The Risk Wheelhouse Podcast

The Risk Wheelhouse is the podcast dedicated to exploring how RiskTech is reshaping the future of risk management. Hosted by our experts, Ori Wellington and Sam Jones, each episode delves deep into Integrated Risk Management (IRM), offering insights into the latest trends, technologies, and strategies. Join us to stay ahead in the ever-evolving risk landscape and empower your organization with actionable knowledge.

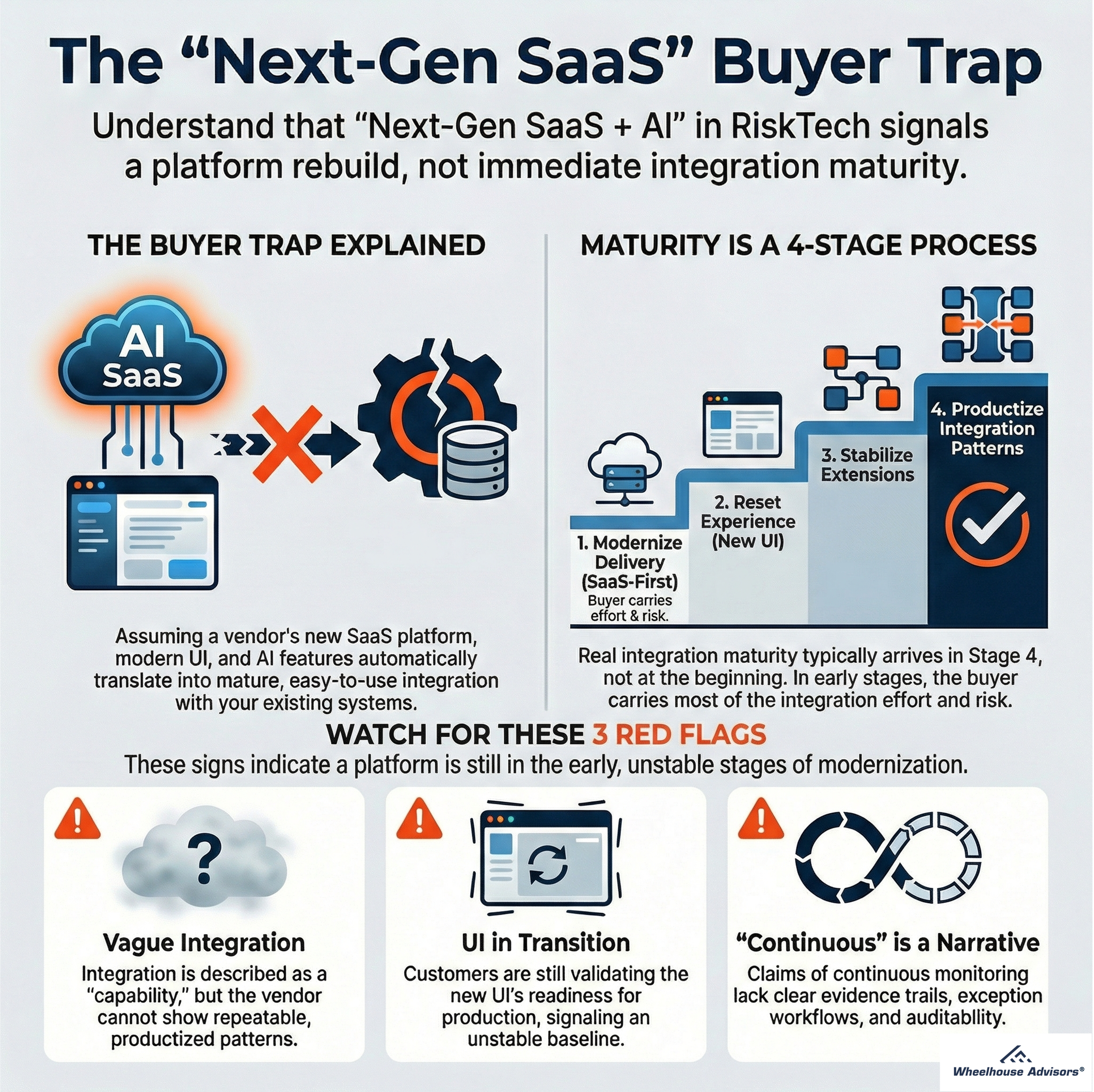

S6E4: Avoiding The RiskTech Buyer Trap

Shiny demos are everywhere, but what if that “next-gen SaaS” risk platform is still a construction zone under the hood? We unpack the Risk Tech Buyer Trap and show how modern UIs and AI buzz can disguise where vendors really are on the path to true integration maturity. Our conversation breaks down a clear four-stage transformation sequence—SaaS foundation, experience reset, object model stabilization, and finally productized integration—so you can pinpoint a platform’s real readiness and avoid inheriting the vendor’s rebuild risk.

AI raises the stakes. As non-human identities proliferate and SaaS-to-SaaS connections multiply, trust becomes the new currency. We explore how data boundaries, continuous assurance, and identity governance reshape due diligence, and why vague claims about “secure cloud” and “powerful AI” no longer cut it. Using Archer’s Evolv journey as a transparent case study, we illustrate the signals of staged modernization and the common gap between marketing momentum and operational maturity

S4E4: How Workiva's 32% Stock Surge Reveals a Deeper Industry Transformation

Workiva's spectacular 32% stock surge after their Q2 2025 earnings reveals something much deeper than just a strong quarter. Their $215 million revenue (up 21% year-over-year) and impressive 114% net retention rate signal the market's growing confidence in their strategic transformation—a shift that parallels the entire risk management industry's evolution.

What makes this story fascinating is the context. Before this surge, Workiva had struggled, with their stock down 24% over two years due to overreliance on specific regulatory drivers like the EU's Corporate Sustainability Reporting Directive. When regulations faced delays, revenue recognition suffered, spooking investors. This vulnerability exposed a fundamental weakness in their business model.