S6E2: Rethinking Integrated Risk, From ROI To Dividends

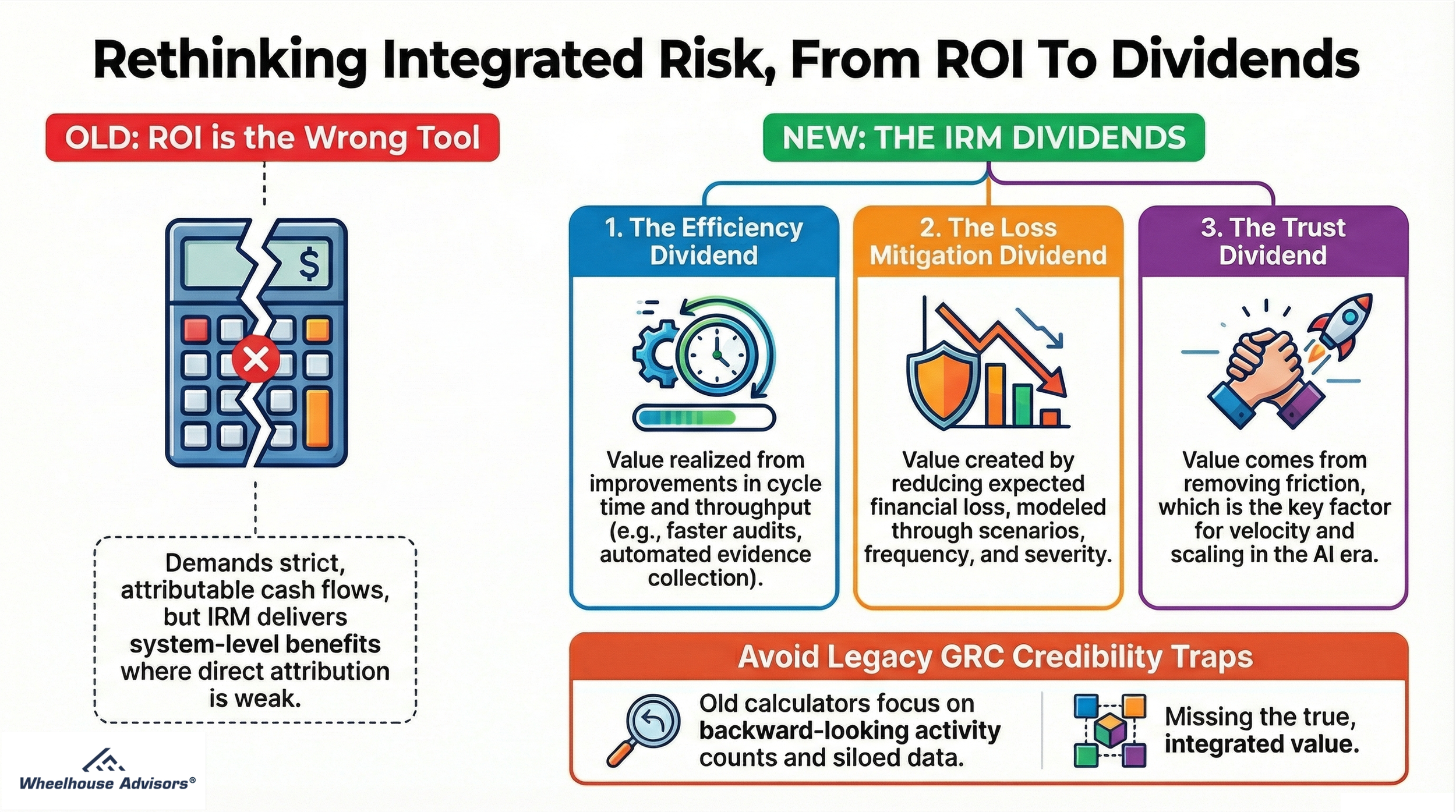

Integrated Risk Management (IRM) is repeatedly underfunded for a structural reason: leaders keep forcing IRM into an ROI construct that demands a single, auditable chain of causality, while IRM is designed to distribute value across multiple domains at once. In this episode, Ori Wellington and Sam Jones explain why ROI framing collapses into assumption-stacked narrative under CFO scrutiny, and why risk leaders need a finance-compatible alternative that remains decision-grade.

The episode’s answer is a disciplined shift: evaluate IRM with cost/benefit analysis, and label the benefit streams as dividends. Dividends are distributed outcomes that improve enterprise performance and resilience without requiring false precision in a single attributable cash-flow line.

What executives should take from this episode

ROI is the wrong container for IRM. ROI demands strict attribution. IRM delivers system-level uplift where attribution is inherently weak.

Use dividends to quantify value in decision-grade terms:

Efficiency dividend (cycle time and throughput improvements), with explicit discipline on what becomes realized value.

Loss mitigation dividend (reduction in expected loss), modeled through scenarios, frequency, severity, and control effectiveness assumptions.

Trust dividend (friction removed), increasingly the gating factor for velocity in an AI-era operating model.

Avoid the credibility traps embedded in legacy GRC value calculators. They pull the conversation toward compliance throughput, invite silo double counting, and emphasize backward-looking activity counts rather than continuous assurance.

If IRM is positioned as a strategic capability, its value model must be positioned the same way. Build a dividend-based business case that finance can challenge and still accept, then use it to protect and accelerate the enterprise’s highest-leverage investments.

Podcast Episode Chapters

0:00 - The ROI Mismatch Problem

3:58 - Defining Finance-Grade ROI Rigor

7:03 - Why IRM Defies Singular Attribution

12:03 - Introducing The Dividends Model

15:48 - Efficiency Dividend And Its Limits

21:48 - Capacity Redeployment Vs Trapped Time

25:58 - Quantifying Loss Mitigation Credibly

31:48 - Presenting Ranges And Confidence

36:03 - The Trust Dividend As Friction Removed

Wheelhouse Advisors’ YouTube channel delivers fast, executive-ready insights on Integrated Risk Management. Explore short explainers, IRM Navigator research highlights, RiskTech Journal analysis, and conversations from The Risk Wheelhouse Podcast. We cover the issues that matter most to modern risk leaders. Every video is designed to sharpen decision making and strengthen resilience in a digital-first world. Subscribe at youtube.com/@wheelhouseadv.

Don't forget to subscribe on your favorite podcast platform—whether it's Apple Podcasts, Spotify, or Amazon Music.

Please contact us directly at info@wheelhouseadvisors.com or feel free to connect with us on LinkedIn and X.com.

Visit www.therisktechjournal.com and www.rtj-bridge.com to learn more about the topics discussed in today's episode.