The Risk Wheelhouse Podcast

The Risk Wheelhouse is the podcast dedicated to exploring how RiskTech is reshaping the future of risk management. Hosted by our experts, Ori Wellington and Sam Jones, each episode delves deep into Integrated Risk Management (IRM), offering insights into the latest trends, technologies, and strategies. Join us to stay ahead in the ever-evolving risk landscape and empower your organization with actionable knowledge.

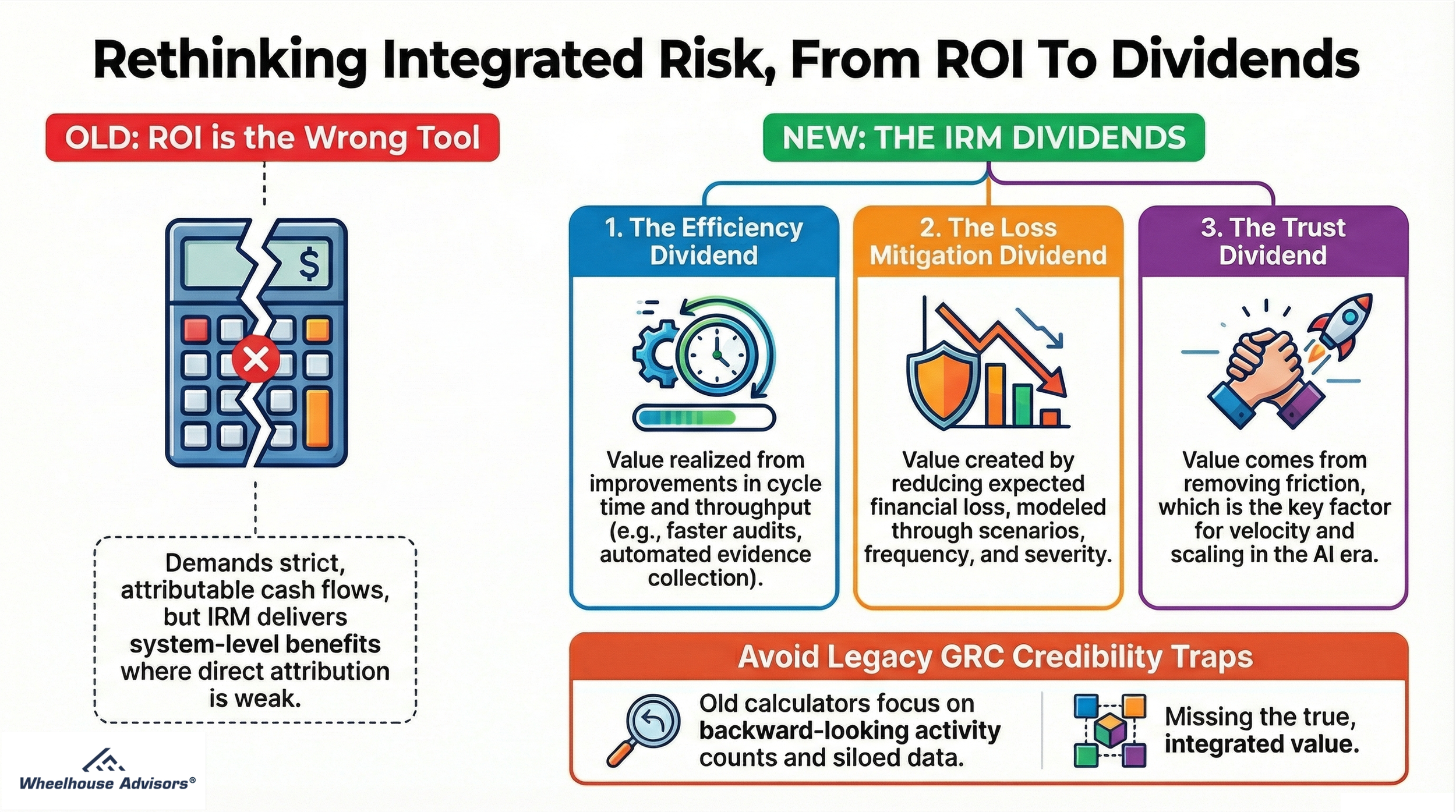

S6E2: Rethinking Integrated Risk, From ROI To Dividends

Integrated Risk Management (IRM) is repeatedly underfunded for a structural reason: leaders keep forcing IRM into an ROI construct that demands a single, auditable chain of causality, while IRM is designed to distribute value across multiple domains at once. In this episode, Ori Wellington and Sam Jones explain why ROI framing collapses into assumption-stacked narrative under CFO scrutiny, and why risk leaders need a finance-compatible alternative that remains decision-grade.

The episode’s answer is a disciplined shift: evaluate IRM with cost/benefit analysis, and label the benefit streams as dividends. Dividends are distributed outcomes that improve enterprise performance and resilience without requiring false precision in a single attributable cash-flow line.

S5E7: Stop Buying Better Silos: How the IRM Navigator™ Curve Exposes RiskTech Hype

In this episode of The Risk Wheelhouse, Ori Wellington and Sam Jones tackle one of the most expensive mistakes in risk management today: buying impressive tools that quietly deepen silos instead of advancing your program. If you have ever sat through a RiskTech demo and wondered whether you are truly moving forward or just spending more, this conversation is your roadmap.

Ori and Sam unpack the IRM Navigator™ Curve, a visual model that traces the journey from fragmented Risk Dysfunction to unified Risk Agency, where human and machine agency work together inside validated guardrails. They explain the five maturity levels and four investment domains, then show why you cannot simply “skip ahead” by buying an advanced TRM or AI platform before your GRC, ERM, and ORM foundations are in place.