S4E2: Autonomous IRM - Orchestrating Risk at Machine Speed

The digital age has accelerated risk to unprecedented speeds, creating a fundamental challenge for organizations: how can you manage threats that move faster than humans can react? This paradigm shift has given rise to Autonomous Integrated Risk Management (IRM), a revolutionary approach that transitions from human-speed reactions to machine-speed foresight and response.

The core problem is deceptively simple but profound: the velocity of modern threats has completely outpaced traditional human decision-making capabilities. While conventional risk management relies on analysts sifting through alerts and manually initiating responses—often taking minutes, hours, or even days—the new reality demands reactions within seconds. This is where agentic AI systems come into play, representing a significant leap beyond basic AI alerts. These systems don't merely flag potential issues; they autonomously assess situations, act within predefined parameters, and continuously learn from outcomes.

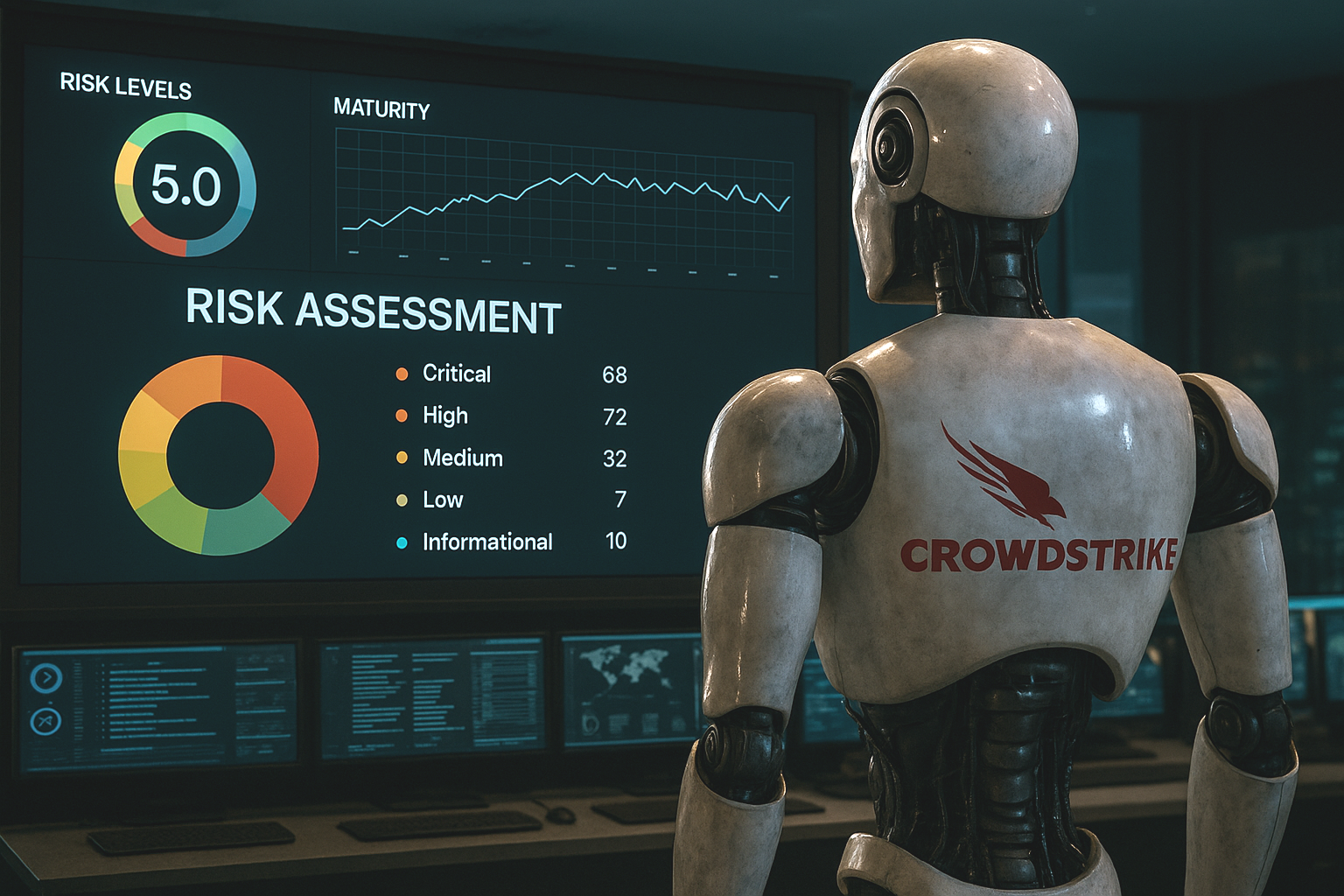

Crowstrike’s Charlotte AI - A Precursor to Autonomous IRM

Source: wheelhouseadvisors.com

CrowdStrike stands at the forefront of this evolution with Charlotte AI, their agentic AI architecture integrated into the Falcon platform. Charlotte AI delivers a powerful triad of capabilities: agentic detection/triage, agentic response, and agentic workflows. This means the system can instantly analyze and prioritize alerts, add critical context, and initiate containment actions without human intervention. The result is a fundamental shift in human roles from frontline analysts to strategic overseers who define policies and governance rather than processing individual alerts.

The real challenge emerges when we consider how these autonomous security decisions ripple throughout an organization. A machine-initiated action may trigger business continuity plans, impact third-party relationships, or require compliance documentation—all of which occur at machine speed. This orchestration challenge represents the current frontier: organizations must translate lightning-fast security responses into coordinated, auditable business actions across various functions, including legal, finance, operations, and vendor management.

Five Layer Autonomous IRM Blueprint

To address this complexity, the 2025 IRM Navigator™ Viewpoint Report outlines a five-layer architectural blueprint for autonomous IRM. At the top, strategic oversight ensures alignment between risk appetites and business priorities. The business orchestration layer coordinates signals across different functions, while the threat intelligence layer provides real-time validation. The remediation and response layer executes autonomous actions, such as isolating compromised accounts or triggering business continuity protocols. Finally, the verification and audit layer captures evidence for accountability and compliance.

Despite the rapid advancement of technologies like Charlotte AI, most organizations find themselves stalled between the "coordinated" and "embedded" stages of the IRM maturity curve. This disconnect stems not only from technological or budgetary constraints, but also from deeper structural and cultural barriers. Many companies still treat risk management as a periodic compliance exercise rather than a dynamic operational system woven into everyday business decisions.

Bridging this gap requires a fundamental shift in mindset throughout the organization. Leaders must reorient their approach from documenting risks retrospectively to orchestrating responses in real-time, and from viewing compliance as point-in-time snapshots to building it into execution frameworks. This transformation isn't theoretical or future-focused—it's happening now, with production-level AI already initiating actions that demand immediate reconciliation across policy, continuity, third-party, and assurance domains.

Operating at Machine Speed

For organizations seeking to operate at machine speed, the path forward involves five concrete steps: ingesting agentic telemetry from systems like Charlotte AI; translating raw signals into meaningful risk context; triggering cross-domain workflows; capturing automated evidence for audit trails; and continuously learning from outcomes to refine policies and thresholds. Organizations that successfully build these capabilities across all five functional layers will gain a decisive advantage not only in addressing today's threats but also in designing resilience for tomorrow's challenges.

Don't forget to subscribe on your favorite podcast platform—whether it's Apple Podcasts, Spotify, or Amazon Music.

Please contact us directly at info@wheelhouseadvisors.com or feel free to connect with us on LinkedIn and X.com.

Visit www.therisktechjournal.com to learn more about the topics discussed in today's episode.