Transitioning from Fragmented GRC to Integrated Risk Management: A Path Forward

The governance, risk, and compliance (GRC) technology landscape remains fragmented and complex, presenting challenges for organizations seeking cohesive enterprise risk management. Gartner's recent analysis highlights organizations' struggles with inconsistent pricing models and disconnected GRC solutions, ultimately obstructing a comprehensive approach to risk. “Due to widely varying government <sic>, risk, and compliance (GRC) tool pricing, enterprise risk management (ERM) leaders must understand four different pricing-tier categories of GRC solutions and apply a scoping framework to further estimate likely costs ahead of vendor selection,” says Gartner.

The IRM Navigator™ Quarterly Insight Report – ERM Edition, published by Wheelhouse Advisors, dives into these complexities and outlines why a shift towards Integrated Risk Management (IRM) is absolutely essential for today's dynamic risk environment. The IRM approach replaces the traditional, siloed GRC model with a unified framework. By transitioning to IRM, organizations can enhance strategic decision-making, increase operational efficiency, and gain a complete view of risks across the enterprise. This transition is not just about adopting a new framework; it's about unlocking the value of risk management as a strategic asset.

The Case for Integrated Risk Management

According to the IRM Navigator™ ERM Edition, the evolution of ERM has moved away from isolated functions focused merely on high-level risk oversight. Today, ERM operates as a strategic discipline that aligns with other essential risk functions, such as operational risk management (ORM), technology risk management (TRM), and GRC. The report highlights that fully mature ERM processes exist in only 37% of organizations, underscoring the need for a more integrated approach.

The IRM Navigator™ framework developed by Wheelhouse Advisors is designed to address this gap. By positioning ERM as a central component within IRM, organizations can break down risk silos and foster seamless risk information sharing. This integration across processes, assets, policies, and goals creates a cohesive environment where risk is managed and strategically aligned with the organization's objectives. In this structure, ERM doesn't operate in isolation but interacts dynamically with ORM, TRM, and GRC to create a robust, interconnected risk management ecosystem.

Key Benefits of Integrating ERM Applications

The report underscores the advantages of integrating ERM within an IRM framework, including:

Comprehensive Risk Perspective: With integrated ERM, organizations gain visibility across all risk domains, helping to identify and mitigate interconnected risks.

Enhanced Strategic Decision-Making: Aligning ERM with organizational goals allows decision-makers to incorporate risk insights into strategic planning.

Improved Collaboration: Breaking down silos fosters collaboration between ERM and other risk functions, leading to a unified risk culture.

Efficient Resource Allocation: Organizations can prioritize critical risks, ensuring resources are directed where needed.

Proactive Risk Management: Integrated ERM applications facilitate continuous monitoring, enabling a proactive approach to emerging risks.

The IRM Market and the Role of ERM

The IRM Navigator™ ERM Edition also analyzes the ERM market segment's size and growth forecast. Despite recent economic uncertainties, ERM is projected to grow steadily, driven by increasing regulatory demands, globalization, and stakeholder expectations for transparency in risk practices. The IRM Navigator framework categorizes ERM solution providers based on their integration capabilities and market positioning, helping organizations select solutions that align with their specific needs.

Within this framework, ERM is directly associated with the integration point of Strategic Goals, emphasizing alignment with the organization's strategic objectives. As businesses face complex challenges—such as technological disruptions and regulatory shifts—ERM is a linchpin for navigating these uncertainties. As the report details, the IRM framework fosters resilience, performance, compliance, and assurance through its core integration points.

The IRM Navigator™ ERM Edition delves into the challenges and opportunities within the ERM market segment, providing valuable insights for senior executives, risk professionals, and technology providers. Key findings from the report include:

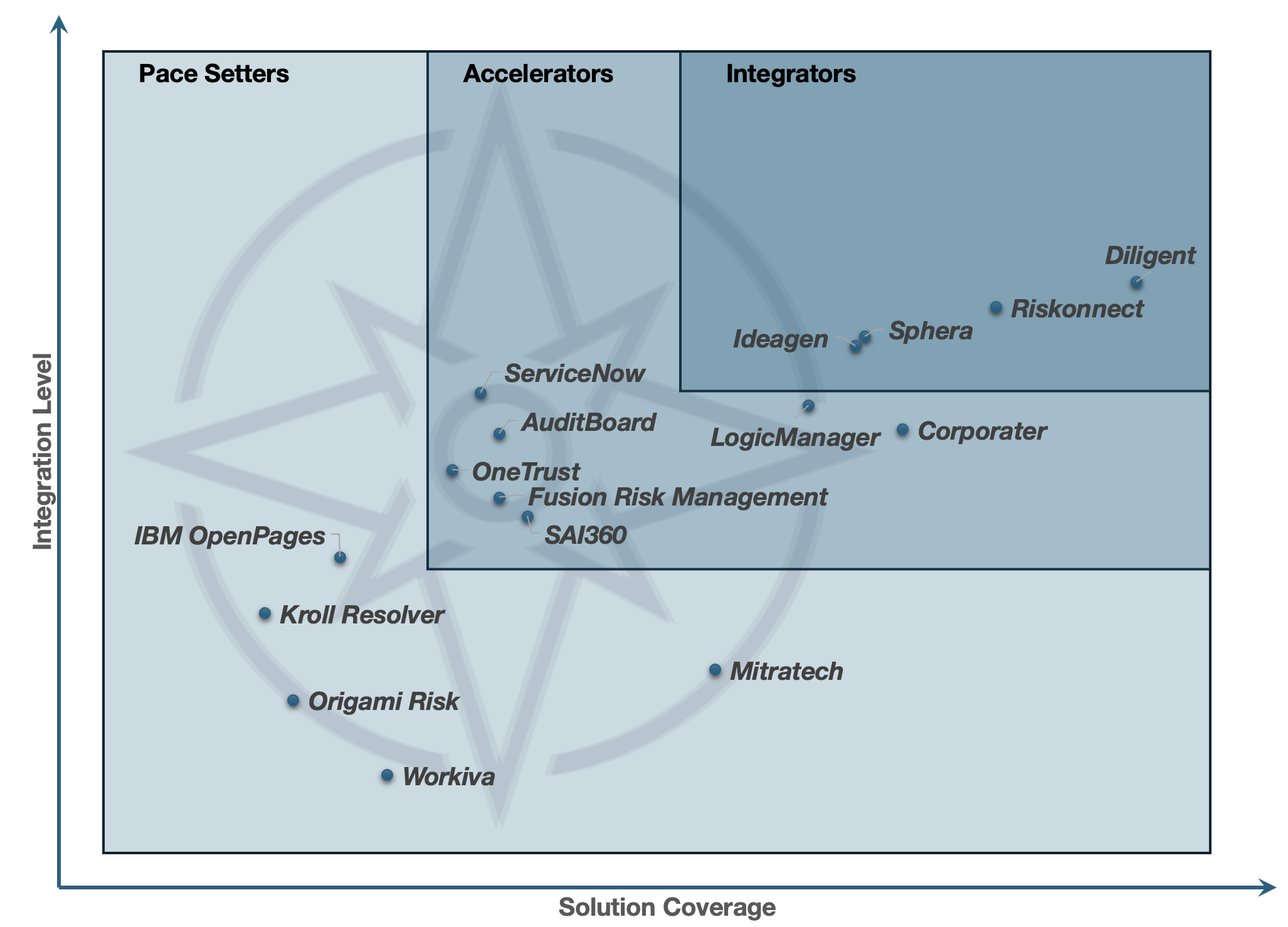

IRM Navigator™ Vendor Compass – ERM Edition

The Evolution of ERM: Tracing ERM's journey from an isolated top-level function to an integrated enterprise-wide discipline. Studies reveal that only 37% of organizations have fully mature ERM processes, and a mere 30% consider their risk management robust.

Importance of ERM in the IRM Navigator™ Framework: Positioning ERM as a central pillar within the IRM Navigator™ framework, aligning strategic objectives with risk management practices across the enterprise. This integration fosters a cohesive environment where risk information flows seamlessly across departments.

Top Players in ERM: Analyzing leading ERM solution providers through the IRM Navigator™ Vendor Compass – ERM Edition. Vendors are categorized based on their integration capabilities and solution coverage:

Integrators: Diligent, Ideagen, Riskonnect, Sphera.

Accelerators: AuditBoard, Corporater, Fusion Risk Management, LogicManager, OneTrust, SAI360, ServiceNow.

Pace Setters: IBM OpenPages, Kroll Resolver, Mitratech, Origami Risk, Workiva.

Strategic Recommendations for Enterprise Risk Integration and Management: Offering actionable recommendations such as adopting a unified IRM framework, integrating sustainability into ERM practices, leveraging AI and data analytics, and strengthening leadership and culture to enhance ERM capabilities.

Access the Full IRM Navigator™ Report Series

Wheelhouse Advisors is also pleased to announce that the Annual Viewpoint Report, the Buyer Persona Guide, and the GRC Edition of the IRM Navigator™ report series are now published and available with the IRM Navigator™ Quarterly Insight Report – ERM Edition at Wheelhouse Advisors' IRM Navigator Reports. These resources provide further insights into Integrated Risk Management strategies, market trends, and technology solutions.

As the risk landscape evolves, moving beyond fragmented GRC solutions to a cohesive IRM framework is essential for achieving strategic agility, resilience, and long-term success. The IRM Navigator™ framework and its insights into ERM, ORM, TRM and GRC are a roadmap for organizations aiming to turn risk management into a competitive advantage.