Click here to access subscription content at The RTJ Bridge - The Premium Version of The RiskTech Journal

〰️

Click here to access subscription content at The RTJ Bridge - The Premium Version of The RiskTech Journal 〰️

The RiskTech Journal

The RiskTech Journal is your premier source for insights on cutting-edge risk management technologies. We deliver expert analysis, industry trends, and practical solutions to help professionals stay ahead in an ever-changing risk landscape. Join us to explore the innovations shaping the future of risk management.

WEF Claims AI Governance is a Growth Strategy

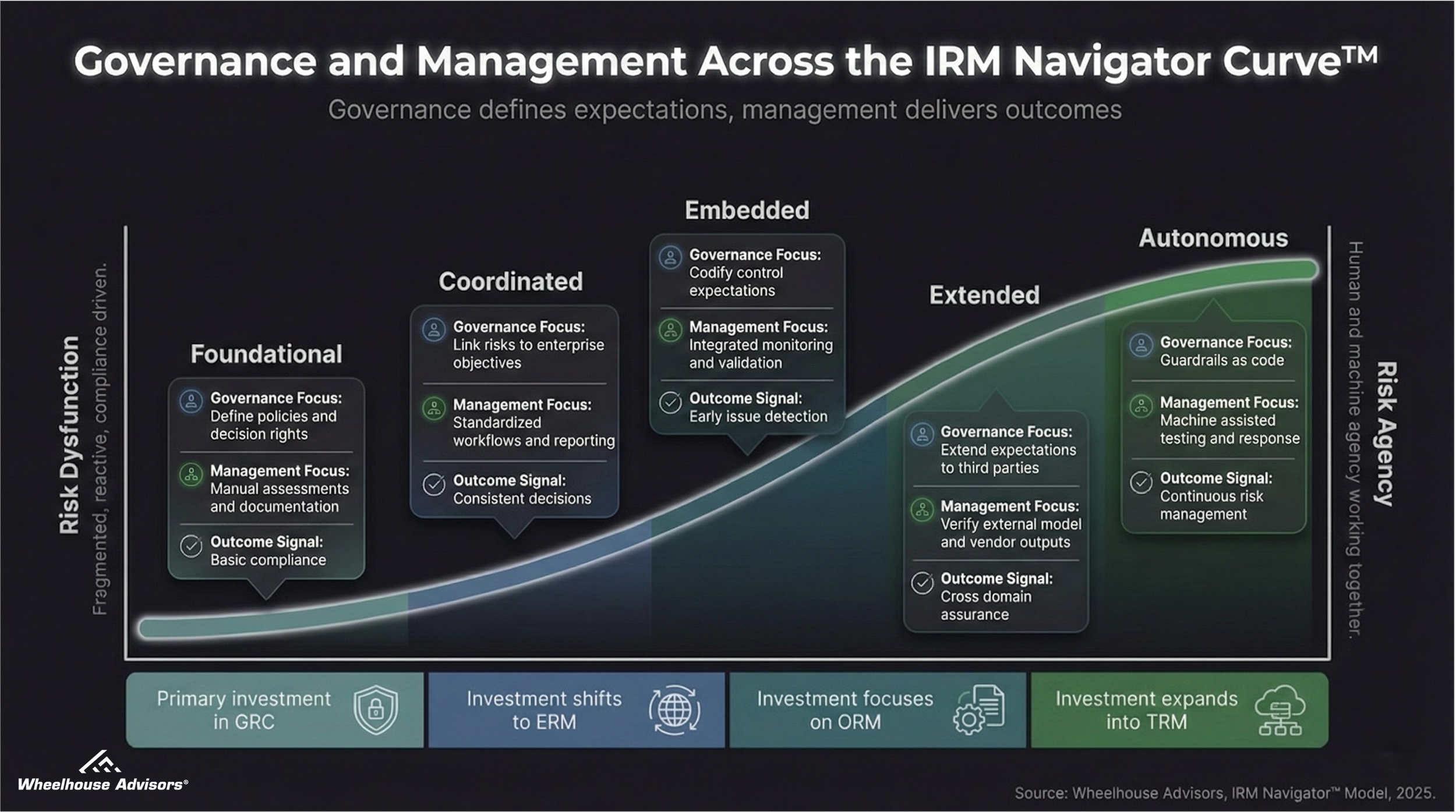

The recent World Economic Forum argument that “effective AI governance” is now a growth strategy is directionally correct, and also incomplete in a way that will matter for buyers in 2026. The claim is correct because governance reduces friction, clarifies accountability, and increases repeatability as AI moves from pilots to enterprise scale. The claim is incomplete because many organizations are calling the entire operating model “AI governance,” when the value is realized only when governance is translated into management execution.

GRC Without Visionaries: What the 2025 Gartner® Magic Quadrant™ Reveals About the Future of Risk

The release of the “2025 Gartner® Magic Quadrant™ for Governance, Risk and Compliance (GRC) Tools, Assurance Leaders” marks an important turning point in the evolution of enterprise risk technology. For the first time in nearly two decades of coverage, Gartner has explicitly defined the GRC category around assurance leaders rather than enterprise risk or governance audiences.

Equally significant is the visual structure of the 2025 quadrant, which contains an entirely empty Visionaries section. While some may interpret this as a sign of stagnation, it more accurately reflects a market that has entered its integration phase. The GRC segment has reached functional maturity and operational stability, creating the foundation upon which the next generation of Integrated Risk Management (IRM) and Autonomous IRM capabilities will develop.

Here, we analyze the implications of the 2025 Magic Quadrant through the lens of the IRM Navigator™ Model and the recent IRM Navigator™ Vendor Compass for Governance, Risk and Compliance (GRC) - 2025 Edition. Our research concludes that the absence of Visionaries does not indicate a failure of innovation, but rather the outcome of successful specialization. GRC has become the operational core of enterprise assurance, while IRM now defines the broader architecture of enterprise confidence and decision intelligence.

Palo Alto Networks CEO Warns of AI Agent Risks

On CNBC yesterday, Palo Alto Networks CEO Nikesh Arora issued one of the most direct warnings yet about the risks of enterprise AI agents. He noted that in the near future, “there’s gonna be more agents than humans running around trying to help you manage your enterprise.” If true, that represents not only an IT transformation, but a fundamental shift in the risk surface of every large organization.

The Coming Wave: Why AI-Fueled Cyber Crime Demands a New Layer of Risk Management

In June 2024, a ransomware attack on Synnovis—an NHS diagnostics provider—led to thousands of canceled surgeries, long-term patient harm, and yet barely registered in the headlines. A year later, an attack on Marks & Spencer, which temporarily left Percy Pig sweets and Colin the Caterpillar cakes off supermarket shelves, wiped £600 million off the company’s market cap and triggered nationwide panic.

This juxtaposition, as Misha Glenny eloquently observes in his Financial Times Weekend article, reveals something uncomfortable about both society’s perception of cyber risk and our structural ability to respond to it. But it also points to a larger and more pressing reality: AI is about to turn every cyber threat vector into a force multiplier—and the defensive tools most organizations rely on are no longer fit for purpose.

As AI matures into autonomous, agentic forms, we’re not just dealing with more attacks—we’re dealing with smarter, faster, and more scalable ones. The solution isn’t just better cybersecurity. It’s Integrated Risk Management (IRM)—and it must evolve as rapidly as the threat landscape.