S6E5: 2026 Convergence - Risk Management Must Be Integrated

Source: wheelhouseadvisors.com

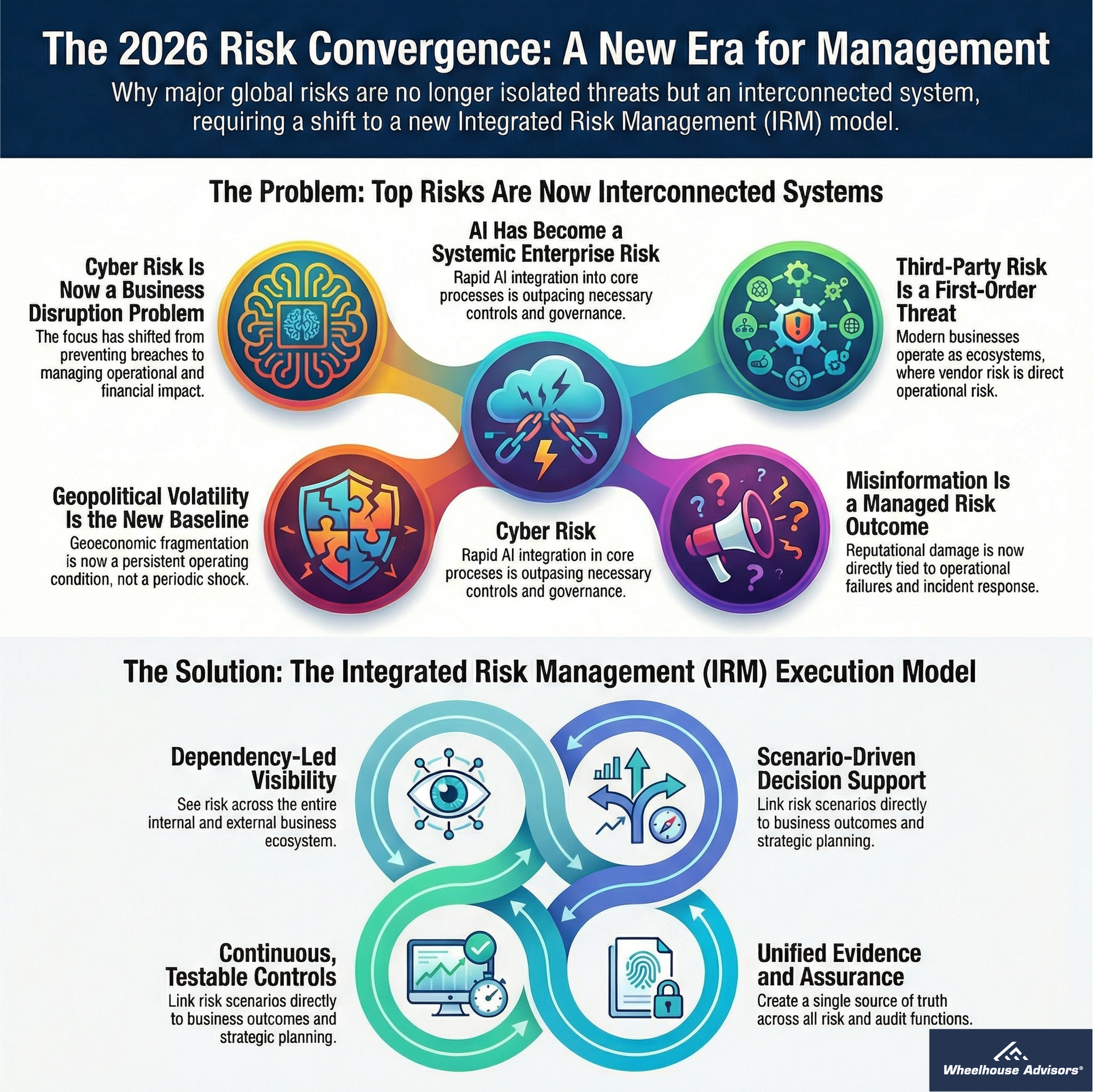

The ground rules of risk have changed, and waiting for the next headline won’t save the balance sheet. We take you inside “The 2026 Convergence: Integrated Risk Management in a New Era” and map how cyber, AI, third parties, geopolitics, and reputation have fused into one risk surface. Instead of chasing alerts, we focus on disruption economics: what a breach costs per minute, which processes bleed first, and how quickly you can recover without compounding fines. Cyber stops being an IT story and becomes a CFO story.

We then unpack why AI is a systemic enterprise risk. The issue isn’t sci‑fi; it’s embedded algorithms making daily decisions with drifting models and murky provenance. Policies alone cannot govern dynamic systems, so we lay out how continuous testing, auditability, and a horizontal control layer protect legal, HR, security, and operations together. From there, we move into the ecosystem era, where vendors run your core functions and static questionnaires leave you blind. The fix is unifying taxonomies and evidence so a critical security finding halts a contract before renewal, not after the breach.

Zooming out, geopolitics is now the climate, not the storm. Sanctions, regulatory divergence, and state-backed cyber campaigns require decision-grade scenarios wired to live data: suppliers, SKUs, revenue, cash. Finally, we connect trust to operations. Reputation is no longer a slogan; it’s the measurable outcome of how you run, respond, and disclose. We share the four pillars of modern IRM—dependency-led visibility, continuous testable controls, scenario-driven decision support, and unified evidence—that turn fragmented signals into real resilience and a brand that survives.

If this resonates, follow the research at wheelhouseadvisors.com and read the full analysis free at risktechjournal.com. Like what you hear? Subscribe, share with your team, and leave a review with the pillar you’ll tackle first.

Visit www.therisktechjournal.com and www.rtj-bridge.com to learn more about the topics discussed in today's episode.

Subscribe at Apple Podcasts, Spotify, or Amazon Music. Contact us directly at info@wheelhouseadvisors.com or visit us at LinkedIn or X.com.

Our YouTube channel also delivers fast, executive-ready insights on Integrated Risk Management. Explore short explainers, IRM Navigator research highlights, RiskTech Journal analysis, and conversations from The Risk Wheelhouse Podcast. We cover the issues that matter most to modern risk leaders. Every video is designed to sharpen decision making and strengthen resilience in a digital-first world. Subscribe at youtube.com/@WheelhouseAdv.