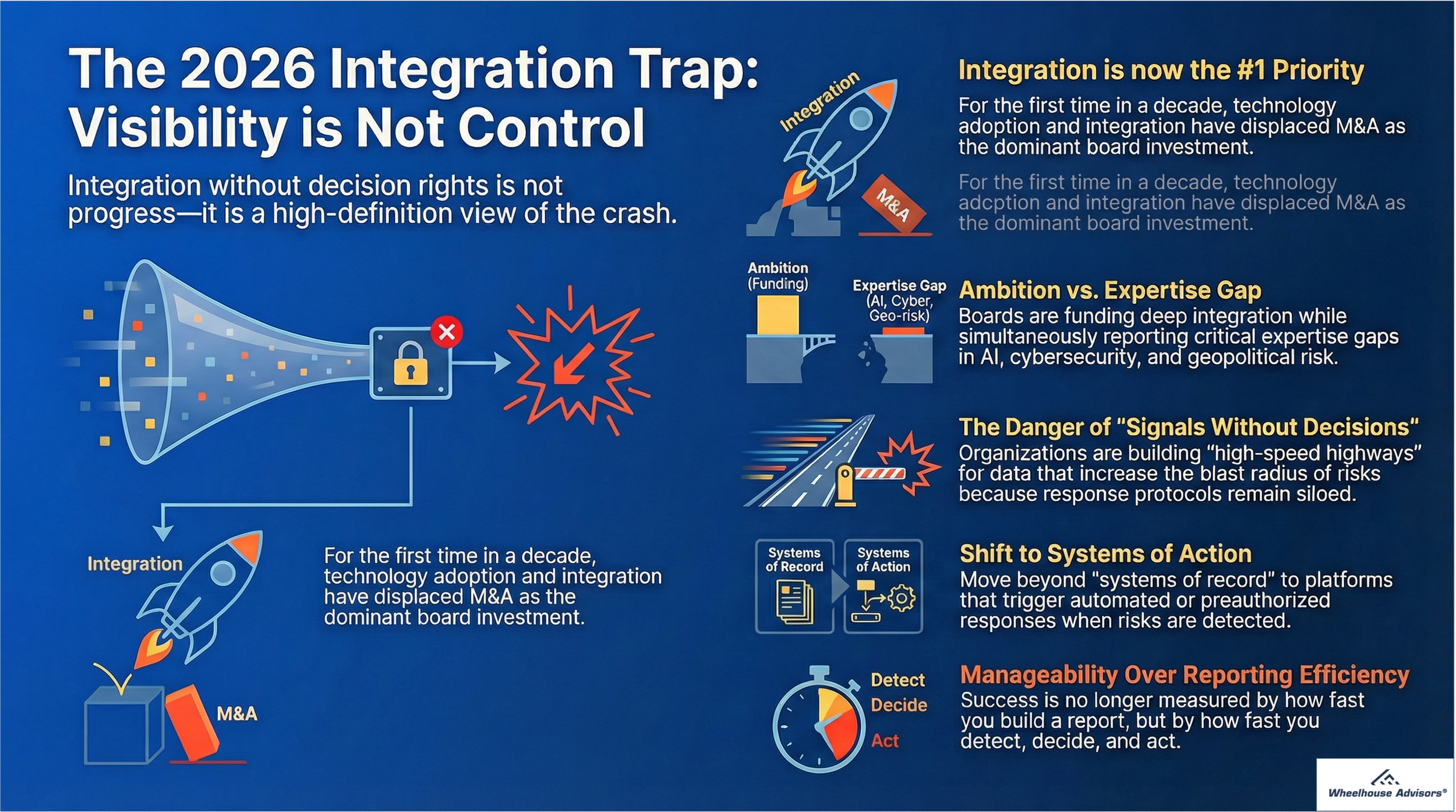

Boards are entering 2026 with a materially different capital allocation posture. For the first time in more than a decade, growth through mergers and acquisitions has been displaced as the dominant investment priority. In its place sits technology adoption and integration.

This shift is not cosmetic. It reflects a board-level acknowledgment that fragmented systems, inconsistent data, and disconnected workflows have become binding constraints on execution. However, new research reveals a dangerous paradox. Boards are prioritizing integration at the same time they report their largest expertise gaps in artificial intelligence, cybersecurity, and geopolitical risk.

The result is a growing integration trap: organizations accelerating the flow of data and automation without the corresponding ability to interpret signals, assign decision rights, or execute timely responses. Integration, pursued without integrated risk management discipline, amplifies risk rather than containing it. This article examines the forces driving the board pivot, the structural risks embedded in the integration-first mindset, and the implications for risk, audit, compliance, and technology leaders navigating 2026.

Source: wheelhouseadvisors.com

The board pivot: From growth to integration

For much of the last decade, boardroom capital allocation discussions followed a familiar pattern. Growth initiatives, especially mergers and acquisitions, dominated agendas. Expansion, scale, and market entry were viewed as the primary levers for shareholder value creation.

New board research indicates a decisive break from this pattern. In 2026, technology adoption and integration ranks as the top capital investment priority. This change signals more than operational housekeeping. Boards are implicitly recognizing that complexity, not capital availability, has become the limiting factor on performance.

Executives increasingly report an inability to execute strategy because core data, controls, and decision systems remain fragmented across legacy platforms, acquired entities, and functional silos. Integration is now viewed as a prerequisite to growth rather than a secondary enablement activity.

The paradox: Integration ambition versus interpretive capacity

While boards are prioritizing integration, they simultaneously acknowledge significant expertise gaps in three critical domains:

Artificial intelligence and advanced analytics

Cybersecurity and digital resilience

Geopolitical and supply chain risk

This creates a structural mismatch. Boards are funding faster, deeper integration while conceding limited understanding of the risks such integration propagates.

In practical terms, organizations are building high-speed highways for data, automation, and AI-driven decisions without fully understanding how those systems behave under stress, bias, regulatory scrutiny, or external disruption. Integration increases speed and reach. Without interpretive capacity, it also increases blast radius.

The three forces compressing board decision-making

1. AI acceleration inside core workflows

Artificial intelligence is no longer confined to experimental use cases. It is increasingly embedded in credit decisions, supply chain optimization, hiring, fraud detection, and operational forecasting.

This introduces new categories of risk including model risk, data provenance risk, bias exposure, and explainability obligations. Regulatory scrutiny is intensifying, particularly around automated decision-making. Boards are funding AI-enabled integration faster than they are establishing accountability, evidence trails, or decision oversight models.

2. Platform sprawl from a decade of M&A

Years of acquisition-driven growth have left organizations with sprawling technology estates. Each acquisition brings its own ERP systems, identity frameworks, control environments, and risk data models.

The result is inconsistent evidence. Different systems provide contradictory answers to the same risk question. Vendor risk, control effectiveness, and financial exposure vary depending on which system is queried. Boards now view integration as the only path to restoring coherence.

However, integration without data normalization and control alignment produces consolidated inconsistency rather than reliable insight.

3. Third-party driven disruption pathways

Operational disruption increasingly originates outside organizational boundaries. Cyber incidents, supplier failures, geopolitical shocks, and infrastructure outages propagate through extended digital supply chains.

Managing this reality requires unified signals across financial health, operational dependency, cyber posture, and geographic exposure. Siloed risk views are no longer viable. Integration becomes essential, but only if signals translate into coordinated action.

Why integration alone is insufficient

The dominant failure mode emerging in 2026 is visibility without control. Organizations improve dashboards, data aggregation, and reporting speed while response authority, decision rights, and escalation protocols remain unchanged.

This produces systems that detect risk faster but do not act faster. Alerts proliferate. Accountability diffuses. Decision latency increases precisely when speed matters most.

Integration without decision architecture creates what many organizations already experience: signals without decisions.

Five implications for IRM leaders

Source: wheelhouseadvisors.com

1. Shift from reporting efficiency to manageability

Reporting efficiency reduces the time required to assemble risk information. Manageability reduces the time required to detect, decide, and act. Boards increasingly expect evidence that integrated systems drive operational outcomes, not just better presentations. Key metrics shift toward time-to-detect, time-to-decide, and time-to-act.

2. Avoid the coordinated maturity trap

Many organizations remain stuck at a coordinated stage. Data is shared across functions, dashboards improve, and visibility increases. However, ownership, authority, and response mechanisms remain siloed. In coordinated environments, everyone can see the risk, but no one is empowered to act decisively. Embedded maturity links detection directly to response through predefined authority and automation.

3. Match integration speed with interpretation speed

Integration initiatives must explicitly define decision ownership. Every signal should map to a named owner, an authorized action, and a predefined escalation path. Preauthorization matters. Waiting to assign decision rights during a crisis guarantees delay, confusion, and failure.

4. Address workforce and supply chain blind spots

Boards are underinvesting in workforce resilience and supplier capability relative to technology integration. This creates brittle systems that fail under human stress. People remain the primary vectors through which disruption propagates. Training, empowerment, and workload sustainability are integral to effective integration outcomes.

5. Expect the rise of systems of action

Market winners are shifting from systems of record to systems of action. Boards no longer value platforms that merely store policies or assessments. They expect platforms that unify signals across goals, processes, assets, and policies, and trigger automated or preauthorized responses. Actionable evidence, not static reports, becomes the standard for regulatory defense and executive assurance.

What to watch next

1. Board agenda evolution

Integration discussions will shift toward decision advantage. Investment cases will increasingly require measurable reductions in decision latency, not just architectural alignment.

2. AI management hardening

The experimentation phase of AI is ending. Boards will demand acceptable use policies, data controls, model accountability, and auditable decision trails tied to AI-influenced outcomes.

3. Continuous third-party monitoring

Static annual assessments will continue to lose credibility. Boards will prioritize continuous monitoring tied to critical operational dependencies.

4. Outcome-driven vendor messaging

Vendors will be pressured to move beyond integration claims toward quantified outcomes such as loss reduction, response acceleration, and compliance defensibility.

Source: wheelhouseadvisors.com

Wheelhouse horizon view

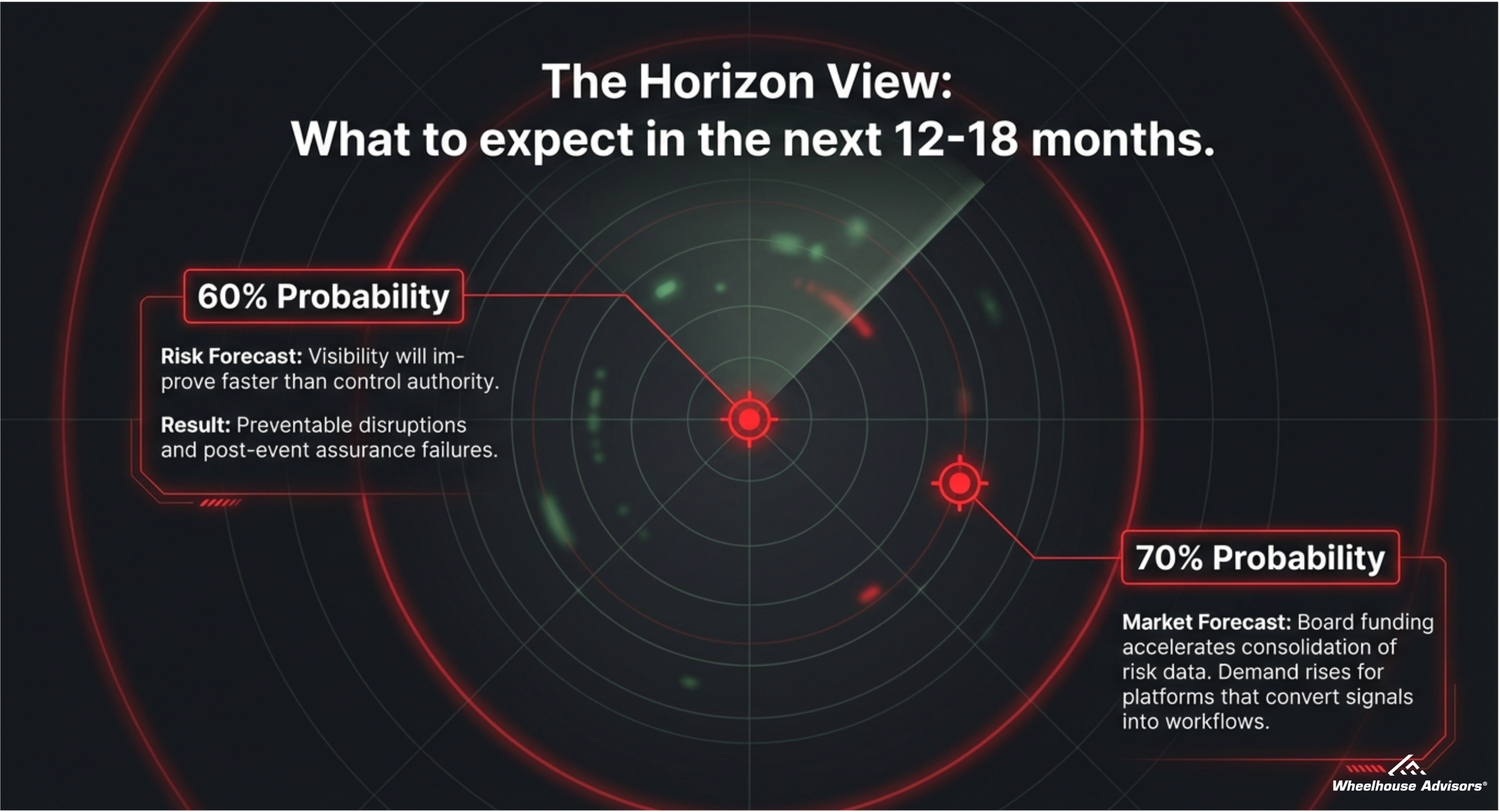

Horizon view, market (12–18 months, ~70% probability)

Board-driven funding accelerates consolidation of risk and assurance data layers. Demand rises for platforms that convert unified signals into automated decision workflows. Leaders should require proof of integration-to-action, not architectural narratives.Horizon view, risk (6–12 months, ~60% probability)

Visibility improves faster than control authority, leading to preventable disruptions and post-event assurance failures. Leadership action requires explicit decision thresholds and accountable owners embedded into every integration initiative.

Final thought

Integration is no longer optional. Boards are funding it aggressively. But integration without decision rights is not progress. It is expensive chaos. The defining question for 2026 is simple: when your dashboard turns red, does everyone know who holds the steering wheel, or will you just have a high-definition view of the crash?

References

Diligent Institute and Corporate Board Member, What Directors Think 2026

Wheelhouse Advisors research on Integrated Risk Management maturity and decision-centric integration

Public regulatory guidance on AI accountability and automated decision transparency

Industry analyses of third-party and supply chain disruption trends

For deeper analysis and weekly research notes, visit rtj-bridge.com.