Click here to access subscription content at The RTJ Bridge - The Premium Version of The RiskTech Journal

〰️

Click here to access subscription content at The RTJ Bridge - The Premium Version of The RiskTech Journal 〰️

The RiskTech Journal

The RiskTech Journal is your premier source for insights on cutting-edge risk management technologies. We deliver expert analysis, industry trends, and practical solutions to help professionals stay ahead in an ever-changing risk landscape. Join us to explore the innovations shaping the future of risk management.

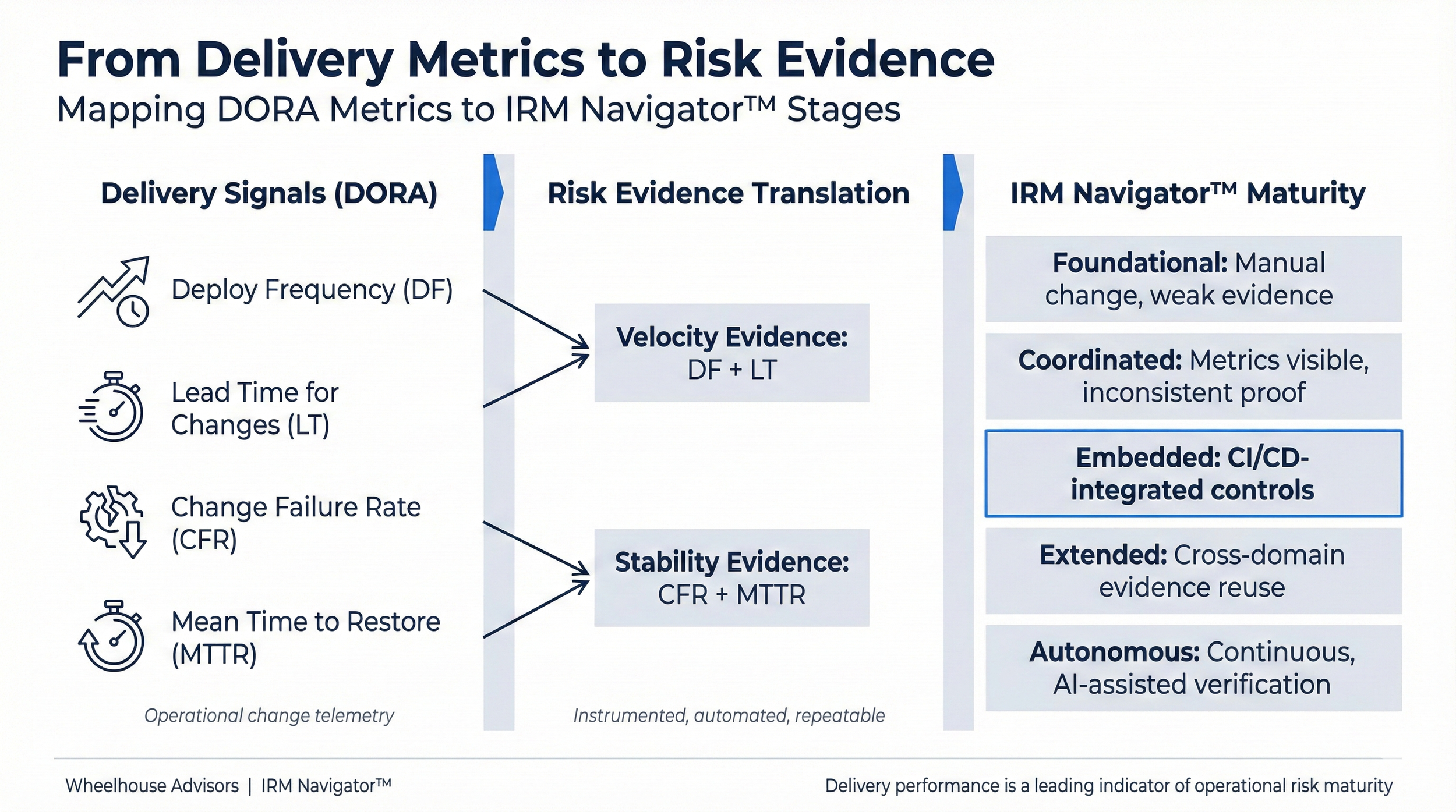

Why DORA Metrics Belong in the Risk Committee Packet

Boards increasingly receive dashboards showing deployment speed, incident counts, and technology uptime. What is often missing is the recognition that software delivery performance is now a primary driver of enterprise risk. Every material change to products, services, data flows, and controls is executed through software delivery pipelines.

DORA metrics were created to measure delivery performance, but when viewed through an integrated risk lens, they function as early-warning indicators of change risk, operational resilience, and assurance quality. Boards that treat these metrics as engineering detail miss one of the clearest signals of whether risk controls are embedded or cosmetic.

The Risk Ignored — Part 1: Revisiting the Origin Story of a Software Industry

Some of the biggest failures in modern risk management didn't happen because we lacked frameworks. They happened because we misunderstood risk and how it must be managed.

We've built controls. We've stood up compliance programs. We've adopted acronyms and bought technology platforms promising enterprise-wide oversight. Yet risk still slips through the cracks—not because it isn't documented, but because it isn't truly visible and understood.

I've spent 35 years helping organizations—from Fortune 100 giants to growing mid-market firms—face this reality. And the truth is this: risk management has always been more fragmented, political, and performative than most are willing to admit.

“The Risk Ignored” is a documentary-style series of articles I’ve created to give readers exclusive insights into what really happened in the last 25 years of risk management technology development.

From Code to Conduct: UK Cyber Mandate and Tech Disruption Signal a Governance Reckoning

Two significant announcements this week—one from the UK government and the other from Deloitte—highlight a rapidly converging future in which cybersecurity, advanced technology, and corporate governance are no longer siloed concerns but integrated imperatives for the boardroom. While distinct in origin and focus, both developments send a clear signal: the pressure on executive leaders to govern technology risks with discipline, foresight, and accountability is mounting.

Why Generative AI Is Breaking Cyber Insurance—and What Risk Leaders Must Do Next

The promise of generative artificial intelligence (AI) is captivating: it automates content creation, accelerates decision-making, and unlocks new efficiencies across industries. But beneath this glittering facade lurks an existential threat that few executives acknowledge: these systems are introducing catastrophic risks that cyber insurance markets are neither prepared for—nor willing to underwrite fully. As insurers frantically scramble to recalibrate policies in light of AI-driven threats, risk executives face a stark choice: transform how they manage emerging digital risks or face potentially devastating uninsured losses.

Audit at the Edge: Governing AI Before It Governs You

Artificial intelligence is no longer a side project buried in IT. It’s now embedded in decision-making processes across finance, operations, marketing, and customer service. From algorithmic underwriting to autonomous workforce tools, AI is transforming how businesses operate—and how they fail. Yet for many organizations, Internal Audit remains stuck in the past: buried in compliance checklists, siloed in function, and reliant on legacy Governance, Risk, and Compliance (GRC) systems incapable of keeping pace.

Moving Beyond the GRC Mindset - Why Boards Must Rethink Risk for the AI Era

I’m often questioned—sometimes challenged and occasionally attacked—by professionals who are deeply invested in traditional Governance, Risk, and Compliance (GRC) approaches. For many, GRC isn’t just a framework or a set of tools—it’s an identity, a career foundation, and in many cases, a commercial interest. So when I suggest that risk management must evolve beyond legacy GRC models, I’m not just raising a strategic argument—I’m challenging a belief system.

But this is not about abandoning GRC. It’s about recognizing that GRC, in its traditional, siloed, compliance-first form, is no longer sufficient for today’s risk environment.