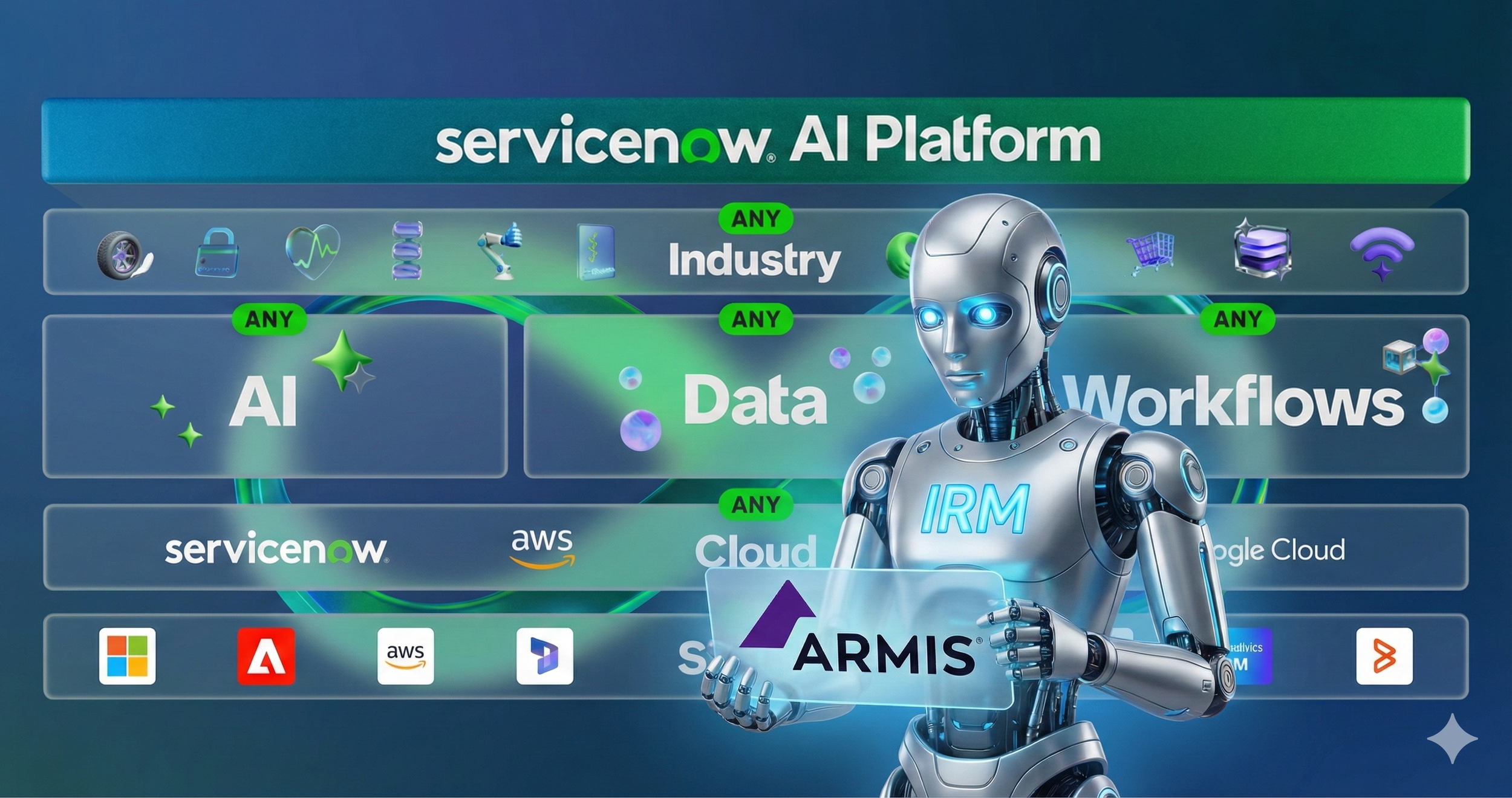

S5E9: ServiceNow Buys Armis, Telemetry Meets Workflow for IRM

ServiceNow’s planned $7.75B all-cash acquisition of Armis (targeted to close in H2 2026) is easy to misfile as “just another cybersecurity deal.” In this episode, Wheelhouse Advisors’ Ori Wellington and Sam Jones explain why it is actually a defining IRM market signal, one that raises the standard for what “risk management at scale” should mean going into 2026 procurement cycles.

Source: wheelhouseadvisors.com

The core message is simple and disruptive: IRM is shifting from artifact completion to verified outcomes. Risk registers, control libraries, assessments, and attestations may prove process, but they do not prove exposure was reduced. The deal signals a move toward a unified operating model where real-time asset and exposure intelligence, prioritization logic, and remediation plus verification workflows increasingly sit on a single platform spine.

Ori and Sam break down the new credibility threshold for “continuous monitoring” using a practical three-layer test:

Visibility: continuous discovery, classification, and exposure scoring across IT, OT, IoT, and medical devices

Action: prioritized routing into owned remediation workflows with clear accountability and SLAs

Verification: audit-grade proof remediation occurred and residual exposure is measured and trending down, not just tickets being closed

They also connect this shift to the next wave of agent-assisted operations, with a clear warning: automation without validation can scale noise faster than it scales risk reduction. The episode defines the audit-grade evidence trail IRM leaders should demand, including signal provenance, decision logic, action records, and verification that a fix held over time.

Finally, Ori and Sam outline three immediate actions IRM leaders should take now for 2026 planning: rewrite outcome metrics, require closed-loop proofs of value, and explicitly test openness to avoid proprietary data-model lock-in as platform consolidation accelerates.

This episode draws from Wheelhouse’s IRM50 OnWatch research note and the IRM50 Vendor Index, and references Wheelhouse’s recently published ERM Vendor Compass Report, where ServiceNow is profiled.

Listen now to recalibrate your evaluation standards before 2026 technology plans get locked.

Access the full IRM50 OnWatch note and more IRM50 research by subscribing at rtj-bridge.com.

Wheelhouse Advisors’ YouTube channel delivers fast, executive-ready insights on Integrated Risk Management. Explore short explainers, IRM Navigator research highlights, RiskTech Journal analysis, and conversations from The Risk Wheelhouse Podcast. We cover the issues that matter most to modern risk leaders. Every video is designed to sharpen decision making and strengthen resilience in a digital-first world. Subscribe at youtube.com/@wheelhouseadv.

Don't forget to subscribe on your favorite podcast platform—whether it's Apple Podcasts, Spotify, or Amazon Music.

Please contact us directly at info@wheelhouseadvisors.com or feel free to connect with us on LinkedIn and X.com.

Visit www.therisktechjournal.com and www.rtj-bridge.com to learn more about the topics discussed in today's episode.