Click here to access subscription content at The RTJ Bridge - The Premium Version of The RiskTech Journal

〰️

Click here to access subscription content at The RTJ Bridge - The Premium Version of The RiskTech Journal 〰️

The RiskTech Journal

The RiskTech Journal is your premier source for insights on cutting-edge risk management technologies. We deliver expert analysis, industry trends, and practical solutions to help professionals stay ahead in an ever-changing risk landscape. Join us to explore the innovations shaping the future of risk management.

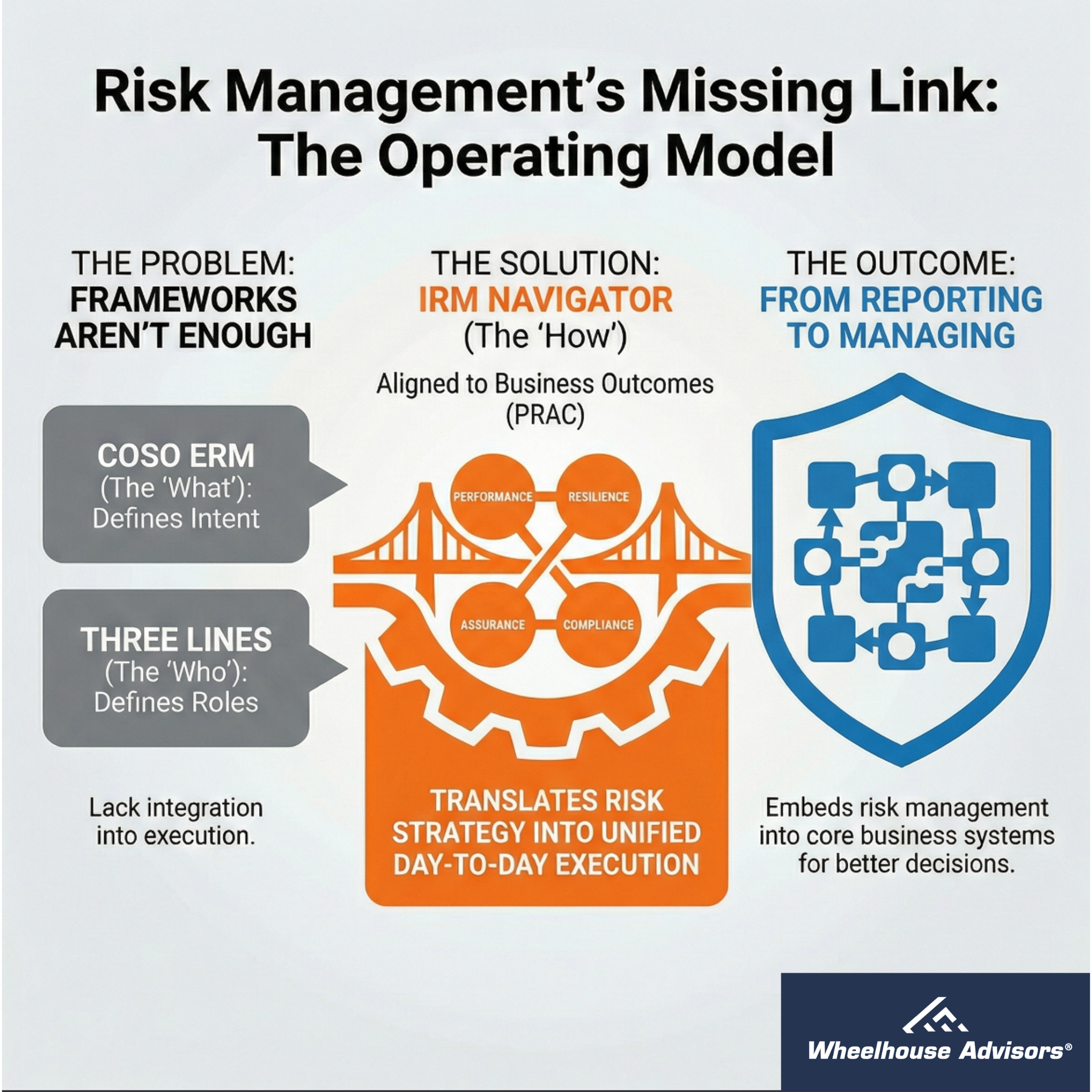

IRM Navigator: The Operating Model for Integrated Risk Management

Many organizations have adopted ERM standards and clarified accountability, yet risk still fails to shape planning, capital allocation, and operational decisions. The gap is not conceptual. It is operational. Most programs have guidance on what effective risk management should achieve and who should perform key activities, but they lack an operating model that specifies how risk work is unified across domains and instrumented through business processes and technology.

Governance and Management: The Distinction That Determines Risk Effectiveness

Executives often use “governance” and “management” interchangeably, but they are distinct disciplines. Without a clear line between them, policies never translate into behavior.

The difference is structural. Governance defines expectations. Management delivers outcomes.

This is the biggest blind spot in AI. Companies mistake principles and checklists for control. But governance is only the guardrails. It cannot catch model drift or detect bias. That is the job of management.

Governance does not scale by adding more rules. Management does not scale by adding more meetings.

[Read the full article to stop confusing documentation with execution.]

The IRM50 All-Stars Take the Field

Wheelhouse Advisors Releases 2025 Lineup on MLB's Biggest Stage

On the same day baseball's best step up to the plate at the 95th MLB All-Star Game in Atlanta, Wheelhouse Advisors has released its all-star roster: the 2025 IRM50.

And just like the Midsummer Classic, this announcement celebrates top-tier talent, position-specific excellence, and strategic versatility—only this time, the field is Integrated Risk Management (IRM), not Truist Park. Wheelhouse's IRM50 recognizes the 50 most influential technology and consulting providers driving the future of IRM. The timing isn't just symbolic—Wheelhouse Advisors is also headquartered in Atlanta, and this year's report marks the broadest, most globally representative IRM50 to date.

McKinsey Confirms the Limits of GRC and Points Toward Integration

In its May 2025 article “Governance, Risk, and Compliance: A New Lens on Best Practices,” McKinsey & Company delivers a candid assessment of the widespread shortcomings in today’s governance, risk, and compliance (GRC) functions. Based on survey data from nearly 200 corporate leaders, the article highlights persistent underperformance across all three pillars of GRC and outlines five imperatives for reform. But what McKinsey never quite says—though it clearly suggests—is that the GRC model itself may be past its expiration date.

The findings echo what many in the risk management profession have long understood: legacy GRC frameworks are no longer adequate in a world defined by interconnected risks, real-time decisions, and strategic uncertainty. Below, we examine the key insights from the report and explain how they point—whether intentionally or not—toward Integrated Risk Management (IRM) as the future-facing alternative.

The Risk Ignored — Part 1: Revisiting the Origin Story of a Software Industry

Some of the biggest failures in modern risk management didn't happen because we lacked frameworks. They happened because we misunderstood risk and how it must be managed.

We've built controls. We've stood up compliance programs. We've adopted acronyms and bought technology platforms promising enterprise-wide oversight. Yet risk still slips through the cracks—not because it isn't documented, but because it isn't truly visible and understood.

I've spent 35 years helping organizations—from Fortune 100 giants to growing mid-market firms—face this reality. And the truth is this: risk management has always been more fragmented, political, and performative than most are willing to admit.

“The Risk Ignored” is a documentary-style series of articles I’ve created to give readers exclusive insights into what really happened in the last 25 years of risk management technology development.

No Manager, No Strategy—Why GRC Alone Can’t Win the Risk Game

If Governance, Risk, and Compliance (GRC) is like a team without a manager, IRM is the system that brings structure, alignment, and leadership to the field. Without a manager, even talented players operate in silos—doing what they think is best individually but without strategic coordination or shared purpose. That’s the reality in many organizations today: siloed compliance, governance, and risk functions acting without integration.

IRM provides the playbook and the leadership. It integrates GRC with Enterprise Risk Management (ERM), Operational Risk Management (ORM), and Technology Risk Management (TRM) to form a unified team—managed strategically, guided by data, and aligned around shared enterprise objectives.

When Encryption Isn't Enough—A Sidewalk Interview and a Global Wake-Up Call

I was in Washington, D.C., when the story broke. Reports surfaced that U.S. officials had used Signal—a consumer-grade encrypted messaging app—to coordinate sensitive military operations in Yemen. I was finishing a dinner meeting after a full day of engagements when my phone rang. It was the BBC reaching out for immediate commentary on a fast-developing national security story.

The Limits of Legacy GRC — Seven Reasons It Fails Modern Risk Management

In the corridors of risk management conferences and behind closed doors at technology vendor meetings, there's a reluctant acknowledgment that few are willing to voice publicly — traditional Governance, Risk, and Compliance (GRC) platforms are struggling to meet the demands of today's dynamic risk landscape. As someone who has spent decades consulting with both GRC vendors and their customers, I've heard the whispered confessions from technology providers who recognize these limitations but fear alienating their long-standing clients by admitting them openly.

The Great Risk Revolution—Why GRC Alone Can't Save Your Organization

In boardrooms across the globe, a quiet revolution is underway. Organizations that once viewed risk management primarily through the lens of Governance, Risk, and Compliance (GRC) are discovering—often the hard way—that yesterday's frameworks are increasingly inadequate for today's complex threat landscape.

Consider this. When the World Economic Forum recently surveyed global executives, the most pressing concerns they identified—from AI disruption to supply chain vulnerabilities—weren’t neatly contained within traditional GRC boundaries. These risks cascade across organizational silos, render conventional approaches obsolete, and demand a fundamentally different way of thinking about organizational resilience.

The Challenges of AI Agents and Why Risk Management Matters

Artificial intelligence (AI) agents are being promoted as game-changers for businesses, helping automate tasks, reduce costs, and improve efficiency. However, recent research from CB Insights shows that many companies using AI agents face three significant problems: unreliable performance, complex integration with existing systems, and lack of uniqueness among different AI solutions. These issues highlight why businesses need Integrated Risk Management (IRM)—a structured way to handle risks related to AI, including security, compliance, and performance challenges. Without proper oversight, AI agents can cause more harm than good.

Bridging the Resilience Gap: Why Integrated Risk Management Outperforms Legacy GRC Solutions

A recent KPMG Risk & Resilience Survey (March 2025) has revealed a concerning reality: most U.S. organizations remain unprepared to handle increasing risk events and broad disruptions. The report highlights that two-thirds to nearly three-quarters of organizations face moderate to strong barriers to managing risk effectively. The survey findings confirm a critical gap in how organizations manage risk and, more importantly, where traditional Governance, Risk, and Compliance (GRC) technologies fall short.

The Digital Risk Paradox - Why Corporate Digitalization Could Be Your Biggest Liability

Digital transformation has long been heralded as the corporate world's silver bullet—promising efficiency, resilience, and competitive advantage. However, emerging research suggests a more unsettling reality: the rush to digitalize may create as many risks as it mitigates.

Citi's $81 Trillion Error Highlights Urgent Need for Stronger Integrated Risk Management

The startling news that Citigroup mistakenly credited a client’s account with $81 trillion instead of a mere $280 underscores a critical weakness pervasive in today’s financial institutions: insufficiently robust integrated risk management (IRM) systems. This incident, termed a “near miss” by Citi, reveals deep-seated operational vulnerabilities that continue to plague banks, despite considerable investment and regulatory scrutiny.

What the Public Sector Can Learn from the Private Sector’s Embrace of Integrated Risk Management

While risk management is not new to government institutions, the public sector lags behind the private sector in adopting a truly integrated approach. The world’s leading corporations have embraced IRM as a critical framework for anticipating threats, enhancing resilience, and driving long-term value creation. It is time for the public sector to take a page from the private sector’s playbook.