The Risk Wheelhouse Podcast

The Risk Wheelhouse is the podcast dedicated to exploring how RiskTech is reshaping the future of risk management. Hosted by our experts, Ori Wellington and Sam Jones, each episode delves deep into Integrated Risk Management (IRM), offering insights into the latest trends, technologies, and strategies. Join us to stay ahead in the ever-evolving risk landscape and empower your organization with actionable knowledge.

S5E8: 2025 ERM Vendor Compass, The New Enterprise Decision Layer

ERM has a perception problem, and in 2025 it becomes a performance problem. Many programs still optimize for completeness, annual reporting cycles, and beautifully formatted board packs. Boards increasingly optimize for something else: faster, defensible decisions under volatility. The market’s new standard is measurable and uncompromising: time to decision and time to evidence. If your ERM platform depends on manual synthesis to tell the story, the story arrives late, and leadership is forced to decide on partial facts.

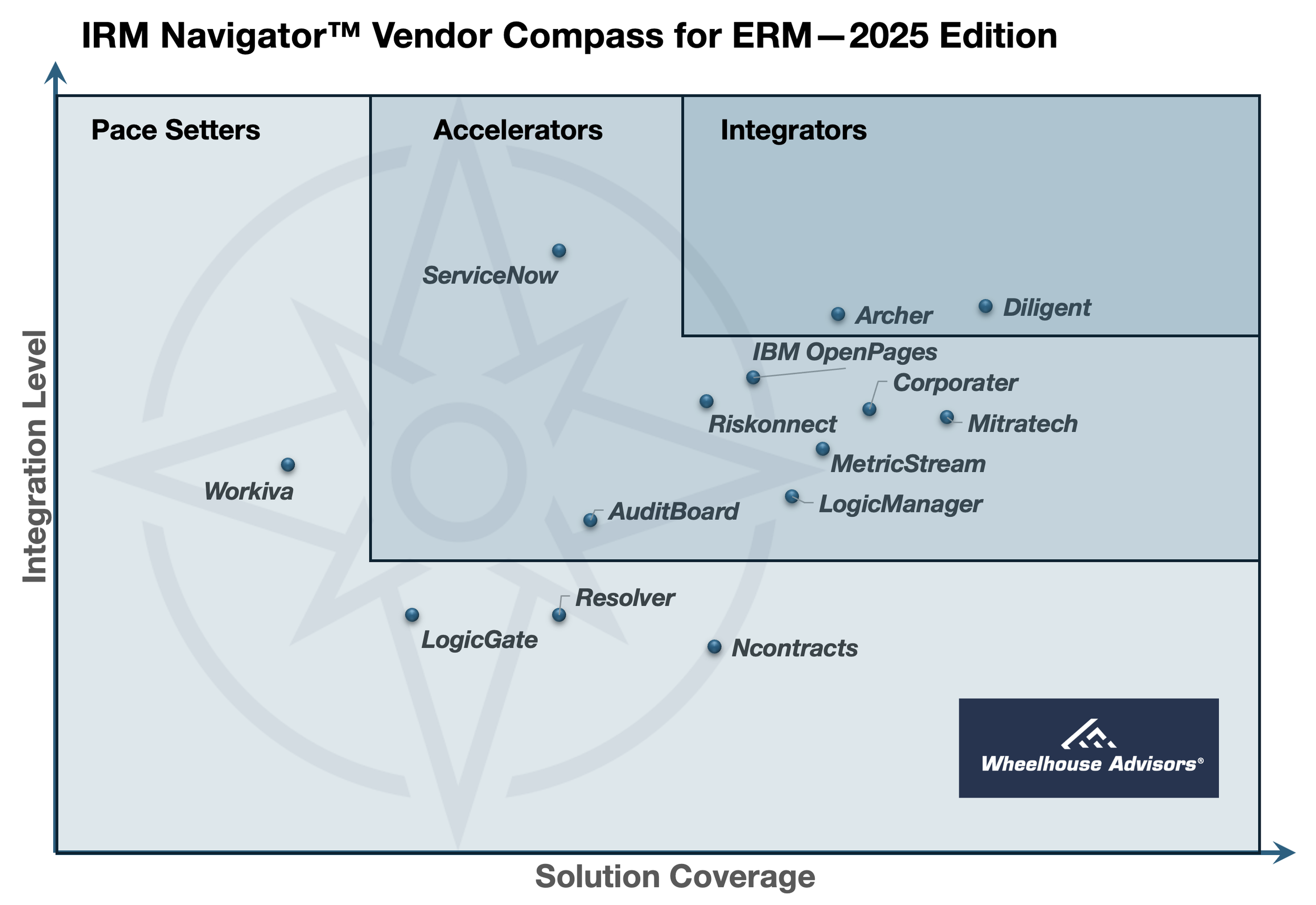

In this episode, we unpack the 2025 IRM Navigator™ Vendor Compass for Enterprise Risk Management (ERM) and explain why ERM must operate as the enterprise decision layer. That means converting risk appetite into quantified thresholds and escalation logic, sustaining a living scenario portfolio that can be refreshed and reused, and reusing verified evidence from ORM, TRM, and GRC to produce board-grade outputs with traceability.

S4E7: The Academic Reckoning of Risk Management

Risk management evolution isn't just about new acronyms. It's about organizational survival in an increasingly complex world. When we examine the journey from checkbox compliance to genuine integration, we uncover profound lessons about how businesses navigate danger and why some approaches fundamentally fail when pressure hits.

This deep dive traces the fascinating progression from Governance, Risk and Compliance (GRC) through Enterprise Risk Management (ERM) to today's Integrated Risk Management (IRM) framework. Drawing from John Wheeler's powerful "Risk Ignored" series, we explore how GRC emerged after Sarbanes-Oxley as an elegant solution on paper that quickly collapsed under its own weight. As Norman Marks memorably quipped, GRC often stood for "Governance, Risk Management, and Confusion."