Click here to access subscription content at The RTJ Bridge - The Premium Version of The RiskTech Journal

〰️

Click here to access subscription content at The RTJ Bridge - The Premium Version of The RiskTech Journal 〰️

The RiskTech Journal

The RiskTech Journal is your premier source for insights on cutting-edge risk management technologies. We deliver expert analysis, industry trends, and practical solutions to help professionals stay ahead in an ever-changing risk landscape. Join us to explore the innovations shaping the future of risk management.

How S&P 100 Leaders Drive Cybersecurity Excellence Through Integrated Risk Management

Recent insights from the Gibson Dunn report, Cybersecurity Overview: A Survey of Form 10-K Cybersecurity Disclosures by the S&P 100 Companies, highlight key trends and practices among public companies. Integrated Risk Management (IRM) is increasingly recognized as the critical approach enabling organizations to meet these requirements while driving strategic value. In this analysis, we'll explore the evolving regulatory landscape, key trends in cybersecurity disclosures, and how IRM empowers organizations to align their cybersecurity strategies with enterprise-wide governance frameworks.

Restating Trust: Tackling the Rise in Financial Restatements with Integrated Risk Management

The financial landscape has been disrupted by a concerning surge in financial restatements among U.S. public companies. According to the Financial Times, 140 public companies reissued their financial statements in the first ten months of 2024 due to material accounting errors—a nine-year high. These restatements erode investor confidence and raise critical questions about the quality of financial reporting, the robustness of internal controls, and the effectiveness of corporate governance. Notable cases, such as Macy's misclassification of $132 million in delivery expenses and Archer Daniels Midland's overstated profits in its nutrition segment, underscore these errors' severe reputational and financial implications. This trend highlights systemic weaknesses that can no longer be overlooked. The rise in restatements calls for a comprehensive solution—one that Integrated Risk Management (IRM) technology and related RiskTech innovations are well-equipped to deliver.

Transitioning from Fragmented GRC to Integrated Risk Management: A Path Forward

The IRM approach replaces the traditional, siloed GRC model with a unified framework. By transitioning to IRM, organizations can enhance strategic decision-making, increase operational efficiency, and gain a complete view of risks across the enterprise. This transition is not just about adopting a new framework; it's about unlocking the value of risk management as a strategic asset.

Navigating IFRS S1 and IFRS S2: A Pathway for Integrated Risk Management and Sustainability

As sustainability reporting becomes increasingly critical for businesses, preparers are faced with new challenges and opportunities. The voluntary application of the International Sustainability Standards Board (ISSB) Standards, specifically IFRS S1 and IFRS S2, offers a framework for companies to disclose sustainability-related financial information, even ahead of regulatory mandates. To support companies, the IFRS Foundation has published Voluntarily applying ISSB Standards—A guide for preparers. This guide published provides companies a pathway to communicate their progress in aligning with these standards, supporting investor decision-making by offering transparent, comparable, and reliable information on sustainability risks and opportunities.

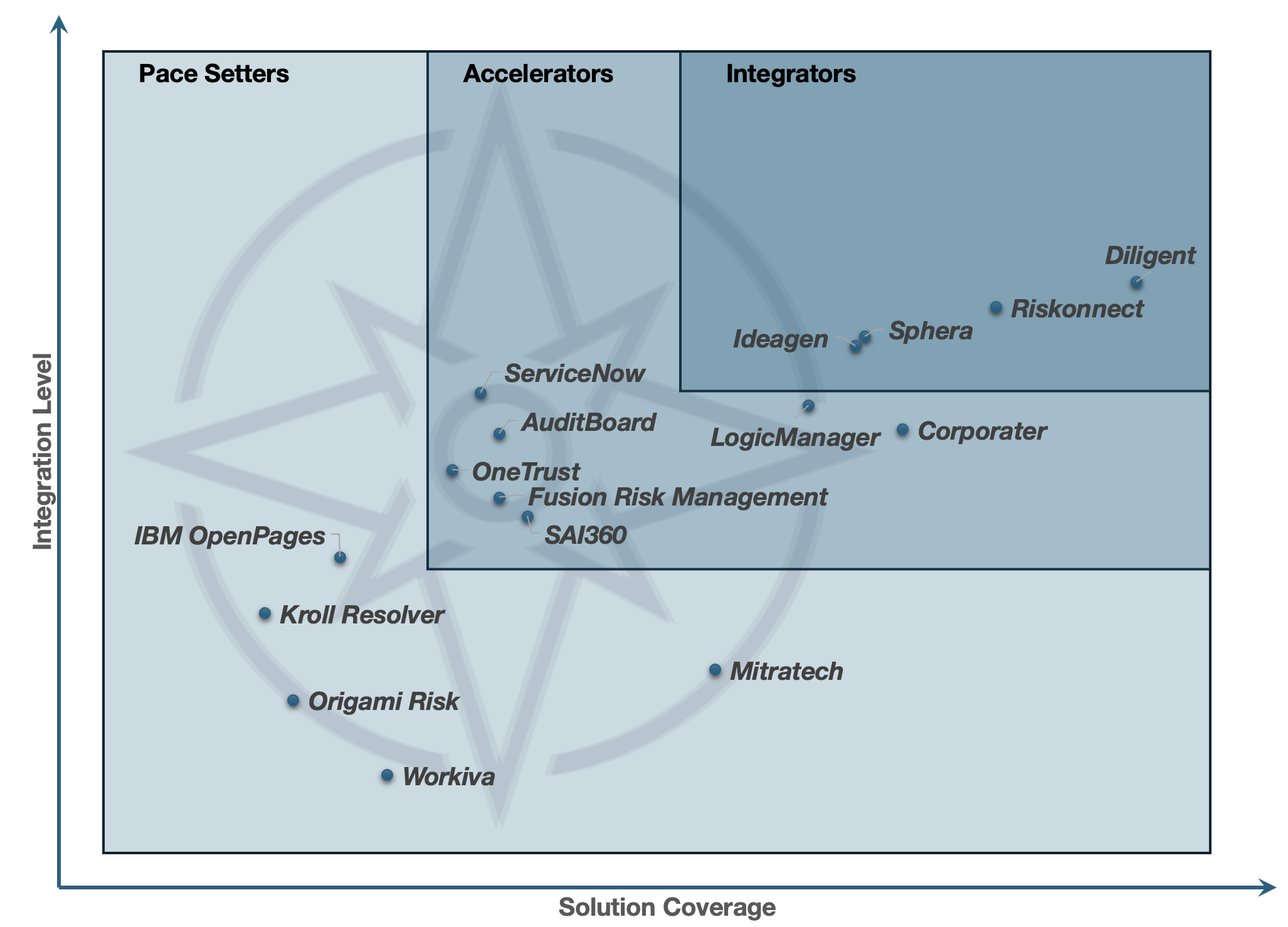

Unlocking the IRM Market: A Deep Dive into the 2024 IRM Navigator™ Buyer Persona Guide

In the rapidly evolving technology market landscape of Integrated Risk Management (IRM), understanding the intricacies of buyer personas is paramount for technology providers aiming to make a significant impact. The recently published 2024 IRM Navigator™ Buyer Persona Guide for Integrated Risk Management (IRM) by Wheelhouse Advisors emerges as a crucial resource for Chief Marketing Officers (CMOs), Chief Product Officers (CPOs), and business leaders. This comprehensive guide dissects the complex IRM market and offers actionable insights to tailor strategies effectively.