The Risk Wheelhouse Podcast

The Risk Wheelhouse is the podcast dedicated to exploring how RiskTech is reshaping the future of risk management. Hosted by our experts, Ori Wellington and Sam Jones, each episode delves deep into Integrated Risk Management (IRM), offering insights into the latest trends, technologies, and strategies. Join us to stay ahead in the ever-evolving risk landscape and empower your organization with actionable knowledge.

S6E6: Board Priorities 2026 - The Integration Trap

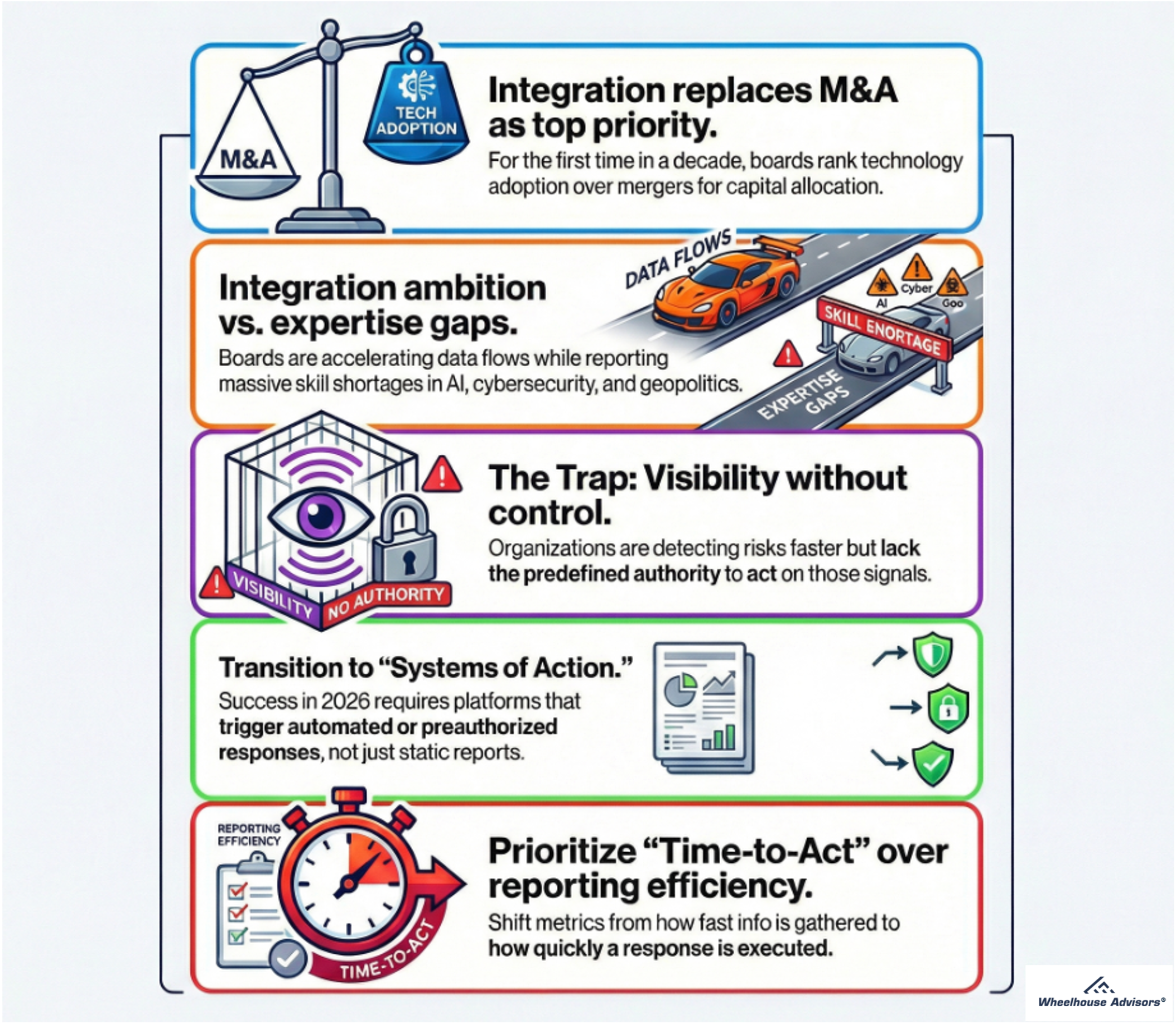

Growth used to win every boardroom vote. Now the data says something different: directors are prioritizing technology adoption and integration as the top 2026 investment, even as they admit their weakest expertise sits in AI, cybersecurity, and geopolitics. We unpack that paradox and show how uninformed speed turns “integration” into a superhighway for risk, unless you pair it with decision rights, embedded controls, and verifiable assurance.

S6E5: 2026 Convergence - Risk Management Must Be Integrated

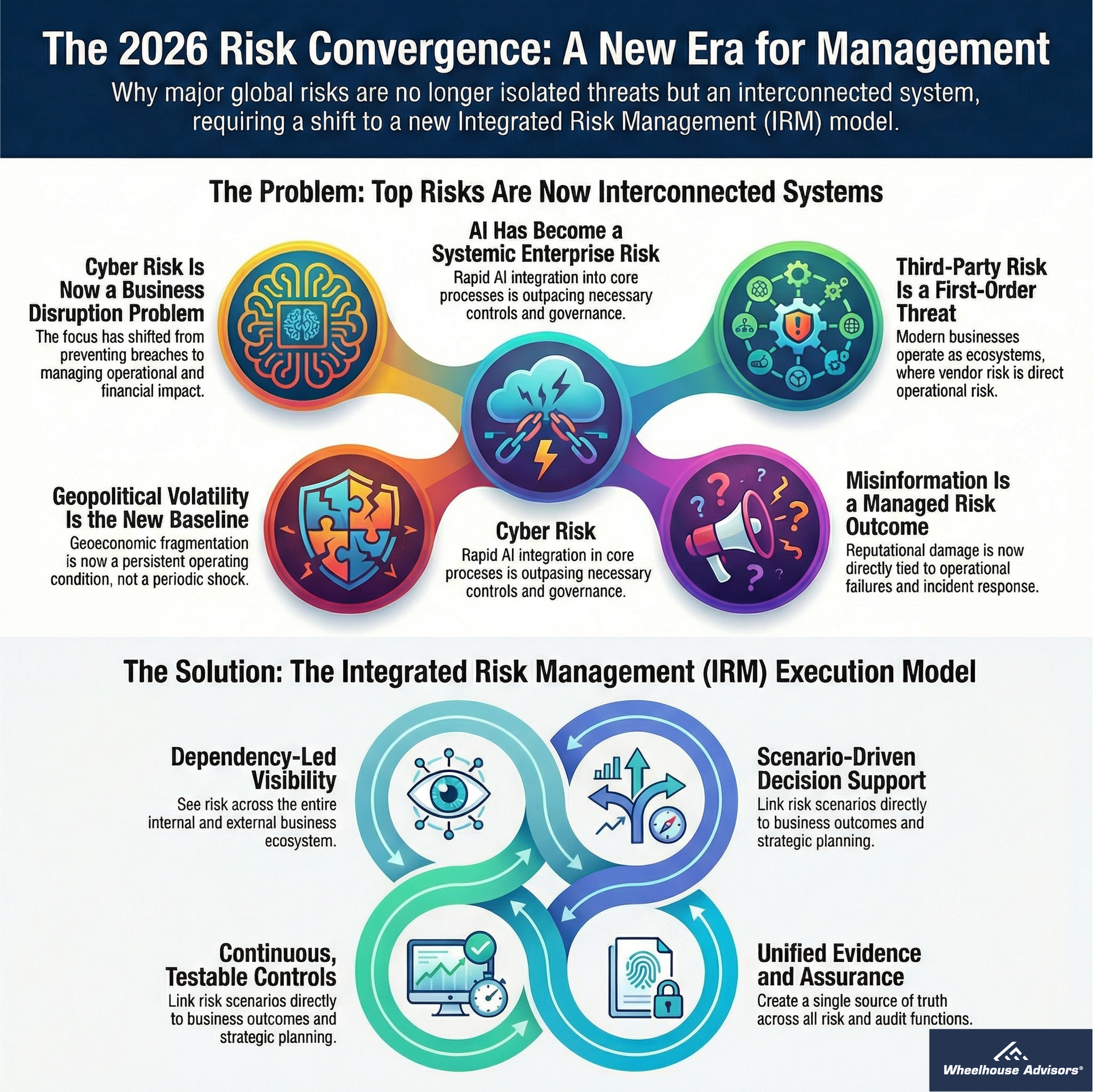

The ground rules of risk have changed, and waiting for the next headline won’t save the balance sheet. We take you inside “The 2026 Convergence: Integrated Risk Management in a New Era” and map how cyber, AI, third parties, geopolitics, and reputation have fused into one risk surface. Instead of chasing alerts, we focus on disruption economics: what a breach costs per minute, which processes bleed first, and how quickly you can recover without compounding fines. Cyber stops being an IT story and becomes a CFO story.

S6E4: Avoiding The RiskTech Buyer Trap

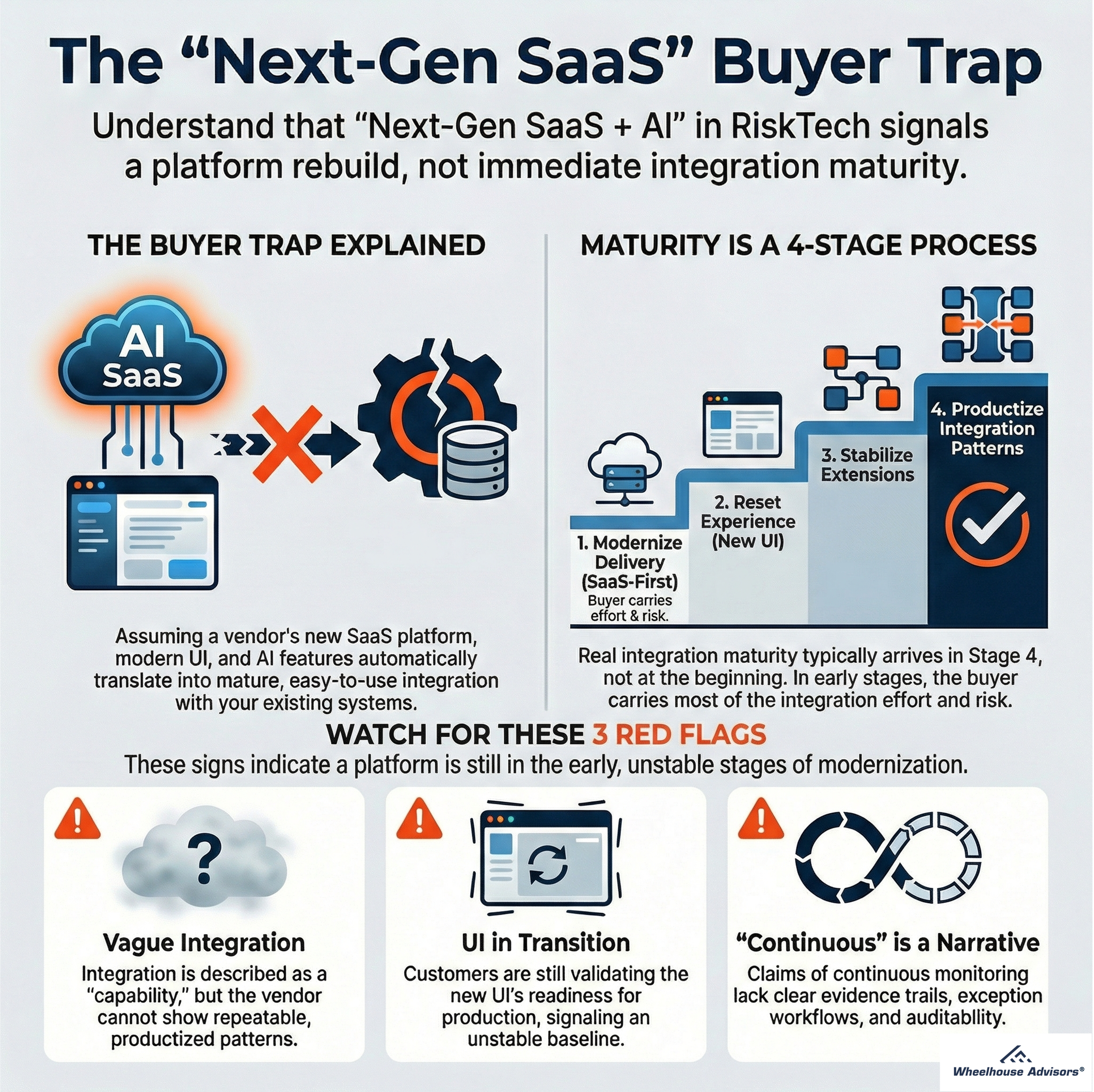

Shiny demos are everywhere, but what if that “next-gen SaaS” risk platform is still a construction zone under the hood? We unpack the Risk Tech Buyer Trap and show how modern UIs and AI buzz can disguise where vendors really are on the path to true integration maturity. Our conversation breaks down a clear four-stage transformation sequence—SaaS foundation, experience reset, object model stabilization, and finally productized integration—so you can pinpoint a platform’s real readiness and avoid inheriting the vendor’s rebuild risk.

AI raises the stakes. As non-human identities proliferate and SaaS-to-SaaS connections multiply, trust becomes the new currency. We explore how data boundaries, continuous assurance, and identity governance reshape due diligence, and why vague claims about “secure cloud” and “powerful AI” no longer cut it. Using Archer’s Evolv journey as a transparent case study, we illustrate the signals of staged modernization and the common gap between marketing momentum and operational maturity

S4E4: How Workiva's 32% Stock Surge Reveals a Deeper Industry Transformation

Workiva's spectacular 32% stock surge after their Q2 2025 earnings reveals something much deeper than just a strong quarter. Their $215 million revenue (up 21% year-over-year) and impressive 114% net retention rate signal the market's growing confidence in their strategic transformation—a shift that parallels the entire risk management industry's evolution.

What makes this story fascinating is the context. Before this surge, Workiva had struggled, with their stock down 24% over two years due to overreliance on specific regulatory drivers like the EU's Corporate Sustainability Reporting Directive. When regulations faced delays, revenue recognition suffered, spooking investors. This vulnerability exposed a fundamental weakness in their business model.