The Risk Wheelhouse Podcast

The Risk Wheelhouse is the podcast dedicated to exploring how RiskTech is reshaping the future of risk management. Hosted by our experts, Ori Wellington and Sam Jones, each episode delves deep into Integrated Risk Management (IRM), offering insights into the latest trends, technologies, and strategies. Join us to stay ahead in the ever-evolving risk landscape and empower your organization with actionable knowledge.

S6E4: Avoiding The RiskTech Buyer Trap

Shiny demos are everywhere, but what if that “next-gen SaaS” risk platform is still a construction zone under the hood? We unpack the Risk Tech Buyer Trap and show how modern UIs and AI buzz can disguise where vendors really are on the path to true integration maturity. Our conversation breaks down a clear four-stage transformation sequence—SaaS foundation, experience reset, object model stabilization, and finally productized integration—so you can pinpoint a platform’s real readiness and avoid inheriting the vendor’s rebuild risk.

AI raises the stakes. As non-human identities proliferate and SaaS-to-SaaS connections multiply, trust becomes the new currency. We explore how data boundaries, continuous assurance, and identity governance reshape due diligence, and why vague claims about “secure cloud” and “powerful AI” no longer cut it. Using Archer’s Evolv journey as a transparent case study, we illustrate the signals of staged modernization and the common gap between marketing momentum and operational maturity

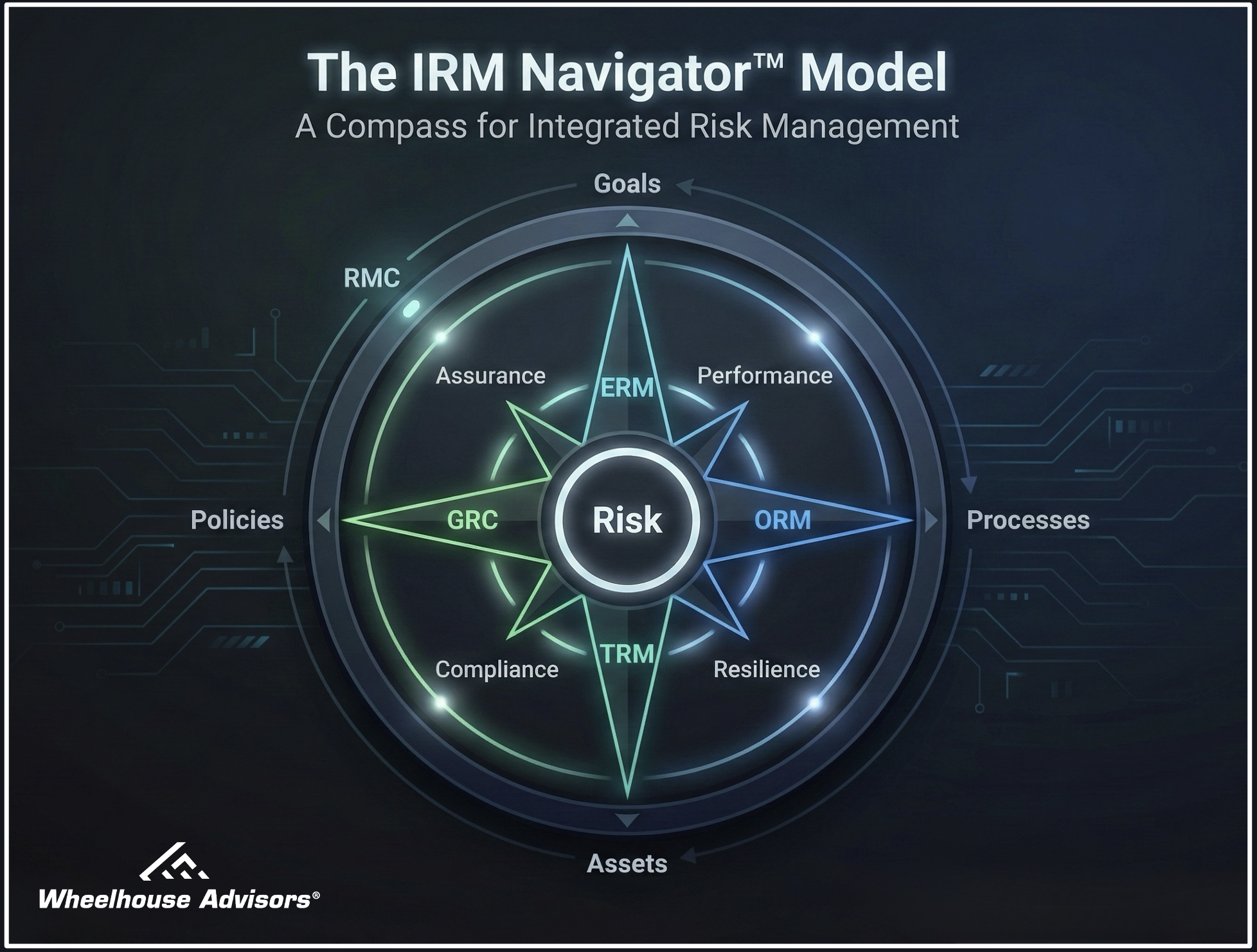

S6E3: The IRM Navigator™ - Turning Risk Into A Strategic Operating Model

Risk work that lives in reports but not in decisions is a hidden tax on performance. We tackle that problem head-on by unpacking the IRM Navigator™, an operating model that connects standards and roles to the real systems and moments where choices are made. Instead of treating risk as a sidecar, we show how to embed it into approvals, planning, and daily operations so decision velocity and decision quality rise together.

S6E2: Rethinking Integrated Risk, From ROI To Dividends

Integrated Risk Management (IRM) is repeatedly underfunded for a structural reason: leaders keep forcing IRM into an ROI construct that demands a single, auditable chain of causality, while IRM is designed to distribute value across multiple domains at once. In this episode, Ori Wellington and Sam Jones explain why ROI framing collapses into assumption-stacked narrative under CFO scrutiny, and why risk leaders need a finance-compatible alternative that remains decision-grade.

The episode’s answer is a disciplined shift: evaluate IRM with cost/benefit analysis, and label the benefit streams as dividends. Dividends are distributed outcomes that improve enterprise performance and resilience without requiring false precision in a single attributable cash-flow line.

S6E1: NVIDIA CES 2026 - The Blueprint for Autonomous IRM

Season 6 opens with a clear message for Technology Risk Management leaders: autonomy is no longer constrained by model capability, it is constrained by infrastructure discipline and auditable management controls.

In S6E1, Ori Wellington and Sam Jones translate NVIDIA’s CES 2026 signals into a practical blueprint for Autonomous IRM, defined as continuous, AI-enabled verification and response loops that operate within explicit policy boundaries and generate audit-grade evidence by design. As inference costs fall, “always-on” control validation becomes economically viable at enterprise scale. That shift forces a new operating model: humans stop chasing evidence and start adjudicating pre-enriched exceptions with decision provenance, context, and rollback paths already assembled.

S5E7: Stop Buying Better Silos: How the IRM Navigator™ Curve Exposes RiskTech Hype

In this episode of The Risk Wheelhouse, Ori Wellington and Sam Jones tackle one of the most expensive mistakes in risk management today: buying impressive tools that quietly deepen silos instead of advancing your program. If you have ever sat through a RiskTech demo and wondered whether you are truly moving forward or just spending more, this conversation is your roadmap.

Ori and Sam unpack the IRM Navigator™ Curve, a visual model that traces the journey from fragmented Risk Dysfunction to unified Risk Agency, where human and machine agency work together inside validated guardrails. They explain the five maturity levels and four investment domains, then show why you cannot simply “skip ahead” by buying an advanced TRM or AI platform before your GRC, ERM, and ORM foundations are in place.

S5E6: Build An Emerging Risk Reflex Before The Next Shock Hits

The conversation centers on a stubborn truth: most boards are well briefed on emerging risks, yet few translate insight into movement. The research shows 76 percent receive comprehensive risk reports, 42 percent engage meaningfully, and just 22 percent act. That collapse at the decision point is the “funnel of inaction.” The hosts argue that leaders chase the wrong fix by investing in problem precision using hyper-detailed probabilities and impact ranges. This approach only provides a marginal, statistically insignificant uplift in action. Precision invites skepticism, shifts attention to model assumptions, and implies costly, multi-year programs that boards rationally defer. The better path is to reframe conversations around solution options that emphasize low regret actions, the cost of delay, adjustments to existing programs, and clear pacing across quarters.

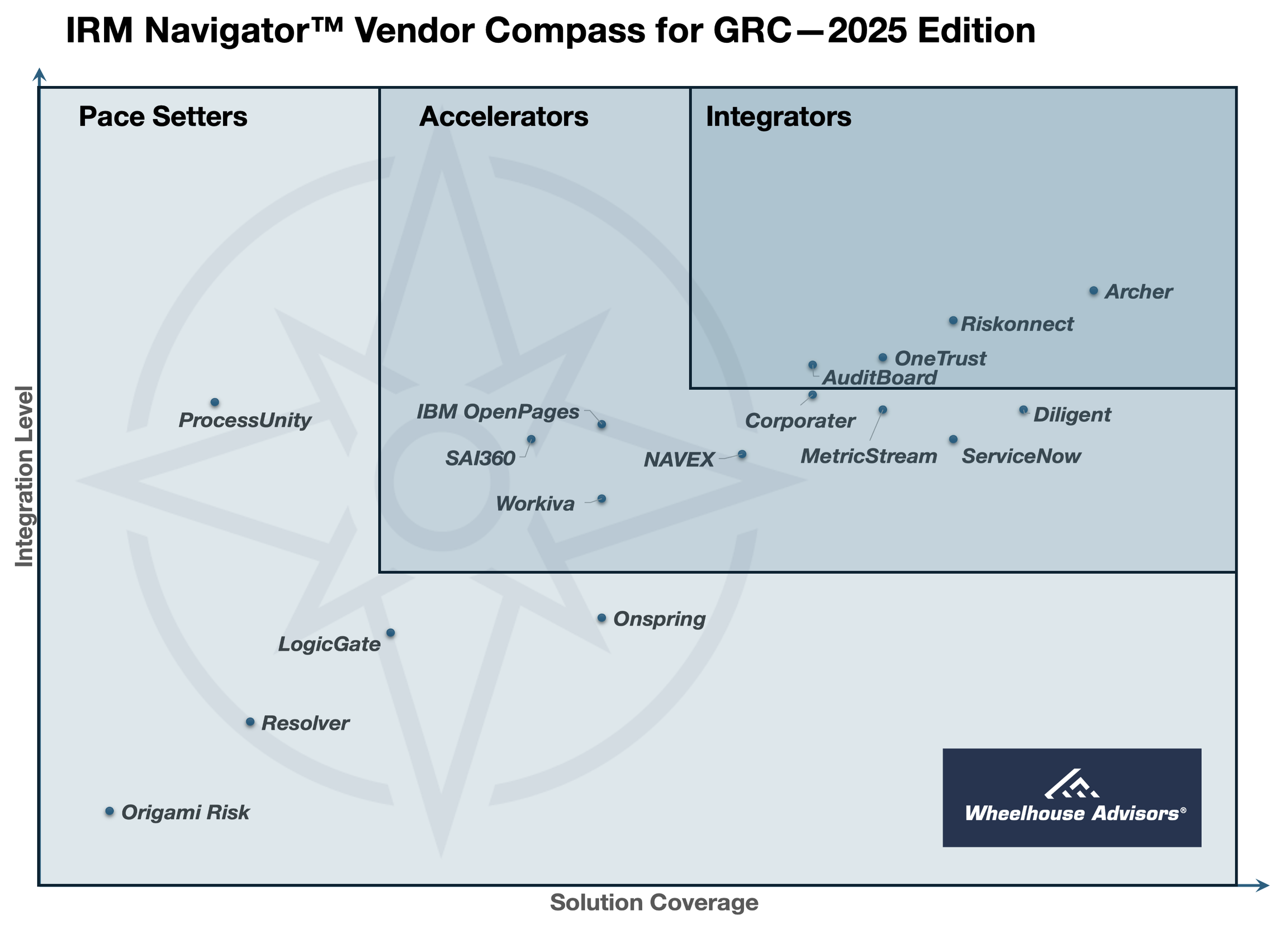

S5E5: Why GRC Stabilized And IRM Took The Lead

The latest episode of The Risk Wheelhouse tackles one of the strangest sights in this year’s risk technology landscape. The “2025 Gartner Magic Quadrant for Governance, Risk, and Compliance” arrives with an empty Visionaries quadrant. No challengers, no upstarts, just silence where innovation used to live. Rather than treating this as a warning sign, Ori Wellington and Sam Jones explain why the quiet is a signal that GRC has finally stabilized into what it was always best suited to be: the institutional assurance backbone that proves what happened, preserves the evidence, and keeps auditors, regulators, and boards on solid ground.

S5E4: Unified IRM - AI Governance, Acquisitions and Alliances

We dive into why AI governance is now table stakes for any serious IRM platform, what an effective AI registry and dynamic risk assessment look like, and how automated compliance mapping to the NIST AI RMF, ISO 42001, and the EU AI Act changes daily work. Along the way, we unpack recent moves like AuditBoard’s AI-focused acquisition and its expanded alliance with a major consultancy, illustrating why services plus software has become the adoption formula. On the ESG front, partnerships that link board reporting with carbon accounting signal a deeper integration of climate and sustainability data into operational risk and financial performance.

S5E3: 2025 ORM Vendor Compass - The Enterprise Resilience Engine

Resilience isn’t a binder anymore. It’s a live system that has to perform under pressure. We pull apart the 2025 IRM Navigator™ Vendor Compass for Operational Risk Management (ORM) to show how ORM moved from back-office compliance to the execution engine of enterprise resilience. The stakes are massive. They include billions in spend, tighter regulations across the US, UK, and EU, and a rising demand for continuous, auditable proof that controls actually work when services fail.

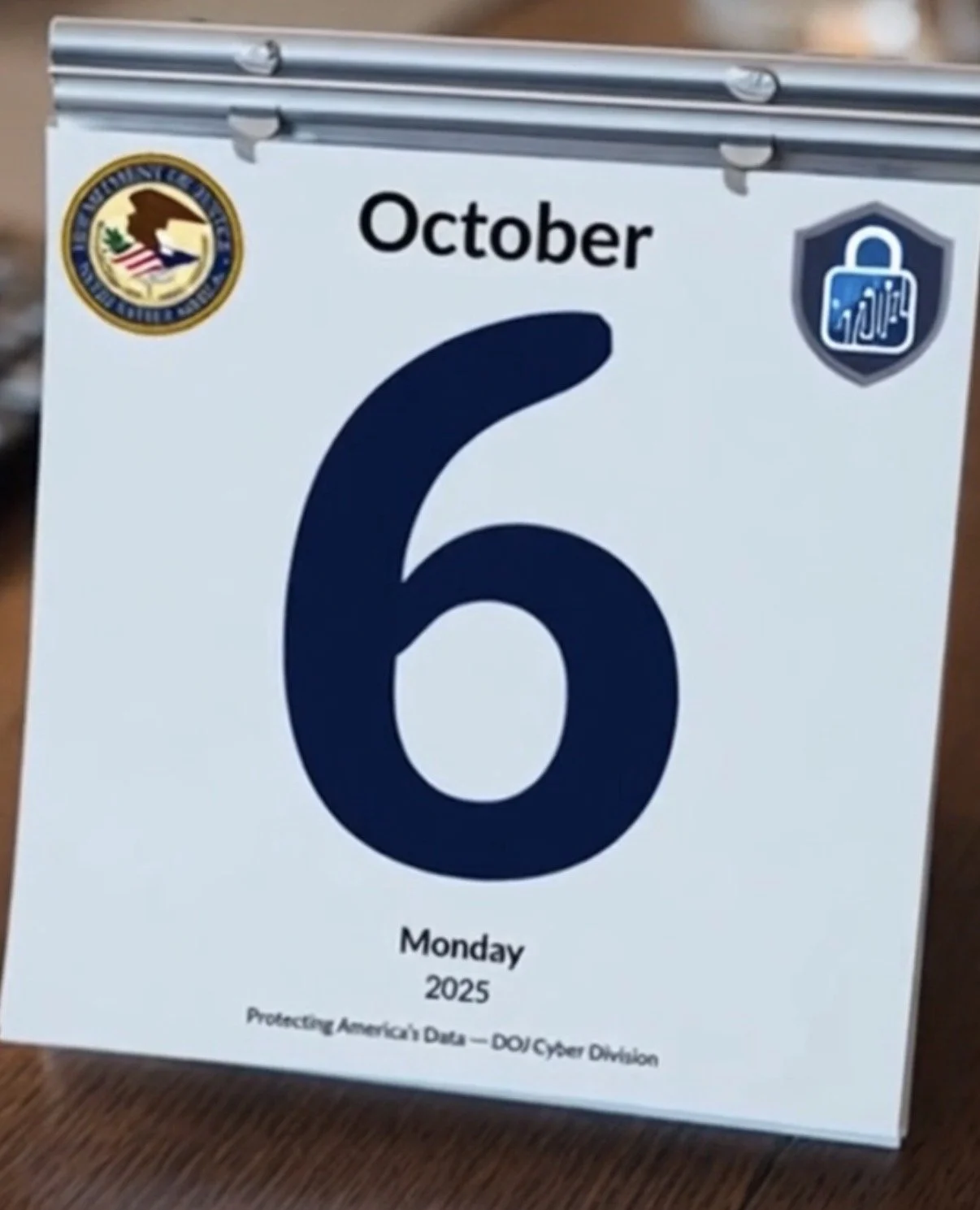

S5E2: Redrawing Data Lines - DOJ’s DSP and the New National Security Mandate

Your “encrypted” data may still be regulated and today the rules start to bite. We unpack how the Department of Justice’s Data Security Program moves from guidance to strict enforcement and why it reframes data governance as a national security mandate. From redefining “covered data” to treating anonymized and encrypted datasets as in-scope when they enable linkage or inference, we walk through what changes right now for risk leaders, counsel, and compliance teams.

S5E1: When AI manages risk, who manages the AI?

Autonomous IRM is moving from the lab into the core of enterprise risk, compliance, and security and the stakes couldn’t be higher. When a self-learning agent flags threats, scores claims, or polices policy violations, who is accountable, how do we intervene, and what proof can we show regulators and customers? We unpack the three frameworks shaping credible answers: ISO/IEC 42001 as a certifiable management system that embeds AI governance into everyday processes, the EU AI Act as hard law with high‑risk tiers and eye‑watering fines, and the NIST AI Risk Management Framework as a practical playbook for building trustworthy systems.

S4E11: Behind Boardroom Doors - The New Era of UK Corporate Transparency

Corporate governance is undergoing a revolution in the UK, and Provision 29 of the 2024 Corporate Governance Code stands at the epicenter of this transformation. Far beyond traditional financial oversight, this groundbreaking rule mandates unprecedented transparency from company boards about their internal controls across all domains – financial, operational, compliance, and critically, technology.

S4E10: From Boardroom to Code Base - How the EU AI Act Reshapes Business Strategy

Artificial intelligence stands at a crossroads of breathtaking innovation and urgent need for responsible guardrails. Every breakthrough brings questions about safety, fairness, and accountability that can no longer be afterthoughts. The European Union has responded with the AI Act – the world's first comprehensive legal framework for artificial intelligence – and its General Purpose AI Code of Practice has already secured commitments from tech giants like OpenAI, Google, Microsoft, and Anthropic.

S4E9: The SaaS Domino Effect - How Compromised OAuth Tokens Created a Cybersecurity Nightmare

Behind every digital business lies an invisible web of trust: the OAuth tokens silently connecting your applications. What happens when these trusted connections become your greatest vulnerability? A sophisticated attack campaign recently exploited these connections, bypassing traditional security measures to breach major cybersecurity companies including Cloudflare, Palo Alto Networks, and Proofpoint. Rather than directly attacking primary platforms, threat actors targeted Drift's OAuth integration tokens, effectively stealing the keys that allowed them to impersonate this trusted web chat tool when connecting to enterprise Salesforce instances.

S4E8: Beyond Binders - GRC's Radical Shift to Integrated Risk Management and Enterprise Trust

Governance, Risk, and Compliance (GRC) has undergone a remarkable transformation. What was once the "department of no" – characterized by manual checklists, endless audits, and rooms full of binders – has evolved into a strategic verification backbone powering trust across organizations.

This radical shift positions GRC at the center of Integrated Risk Management (IRM), where policies, controls, and compliance data flow dynamically through organizations to provide real-time assurance. The market reflects this evolution, with GRC projected to grow from $12.1 billion in 2025 to $25.1 billion by 2032 – not as an unavoidable cost, but as a strategic investment that builds market-enhancing trust and enables bolder innovation.

S4E6: When AI Agents Outnumber Humans

The rapid proliferation of AI agents throughout enterprise environments isn't just another tech trend—it's a fundamental transformation of how organizations operate. When Nikesh Arora, CEO of Palo Alto Networks, warns that "there's going to be more agents than humans running around trying to help manage your enterprise," he's highlighting a seismic shift that demands immediate attention.

S4E2: Autonomous IRM - Orchestrating Risk at Machine Speed

The digital age has accelerated risk to unprecedented speeds, creating a fundamental challenge for organizations: how can you manage threats that move faster than humans can react? This paradigm shift has given rise to Autonomous Integrated Risk Management (IRM), a revolutionary approach that transitions from human-speed reactions to machine-speed foresight and response.

S4E1: The 2025 IRM50—Integrated Risk Management All-Stars

The baseball All-Stars aren't the only MVPs making headlines in Atlanta this summer. Just as the MLB's finest gather at Truist Park, Wheelhouse Advisors has released their game-changing 2025 IRM Navigator™ Viewpoint Report, spotlighting the 50 most influential players in integrated risk management.

This explosive market—projected to reach a staggering $147 billion by 2032—is undergoing a profound transformation. What was once a back-office compliance function has evolved into a strategic imperative for boards, CISOs, and transformation leaders worldwide. The Viewpoint Report cuts through the noise, evaluating over 220 global providers to identify the IRM50— 50 all-stars across five critical domains: Enterprise Risk Management, Governance Risk & Compliance, Operational Risk Management, Technology Risk Management, and—new this year—Risk Management Consulting.

S3E10: Concentration Breeds Collapse - What the UNFI Outage Taught Us About Hidden Risk and How IRM Fixes It

In Episode 10 of Season 3 of The Risk Wheelhouse, hosts Ori Wellington and Sam Jones go deep into a case that should make every executive sit up straight: the June 2025 cyberattack on United Natural Foods Inc. (UNFI). As the primary distributor for Whole Foods, UNFI represents a critical node in the North American food supply chain—and when that node collapsed, the results were immediate and jarring: empty shelves, viral photos, panicked customers, and a $300 million hit to UNFI’s market value.

But this episode isn’t just about groceries. It’s a cautionary tale for every industry.

S3E9: Starved from the Edges – Why Connected Intelligence Matters in Autonomous IRM

When Automation Moves Fast—and Misses the Point

In this episode of The Risk Wheelhouse, Ori Wellington and Sam Jones expose the blind spot threatening today’s most advanced risk tech: isolation.

Autonomous IRM is no longer theory. AI platforms like Tuskira are already simulating threats and triggering real-time responses. But as this episode reveals, most operate in a vacuum—starved of strategic input from the top and assurance feedback from the bottom.

The result? High-speed automation chasing low-value noise.