Click here to access subscription content at The RTJ Bridge - The Premium Version of The RiskTech Journal

〰️

Click here to access subscription content at The RTJ Bridge - The Premium Version of The RiskTech Journal 〰️

The RiskTech Journal

The RiskTech Journal is your premier source for insights on cutting-edge risk management technologies. We deliver expert analysis, industry trends, and practical solutions to help professionals stay ahead in an ever-changing risk landscape. Join us to explore the innovations shaping the future of risk management.

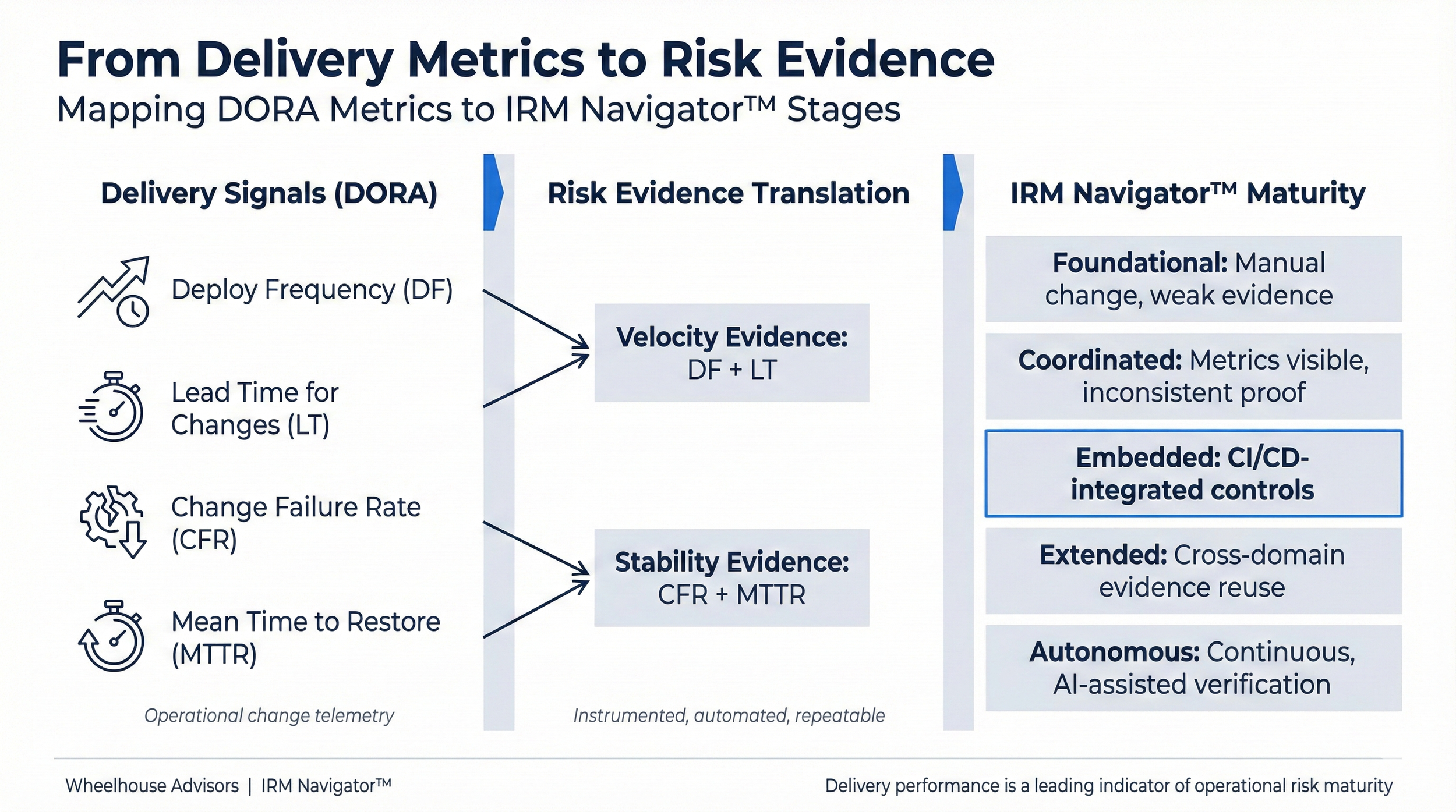

Why DORA Metrics Belong in the Risk Committee Packet

Boards increasingly receive dashboards showing deployment speed, incident counts, and technology uptime. What is often missing is the recognition that software delivery performance is now a primary driver of enterprise risk. Every material change to products, services, data flows, and controls is executed through software delivery pipelines.

DORA metrics were created to measure delivery performance, but when viewed through an integrated risk lens, they function as early-warning indicators of change risk, operational resilience, and assurance quality. Boards that treat these metrics as engineering detail miss one of the clearest signals of whether risk controls are embedded or cosmetic.

From Code to Conduct: UK Cyber Mandate and Tech Disruption Signal a Governance Reckoning

Two significant announcements this week—one from the UK government and the other from Deloitte—highlight a rapidly converging future in which cybersecurity, advanced technology, and corporate governance are no longer siloed concerns but integrated imperatives for the boardroom. While distinct in origin and focus, both developments send a clear signal: the pressure on executive leaders to govern technology risks with discipline, foresight, and accountability is mounting.

Audit at the Edge: Governing AI Before It Governs You

Artificial intelligence is no longer a side project buried in IT. It’s now embedded in decision-making processes across finance, operations, marketing, and customer service. From algorithmic underwriting to autonomous workforce tools, AI is transforming how businesses operate—and how they fail. Yet for many organizations, Internal Audit remains stuck in the past: buried in compliance checklists, siloed in function, and reliant on legacy Governance, Risk, and Compliance (GRC) systems incapable of keeping pace.

Moving Beyond the GRC Mindset - Why Boards Must Rethink Risk for the AI Era

I’m often questioned—sometimes challenged and occasionally attacked—by professionals who are deeply invested in traditional Governance, Risk, and Compliance (GRC) approaches. For many, GRC isn’t just a framework or a set of tools—it’s an identity, a career foundation, and in many cases, a commercial interest. So when I suggest that risk management must evolve beyond legacy GRC models, I’m not just raising a strategic argument—I’m challenging a belief system.

But this is not about abandoning GRC. It’s about recognizing that GRC, in its traditional, siloed, compliance-first form, is no longer sufficient for today’s risk environment.

How Integrated Risk Management Will Propel the Board Agenda in 2025

As we step into 2025, corporate boards face an increasingly complex risk landscape characterized by geopolitical shifts, economic uncertainty, technological disruption, and heightened stakeholder expectations. Integrated Risk Management (IRM) is set to play a pivotal role in helping boards navigate these challenges and align risk oversight with strategic priorities. Leveraging insights from recent reports on board and audit committee agendas, this article explores how IRM will shape boardroom discussions and drive value creation.

Strengthening Audit Committee Oversight with Integrated Risk Management

Audit committees are under increasing scrutiny as the complexity and scope of risks facing organizations expand. The 2024 Audit Committee Transparency Barometer from the Center for Audit Quality (CAQ) highlights a growing demand for greater accountability in overseeing financial reporting and emerging areas like cybersecurity and Environmental, Social, and Governance (ESG) risks. To meet these demands and build investor confidence, audit committees must shift toward more strategic and integrated approaches to risk management.

Balancing Innovation and Risk: AI’s Role in Boardroom Strategy

As artificial intelligence (AI) steadily integrates into corporate governance, boardrooms are witnessing a transformative shift. The concept of a 'robo-director,' where AI provides insights alongside human board members, is becoming a reality. This emerging trend raises significant questions about governance, oversight, and risk management. Wheelhouse Advisors' IRM Navigator™ can play a pivotal role in navigating these uncharted waters, ensuring that AI is leveraged effectively while mitigating associated risks.

Leading with Purpose: How Boards Can Drive Sustainability Through Integrated Risk Management

The integration of sustainability into business strategy is no longer optional; it's imperative for long-term success and resilience in today's volatile business environment. The recent 2024 European Corporate Governance Conference, sheds light on the multifaceted benefits and challenges of embedding sustainability into corporate governance, emphasizing the crucial role of Integrated Risk Management (IRM).

2024 Risk Management Insights: What Every Board Member Needs to Know

Understanding the dynamics of risk management is critical for audit committees and boards of directors in the ever-evolving corporate governance landscape. The recent CAQ-Deloitte 2024 Audit Committee Practices Report and Wheelhouse Advisors' 2024 IRM Navigator™ Annual Viewpoint Report provide comprehensive insights into these dynamics. These reports highlight the increasing significance of Enterprise Risk Management (ERM) and Integrated Risk Management (IRM) technology, shedding light on their critical roles in navigating today's complex risk environment. This article delves into the key findings of these reports, exploring how IRM technology bridges the gap between ERM, Operational Risk Management (ORM), Technology Risk Management (TRM), and Governance, Risk, and Compliance (GRC).

Harnessing Integrated Risk Management to Navigate the Evolving Data Governance Landscape

Data is increasingly becoming a cornerstone asset for organizations, but with its rising value comes a proportional increase in regulatory scrutiny and potential threats. From the SEC's detailed rules on cybersecurity disclosures to comprehensive AI regulations looming in the EU, companies are navigating a labyrinth of obligations that span multiple jurisdictions and sectors. In this complex environment, boards must maintain vigilant oversight over the organization's data strategies and implementation.