The RTJ Bridge is the new premium version of The RiskTech Journal, delivering fast-moving, strategically relevant insights for risk leaders navigating today’s digital business landscape.

Designed as the link between editorial commentary and in-depth research, The RTJ Bridge offers exclusive access to:

High-frequency insight notes on market shifts, regulatory signals, and emerging technologies

Executive briefings and editorial series including “The Risk Ignored”

Strategic previews of IRM Navigator™ research, including upcoming Risk Landscape Reports

Whether you're monitoring vendor moves, tracking governance shifts, or preparing for regulatory disruption, The RTJ Bridge equips you with actionable foresight.

The RTJ Bridge - The Premium Version of The RiskTech Journal

Subscribe to get access now

The RTJ Bridge Subscription is a premier resource for executives and professionals focused on the intersection of risk management and technology. It provides subscribers with access to a curated collection of articles and expert insights designed to enhance risk management strategies through technological innovation. With its online format, The RTJ Bridge offers flexible access to critical information, helping leaders make informed decisions and stay competitive.

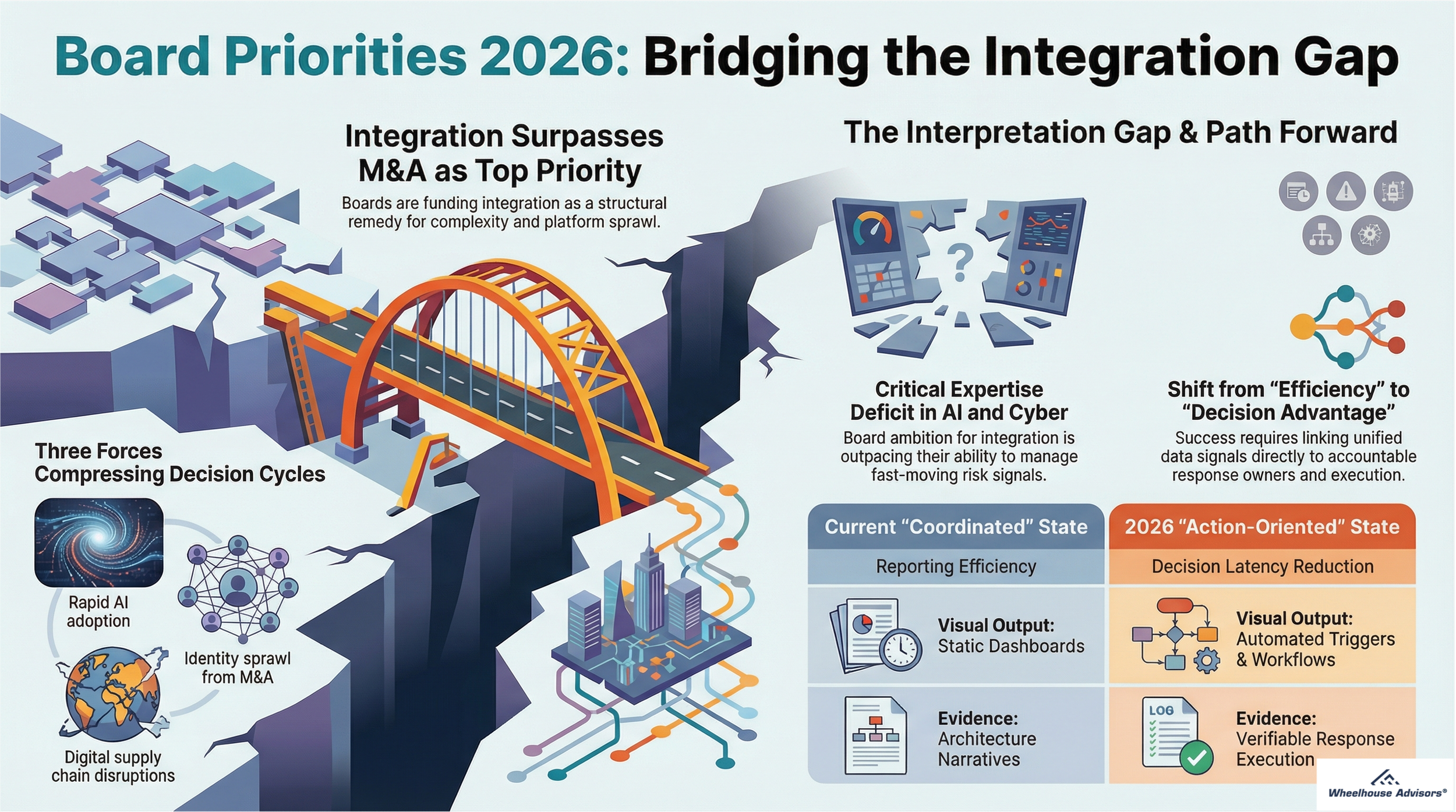

IRM50 OnWatch: Diligent Says Boards Put “Integration” at the Top of 2026 Capital Priorities

Diligent Institute and Corporate Board Member data indicates directors are prioritizing “technology adoption and integration” as the leading 2026 capital investment focus. This is not a routine modernization signal, it is a board-level acknowledgment that fragmentation has become a constraint on execution. The same dataset also indicates meaningful board expertise gaps in AI, cybersecurity, and geopolitical risk, creating a mismatch between integration ambition and the enterprise’s ability to interpret, manage, and act on fast-moving risk signals.

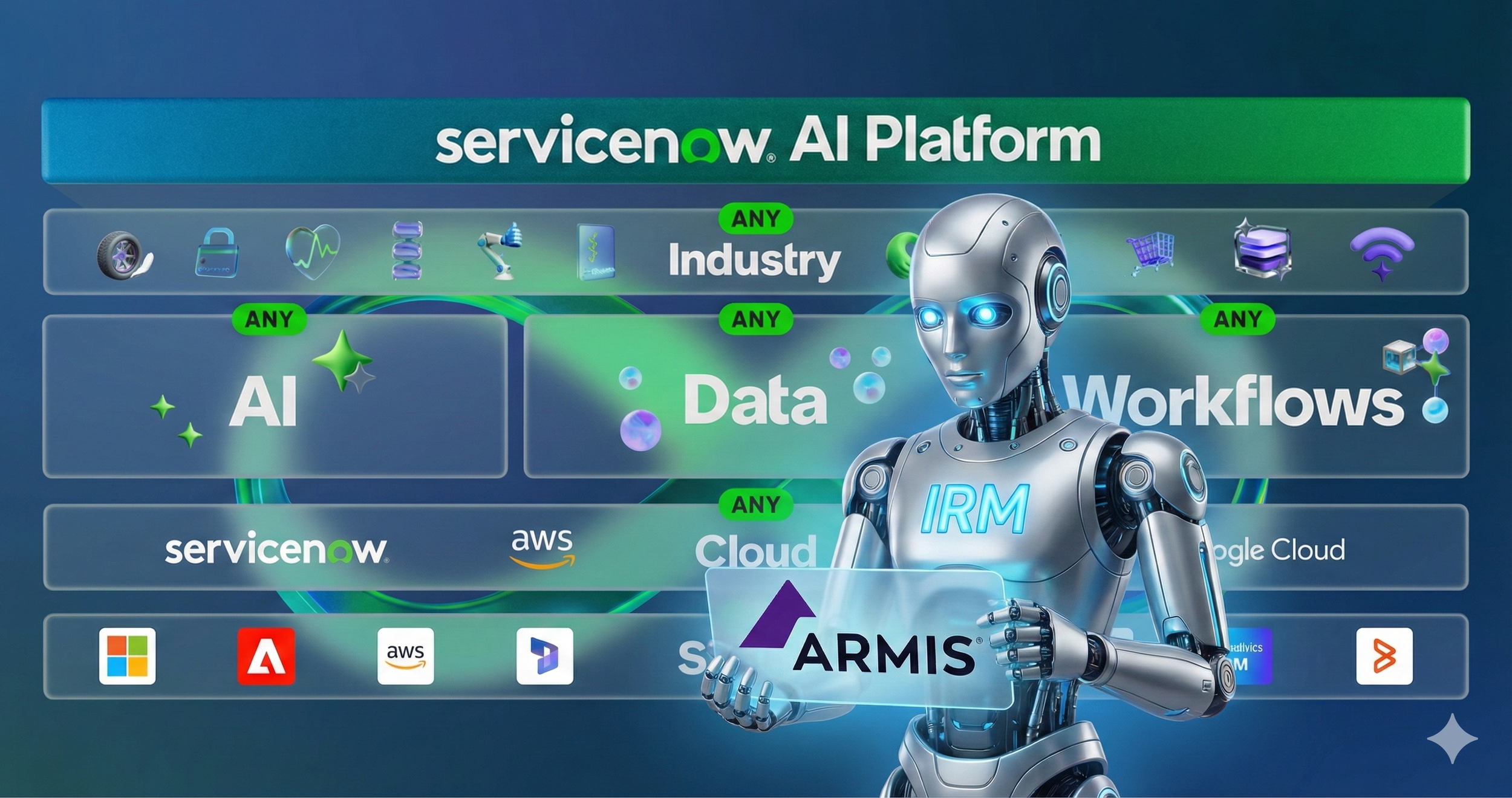

IRM50 OnWatch - What the ServiceNow Armis Deal Signals for IRM

ServiceNow’s announced agreement to acquire Armis for $7.75 billion in an all-cash transaction (expected to close in the second half of 2026) is not just a cybersecurity expansion move. It is a market signal that “risk management at scale” is shifting toward a unified operating model where (1) real-time technology and asset intelligence, (2) prioritization logic, and (3) remediation and verification workflows increasingly sit on the same platform spine.

For IRM leaders, this matters because it tightens the linkage between technology risk signals and enterprise risk action, and it changes what “continuous monitoring” should mean in buyer evaluations.