GRC Without Visionaries: What the 2025 Gartner® Magic Quadrant™ Reveals About the Future of Risk

Executive Summary

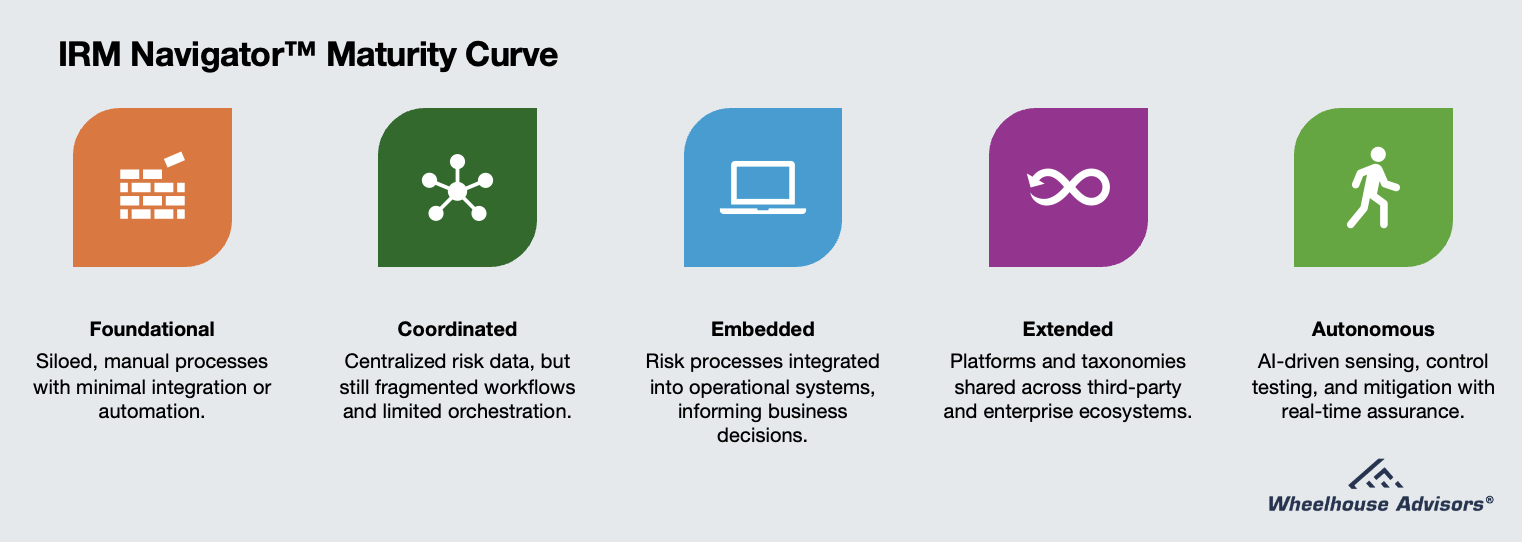

Source: IRM Navigator™ Model, Wheelhouse Advisors

The release of the “2025 Gartner® Magic Quadrant™ for Governance, Risk and Compliance (GRC) Tools, Assurance Leaders” marks an important turning point in the evolution of enterprise risk technology. For the first time in nearly two decades of coverage, Gartner has explicitly defined the GRC category around assurance leaders rather than enterprise risk or governance audiences.

Equally significant is the visual structure of the 2025 quadrant, which contains an entirely empty Visionaries section. While some may interpret this as a sign of stagnation, it more accurately reflects a market that has entered its integration phase. The GRC segment has reached functional maturity and operational stability, creating the foundation upon which the next generation of Integrated Risk Management (IRM) and Autonomous IRM capabilities will develop.

Here, we analyze the implications of the 2025 Magic Quadrant through the lens of the IRM Navigator™ Model and the recent IRM Navigator™ Vendor Compass for Governance, Risk and Compliance (GRC) - 2025 Edition. Our research concludes that the absence of Visionaries does not indicate a failure of innovation, but rather the outcome of successful specialization. GRC has become the operational core of enterprise assurance, while IRM now defines the broader architecture of enterprise confidence and decision intelligence.

The Narrowing Scope of GRC

The “2025 Gartner® Magic Quadrant™ for GRC Tools, Assurance Leaders”, represents a deliberate narrowing of scope. In Gartner’s Magic Quadrant title, it is evident GRC is no longer positioned as a unifying market category for governance, risk, and compliance activities. Instead, it is now a set of tools for assurance leaders to enable enterprise internal audit, compliance, ethics, and internal control programs. This evolution marks the institutional maturity of GRC as a technology market.

The tools and workflows supporting policy management, control monitoring, and compliance attestations are now standardized, automated, and well understood. This is consistent with what Wheelhouse Advisors describes as the “verification layer” of the risk technology stack, where governance becomes measurable. The GRC segment delivers traceability, repeatability, and confidence in compliance evidence. However, it remains retrospective by design. It answers the question, “Did we do what we said we would do?” rather than “Are we prepared for what happens next?”

That difference, between verification and anticipation, defines the gap that IRM fills. The role of GRC is to prove assurance, while the role of IRM is to enable foresight.

Historical Context: From Integration Promise to Assurance Specialization

When GRC emerged in the mid-2000s, it carried the promise of unification. The acronym itself suggested integration, bringing governance, risk, and compliance under a single technological and conceptual framework. Early platform providers such as Archer, OpenPages, and MetricStream pioneered the category, presenting GRC as an enterprise system of record for risk and compliance data.

By the mid-2010s, however, the market had reached a crossroads. Many organizations found that while GRC tools successfully centralized control data, they struggled to integrate meaningfully with performance management, operations, or cybersecurity. In practice, GRC became the hub of assurance rather than a hub of strategy. Gartner’s segmentation of the 2025 Magic Quadrant acknowledges this reality. The analysts’ decision to focus the report on assurance leaders reflects recognition that GRC has achieved its most natural equilibrium as a system of record and workflow engine for compliance, audit, and internal control.

This is not a retreat but an evolutionary milestone. Every mature technology market reaches a phase where its boundaries are defined, and innovation migrates to adjacent domains. For GRC, that domain is not external but higher order. It is IRM, the encompassing market that integrates GRC along with ERM, ORM, and TRM under a unified model of risk management.

Absence of Visionaries: A Marker of Market Maturity

The 2025 GRC Magic Quadrant’s empty Visionary quadrant is its most symbolically important feature. For the first time since Gartner began covering GRC, no vendor occupies that space.

At first glance, this may appear concerning to those who equate Visionary status with progress. Yet, in the context of technology diffusion and maturity models, the absence of Visionaries indicates that the market has completed its first innovation cycle. GRC has reached the stage of optimization, where differentiation no longer depends on invention but on integration, automation, and assurance outcomes. This mirrors the trajectory of other mature technology categories such as ERP and HR systems, where Visionary quadrants often thin out once foundational capabilities stabilize and innovation migrates toward interoperability.

In Wheelhouse Advisors’ analysis, this marks a transfer of innovation energy rather than its loss. While GRC consolidates around assurance reliability, innovation has moved to IRM, the management layer that unites assurance with performance, resilience, and risk insight.

The Inclusive Relationship Between GRC and IRM

The relationship between GRC and IRM is not one of adjacency, but of inclusion. GRC operates within IRM as the layer that delivers assurance and compliance outcomes, while IRM encompasses the broader system of management that integrates enterprise, operational, technology, and assurance risk domains.

In the IRM Navigator™ Model, this relationship is mapped through the PRAC objectives:

Performance (P) – Defined by enterprise risk management (ERM) and its alignment of goals and strategy.

Resilience (R) – Driven by operational risk management (ORM) and its role in maintaining business continuity and adaptive capacity.

Assurance (A) – Enabled through GRC platforms that validate control integrity and compliance effectiveness.

Compliance (C) – Structured through policy management and regulatory adherence within GRC.

Technology Risk Management (TRM) is woven through the model by connecting the performance and resilience layers (P and R) with the assurance and compliance layers (A and C). In today’s digital age, all organizations have become technology driven. Cyber attacks and network outages can cripple businesses and lead to strategic, operational, regulatory and control failures. So, TRM must be integrated into all PRAC objectives.

IRM therefore unites these four PRAC objectives into a single, integrated model of enterprise confidence. GRC provides the verification framework that underpins the model, while TRM provides the connective intelligence that allows assurance to flow into management action.

This inclusive structure positions GRC not as a parallel category, but as an essential component of IRM’s broader market architecture.

The Strategic Role of Assurance in a Unified Risk Model

Source: IRM Navigator™ Viewpoint Report - 2025 Edition, Wheelhouse Advisors

The long-term direction of the risk management market is toward integration rather than replacement. GRC remains the entry point for assurance and compliance data, but its integration within IRM determines its strategic relevance. In practical terms, metrics once used to measure compliance efficiency, such as control testing cycle time, audit finding remediation, or policy updates, are now being correlated with indicators of enterprise resilience, including business continuity readiness and cyber exposure management.

This unification of assurance and operational data represents the early stage of what Wheelhouse Advisors defines as Assurance Intelligence. The concept describes the continuous correlation of compliance, control, and risk data for decision impact.

Here, GRC’s historical strengths intersect with IRM’s forward-looking analytics, producing continuous assurance that informs management decisions. As organizations move through the IRM Navigator™ Maturity Curve, assurance evolves from a static reporting function into a dynamic verification mechanism embedded within daily operations and decision cycles.

Strategic Implications: Continuity Through Integration

The most important insight from the 2025 Magic Quadrant is that GRC is no longer about competition but about continuity. The absence of Visionaries does not suggest that innovation has stopped. Instead, it confirms that innovation is now measured through integration.

GRC’s role will increasingly resemble that of accounting or financial reporting systems: essential, standardized, and foundational to enterprise trust. The innovation frontier lies in how effectively these systems integrate with AI-driven IRM environments that deliver continuous monitoring and autonomous risk detection.

Risk Event Forecast (2025–2028)

Predicted risk event: By 2028, leading assurance platforms will integrate natively with IRM ecosystems, combining continuous control monitoring with AI governance and real-time reporting capabilities. Probability: 80%.

Strategic change: GRC vendors will expand interoperability through advanced APIs, analytics integration, and AI-assisted evidence validation. The boundary between audit and risk management will narrow as automation enables continuous assurance across functions.

Secondary implication: The most advanced GRC vendors will reposition themselves not as compliance platforms but as assurance engines within unified IRM operating models. Success will hinge on measurable outcomes such as reduced audit fatigue, improved control reliability, and predictive remediation.

This evolution aligns with the Wheelhouse Advisors forecast through 2032, in which GRC remains a stable market whose growth is fueled by integration with IRM, ERP, and AI governance environments.

Why the Market Needs Both Stability and Innovation

The risk technology market depends equally on stability and innovation. The reliability of GRC platforms enables the innovation occurring in IRM and Autonomous IRM to scale safely. Without verifiable controls and defensible audit trails, autonomous decision-making would introduce unacceptable uncertainty. GRC therefore provides the confidence architecture that underpins the entire IRM maturity journey.

For this reason, the GRC category will not disappear even as IRM expands. Its role is shifting from front-end innovation to systemic reliability, ensuring that AI-enabled risk ecosystems remain transparent, auditable, and compliant with emerging AI assurance standards such as ISO/IEC 42001 and the NIST AI Risk Management Framework. GRC will remain the anchoring discipline in a hybrid assurance landscape, one where human oversight, algorithmic monitoring, and autonomous risk control coexist in continuous balance.

Conclusion

The 2025 Gartner Magic Quadrant for GRC Tools, Assurance Leaders, provides more than a vendor snapshot. It represents a structural milestone in the risk technology landscape. The absence of Visionaries is not a sign of decline, but confirmation that the GRC market has achieved operational maturity, enabling the next wave of innovation at the IRM level. GRC’s continuing relevance lies in its specialization. Its platforms have become the digital infrastructure of assurance, transforming governance into verifiable action and accountability. As IRM and Autonomous IRM mature, GRC will serve as their evidence backbone, supporting trust and traceability in increasingly autonomous risk environments.

For organizations and technology providers alike, the message is clear: the future of risk is not post-GRC, but beyond GRC, where assurance data, risk intelligence, and performance outcomes converge within a unified architecture of enterprise confidence. To learn more about GRC top vendors and how it is now a part of the larger IRM market, read our IRM Navigator™ Vendor Compass for GRC - 2025 Edition.

References

Gartner, Magic Quadrant for Governance, Risk and Compliance (GRC) Tools, Assurance Leaders, 2025.

Wheelhouse Advisors, IRM Navigator™ Vendor Compass for GRC 2025.

Wheelhouse Advisors, IRM Navigator™ Annual Viewpoint Report 2025.

Wheeler, J.A., The Great Risk Revolution—Why GRC Alone Can't Save Your Organization, The RiskTech Journal, 2025.

Gartner, AI Opportunity Radar: Set Your Enterprise’s AI Ambition, February 2025.

ISO/IEC 42001, Artificial Intelligence Management System Standard, 2023.

NIST, AI Risk Management Framework (AI RMF 1.0), 2023.