Click here to access subscription content at The RTJ Bridge - The Premium Version of The RiskTech Journal

〰️

Click here to access subscription content at The RTJ Bridge - The Premium Version of The RiskTech Journal 〰️

The RiskTech Journal

The RiskTech Journal is your premier source for insights on cutting-edge risk management technologies. We deliver expert analysis, industry trends, and practical solutions to help professionals stay ahead in an ever-changing risk landscape. Join us to explore the innovations shaping the future of risk management.

Climate Disclosure Regulations and the Future of Risk Management

The global regulatory landscape for climate-related disclosures is rapidly evolving, creating business opportunities and challenges. As companies navigate shifting mandates across jurisdictions, the need for a comprehensive and integrated approach to risk management has never been more pressing. Integrated Risk Management (IRM) offers a framework to help organizations proactively manage compliance, enhance resilience, and align with long-term sustainability goals.

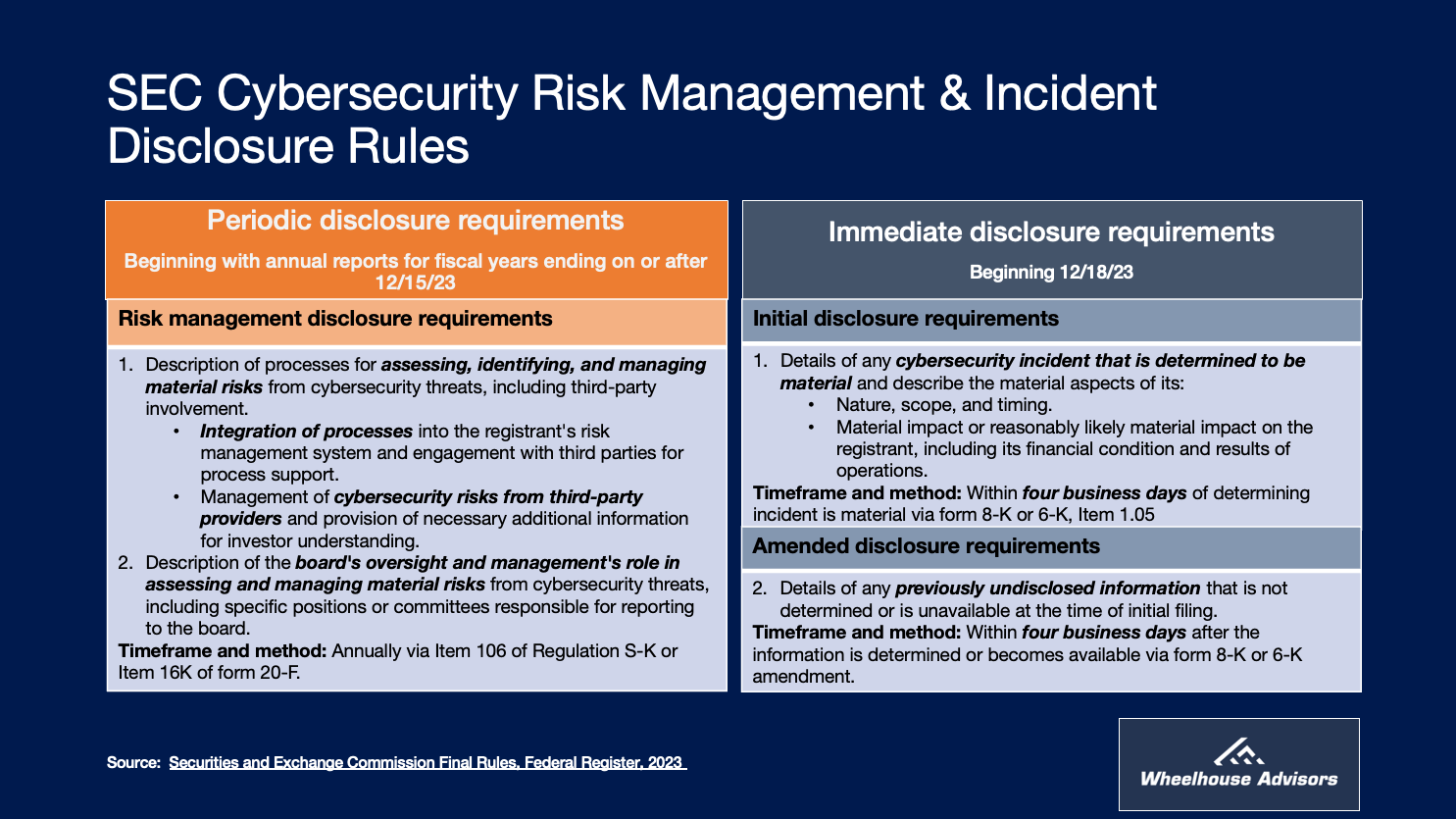

Ticking Clock: Companies Scramble to Meet SEC Cybersecurity Rules, Audit Partners Cautious

With the December 15th deadline for the SEC's new cybersecurity risk disclosure rules rapidly approaching, companies are intensifying their preparations. The Center for Audit Quality’s (CAQ) biannual Audit Partner Pulse Survey provides valuable insights into the corporate response, especially in the context of the complex economic, political, and technological challenges businesses currently face.

SEC's Cybersecurity Countdown: Critical Steps for Public Companies

As the December 2023 deadline looms, U.S. public companies and their third parties face a critical juncture in cybersecurity risk management. The SEC's new disclosure rules demand swift adaptation, with implications for cybersecurity practices and risk management infrastructures. The upcoming webinar, "Cyber Risk Reporting to the Board: A Step-by-Step Playbook," offers an in-depth analysis and actionable strategies for compliance.

Integrated Risk Management: The Linchpin for Bridging SEC and NYDFS Cybersecurity Regulations

In response to escalating cyber threats, regulatory bodies such as the New York State Department of Financial Services (NYDFS) and the U.S. Securities and Exchange Commission (SEC) have fortified their cybersecurity rules, presenting a complex regulatory environment for financial institutions. As entities strive to comply with the nuanced requirements of the NYDFS's updated cybersecurity regulations and the SEC's proposed rules, Integrated Risk Management (IRM) emerges as a crucial strategy, providing a unified framework to manage cybersecurity risks and regulatory compliance effectively.

Leveraging IRM for Comprehensive Risk Assessments in Line with SEC Guidelines

In an era where the complexity of risks continuously escalates, the integration of operational risk management (ORM), IT risk management (ITRM), enterprise risk management (ERM), and governance, risk, and compliance (GRC) technologies within the broader umbrella of Integrated Risk Management (IRM) has never been more crucial.