3 Ways IRM Offers a Path Forward for Fragmented Risk Disciplines - Including GRC

In the dynamic world of business, organizations are constantly exposed to myriad threats and risks. To tackle these challenges, companies traditionally deploy different risk management disciplines tailored to address specific facets of risk. These disciplines include Operational Risk Management (ORM), Information Technology Risk Management (ITRM), Enterprise Risk Management (ERM), and Governance, Risk and Compliance (GRC). GRC is most often the outlier among these risk management disciplines due to its legacy nature as a standalone function. While this was accepted in the past, it is a significant barrier to more effective ways of managing risk.

The Isolation of GRC from Other Risk Management Disciplines

GRC is often perceived as isolated from other risk management disciplines due to several underlying factors. Firstly, GRC has its own unique set of frameworks, methodologies, and tools that are tailored specifically for overseeing governance and assessing risks expressly related to legal and regulatory compliance. This specialized approach can sometimes result in a disconnect from other risk management functions, such as enterprise risk management (ERM) or operational risk management (ORM). Secondly, since the focus of GRC is primarily on regulatory and legal requirements, broader strategic and operational risks that other disciplines address are overshadowed or simply ignored. Moreover, GRC efforts are often departmentalized within organizations, with separate teams solely responsible for compliance, internal audits, and risk management, leading to limited collaboration and integration.

As a result, GRC is frequently viewed as a distinct entity, operating in its own silo, which prevents synergy and a comprehensive understanding of risk across the organization. Breaking down these barriers and fostering closer alignment between GRC and other risk management disciplines is crucial for organizations aiming to adopt a comprehensive, integrated risk management (IRM) approach.

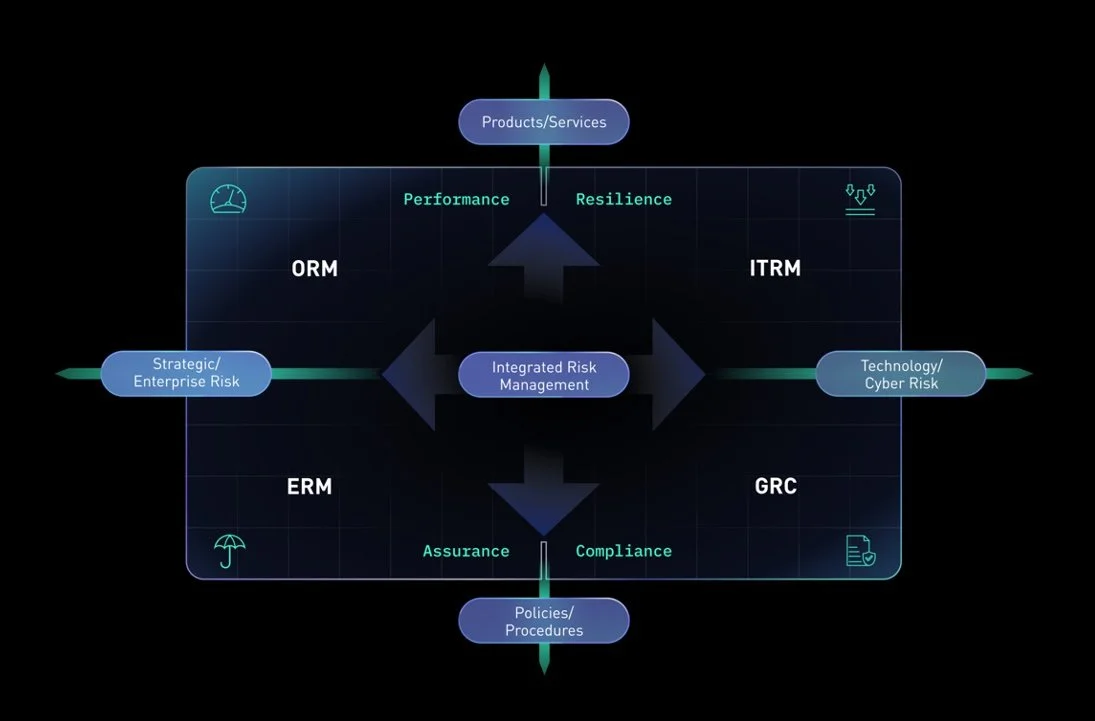

Source: IRM Navigator™ Framework, Wheelhouse Advisors

The Integrated Approach:

Aligning ORM with performance risk, ITRM with resilience risk, ERM with assurance risk, and GRC with compliance risk provides a balanced perspective of all risk areas and disciplines. Together, these create the foundation of effective IRM technology. This comprehensive approach is not just a luxury but a necessity in the modern corporate landscape. Here's why.

1. Comprehensive Risk Identification and Mitigation:

Integrated Risk Management's primary advantage is its ability to present a complete picture of the risks that an organization might face. Each risk management discipline addresses different types of risks. ORM, for example, is primarily concerned with the non-financial performance risks, such as the potential for process failures or inefficiencies that could impair business operations. ITRM, on the other hand, focuses on resilience risks, dealing with business disruptions caused by IT infrastructure failures, cybersecurity breaches, and data mismanagement. ERM deals with assurance risks that might affect a company's strategic goals, including financial, strategic, and reputational risks. GRC manages compliance risks, ensuring adherence to governance standards and legal regulations.

When these disciplines work independently, the resulting approach is often disjointed, leaving potential for overlooked or underestimated risks, and costly redundancies. On the contrary, an integrated approach under the IRM umbrella facilitates dialogue and data exchange, enabling all potential risks to be identified, evaluated, and mitigated in a comprehensive manner. This cohesion promotes a balanced perspective of all risk areas and disciplines, offering a cohesive risk mitigation strategy.

2. Strategic Decision-Making and Resource Optimization

The second compelling reason for integrating these disciplines is the enhancement of strategic decision-making and resource optimization. With separate risk management disciplines, strategies and responses are often developed in isolation, leading to potential inefficiencies or missed opportunities. The different areas might also vie for resources, leading to potential misallocations.

With an integrated approach, all risk areas come under one framework, offering a unified view of all risks and resources. This coordinated perspective allows for aligning strategies across disciplines and optimizing resource allocation based on a thorough understanding of the entire risk landscape. The result is informed, proactive, and strategic decision-making that can serve as a source of competitive advantage.

3. Regulatory Compliance and Incident Response:

The integration of these four disciplines within an IRM framework not only promotes regulatory compliance but also augments the abilities to respond to compliance failures. Regulatory bodies are progressively demanding evidence of robust, comprehensive risk management systems. An integrated approach is the key to satisfying these demands, while also equipping the firm to react effectively to future regulatory changes.

Moreover, a coordinated response during a risk event is possible through an integrated system, minimizing downtime, speeding up recovery, and fostering trust among key stakeholders such as the board of directors, investors, customers, regulators, and auditors. This approach allows companies to not only survive during crisis situations, but also to thrive by leveraging the inherent opportunities present in risk events.

Leveraging IRM Technology:

To accomplish these benefits, organizations should look to deploy a unified risk management platform that offers a single, accessible point for all risk-related data. Such a platform encourages collaboration between risk management teams, simplifies reporting, and provides a complete, real-time snapshot of the organization's risk profile. This, in essence, is what effective IRM technology embodies - a balanced and comprehensive view of all risk areas and disciplines.

The integration of ORM, ITRM, ERM, and GRC using an IRM framework is not just an advantage but a necessity in today's volatile business environment. By offering a comprehensive risk identification process, enhanced decision-making capabilities, and bolstered regulatory compliance and resilience, a well-structured, integrated approach to risk management can help safeguard the future of any business in our unpredictable and often turbulent business landscape.