Click here to access subscription content at The RTJ Bridge - The Premium Version of The RiskTech Journal

〰️

Click here to access subscription content at The RTJ Bridge - The Premium Version of The RiskTech Journal 〰️

The RiskTech Journal

The RiskTech Journal is your premier source for insights on cutting-edge risk management technologies. We deliver expert analysis, industry trends, and practical solutions to help professionals stay ahead in an ever-changing risk landscape. Join us to explore the innovations shaping the future of risk management.

The Future of AI Agents in Integrated Risk Management

The digital transformation of risk management has entered a new era with the emergence of AI agents, autonomous systems that promise to revolutionize how organizations approach integrated risk management (IRM). These sophisticated systems represent more than just an automation tool; they offer a fundamental shift in how organizations identify, assess, and respond to risks across their operations. As organizations face increasingly complex risk landscapes, AI agents provide the capability to handle this complexity while maintaining the comprehensive perspective essential to effective IRM.

How S&P 100 Leaders Drive Cybersecurity Excellence Through Integrated Risk Management

Recent insights from the Gibson Dunn report, Cybersecurity Overview: A Survey of Form 10-K Cybersecurity Disclosures by the S&P 100 Companies, highlight key trends and practices among public companies. Integrated Risk Management (IRM) is increasingly recognized as the critical approach enabling organizations to meet these requirements while driving strategic value. In this analysis, we'll explore the evolving regulatory landscape, key trends in cybersecurity disclosures, and how IRM empowers organizations to align their cybersecurity strategies with enterprise-wide governance frameworks.

Looking Back: The RiskTech Journal’s Top 10 Trends and Innovations of 2024

The 2024 edition of The RiskTech Journal provided a front-row seat to the critical shifts and emerging innovations transforming risk management. Through expert insights and in-depth analysis, the Journal detailed how organizations across industries are adapting to a dynamic risk landscape, using tools like Integrated Risk Management (IRM) frameworks and advanced technologies to stay resilient.

The Evolving Perspective on Generative AI: From Technology Risk to Operational Risk

In financial services, generative AI (GenAI) has rapidly emerged as both a transformative opportunity and a formidable risk. According to a recent ORX survey, three-quarters of financial institutions now classify oversight of GenAI under operational risk. This pivotal shift highlights how GenAI is increasingly perceived as a broader business risk rather than merely a technology-specific challenge. For banks and other financial institutions, this development underscores the necessity of integrated risk management (IRM) frameworks to effectively navigate the complexities of AI adoption.

Restating Trust: Tackling the Rise in Financial Restatements with Integrated Risk Management

The financial landscape has been disrupted by a concerning surge in financial restatements among U.S. public companies. According to the Financial Times, 140 public companies reissued their financial statements in the first ten months of 2024 due to material accounting errors—a nine-year high. These restatements erode investor confidence and raise critical questions about the quality of financial reporting, the robustness of internal controls, and the effectiveness of corporate governance. Notable cases, such as Macy's misclassification of $132 million in delivery expenses and Archer Daniels Midland's overstated profits in its nutrition segment, underscore these errors' severe reputational and financial implications. This trend highlights systemic weaknesses that can no longer be overlooked. The rise in restatements calls for a comprehensive solution—one that Integrated Risk Management (IRM) technology and related RiskTech innovations are well-equipped to deliver.

Cyber-Attacks and Corporate Ruin: The Ripple Effects Leading to Bankruptcy

In today's hyperconnected world, cyberattacks have become existential threats capable of reducing even the most established businesses to insolvency. Recent high-profile cases, such as the collapse of National Public Data and the bankruptcy of Stoli Group's U.S. subsidiaries, highlight how cyber breaches and ransomware attacks devastate systems and create cascading impacts that extend far beyond the initial compromise. These incidents serve as cautionary tales about the interconnected nature of operational, financial, and reputational risks in the digital age.

The Key to the RiskTech Kingdom: How the Model Context Protocol (MCP) Unlocks Autonomous IRM

The risk management landscape is transforming as technology evolves to meet the demands of increasingly complex business environments. A new open-source tool from Anthropic, the Model Context Protocol (MCP), could represent the pivotal technology that unlocks the potential of autonomous Integrated Risk Management (IRM) systems. MCP may revolutionize how organizations deploy AI-driven IRM solutions by providing seamless, universal connectivity to diverse datasets. At the heart of this transformation is the emergence of AI agents, which stand to benefit significantly from MCP's capabilities.

The Rising Tide of Cyber Threats: How Integrated Risk Management Can Combat AI-Driven Attacks

The cyber threat landscape is changing rapidly, with artificial intelligence (AI) serving as both a powerful tool for defense and a formidable weapon for attackers. In a recent interview with The Wall Street Journal, Amazon's Chief Information Security Officer, CJ Moses, revealed a staggering increase in daily cyber threats faced by the company. Over the past six to seven months, Amazon has witnessed an escalation from 100 million to an average of 750 million cyber-attack attempts per day. This exponential rise underscores the urgent need for organizations to implement Integrated Risk Management (IRM) strategies to protect their assets in an increasingly complex digital environment.

AI's Transformative Economic Potential and the Accelerated Evolution of Integrated Risk Management

Artificial intelligence (AI) is ushering in a new era that promises to redefine the global economy and risk management landscape. Recent projections by IDC estimate that AI will contribute a staggering $19.9 trillion to the global economy by 2030, driving 3.5% of the worldwide GDP. For every dollar invested in AI, an impressive $4.60 is expected in economic returns. Simultaneously, KPMG International's 2024 Future of Risk report reveals that 61% of executives anticipate a significant increase in risk levels over the next three to five years.

Cyberattack on Grocery Giant Exposes Global Risk Management Gaps

As organizations like Ahold Delhaize increasingly rely on technology for inventory management, e-commerce, and logistics, cyber disruptions can extend beyond IT systems to affect global supply chains and customer trust. This event serves as a wake-up call for businesses globally to adopt an Integrated Risk Management (IRM) approach to ensure performance, resilience, assurance, and compliance in an interconnected digital landscape.

Strengthening Audit Committee Oversight with Integrated Risk Management

Audit committees are under increasing scrutiny as the complexity and scope of risks facing organizations expand. The 2024 Audit Committee Transparency Barometer from the Center for Audit Quality (CAQ) highlights a growing demand for greater accountability in overseeing financial reporting and emerging areas like cybersecurity and Environmental, Social, and Governance (ESG) risks. To meet these demands and build investor confidence, audit committees must shift toward more strategic and integrated approaches to risk management.

Wheelhouse Advisors' 2025 Predictions: Integrated Risk Management Becomes Non-Negotiable

Risk managers are now more involved than ever in integrating Enterprise Risk Management (ERM) with other risk domains and the business at large. However, the accelerating demands of AI introduce complexities that cannot be ignored. Integrated Risk Management (IRM) technology emerges as a critical tool, providing greater visibility and understanding of risks to drive actionable change.

Transitioning from Fragmented GRC to Integrated Risk Management: A Path Forward

The IRM approach replaces the traditional, siloed GRC model with a unified framework. By transitioning to IRM, organizations can enhance strategic decision-making, increase operational efficiency, and gain a complete view of risks across the enterprise. This transition is not just about adopting a new framework; it's about unlocking the value of risk management as a strategic asset.

ServiceNow and Salesforce Enter the AI Agent Arena: Paving the Way for Autonomous IRM

In my previous article on Autonomous Integrated Risk Management (IRM), I explored how AI agents are driving IRM into a new era of automation. With industry leaders like ServiceNow and Salesforce making significant strides in the AI agent market, we are witnessing a transformative moment for business technology. These advancements signal a shift in automation capabilities and present a massive opportunity to develop AI agents specifically for autonomous IRM capabilities.

Navigating IFRS S1 and IFRS S2: A Pathway for Integrated Risk Management and Sustainability

As sustainability reporting becomes increasingly critical for businesses, preparers are faced with new challenges and opportunities. The voluntary application of the International Sustainability Standards Board (ISSB) Standards, specifically IFRS S1 and IFRS S2, offers a framework for companies to disclose sustainability-related financial information, even ahead of regulatory mandates. To support companies, the IFRS Foundation has published Voluntarily applying ISSB Standards—A guide for preparers. This guide published provides companies a pathway to communicate their progress in aligning with these standards, supporting investor decision-making by offering transparent, comparable, and reliable information on sustainability risks and opportunities.

NYDFS's AI Cybersecurity Guidance Explained: An IRM Approach for Banks Nationwide

On October 16, 2024, the New York State Department of Financial Services (NYDFS) issued groundbreaking guidance addressing the cybersecurity risks of artificial intelligence (AI). The guidance highlights the dual-edged nature of AI in financial services—offering unparalleled opportunities for efficiency and growth while introducing sophisticated cyber threats. As AI technologies evolve, so do the tactics of cybercriminals, necessitating a robust and integrated approach to risk management.

The Exponential Growth of Cybersecurity Risks and Their Impact on Business Operations

The recent UnitedHealth hack, as detailed in a Wall Street Journal article today, serves as a stark reminder of the growing scale and severity of cybersecurity threats. UnitedHealth’s ongoing struggle with this breach reveals the broader business risks that companies face when a cyber incident occurs, particularly as the monetary and operational impacts spiral far beyond initial forecasts.

How Integrated Risk Management Aligns with the DOJ's Updated 2024 Guidance on Corporate Compliance Programs

The DOJ's updated guidance is critically important for U.S. companies right now because it underscores the necessity of a unified and strategic approach to risk management. It emphasizes the design and implementation of effective compliance programs and their practical application and continuous evolution in response to emerging risks. Failure to align with this guidance could result in severe penalties, reputational damage, and loss of stakeholder trust.

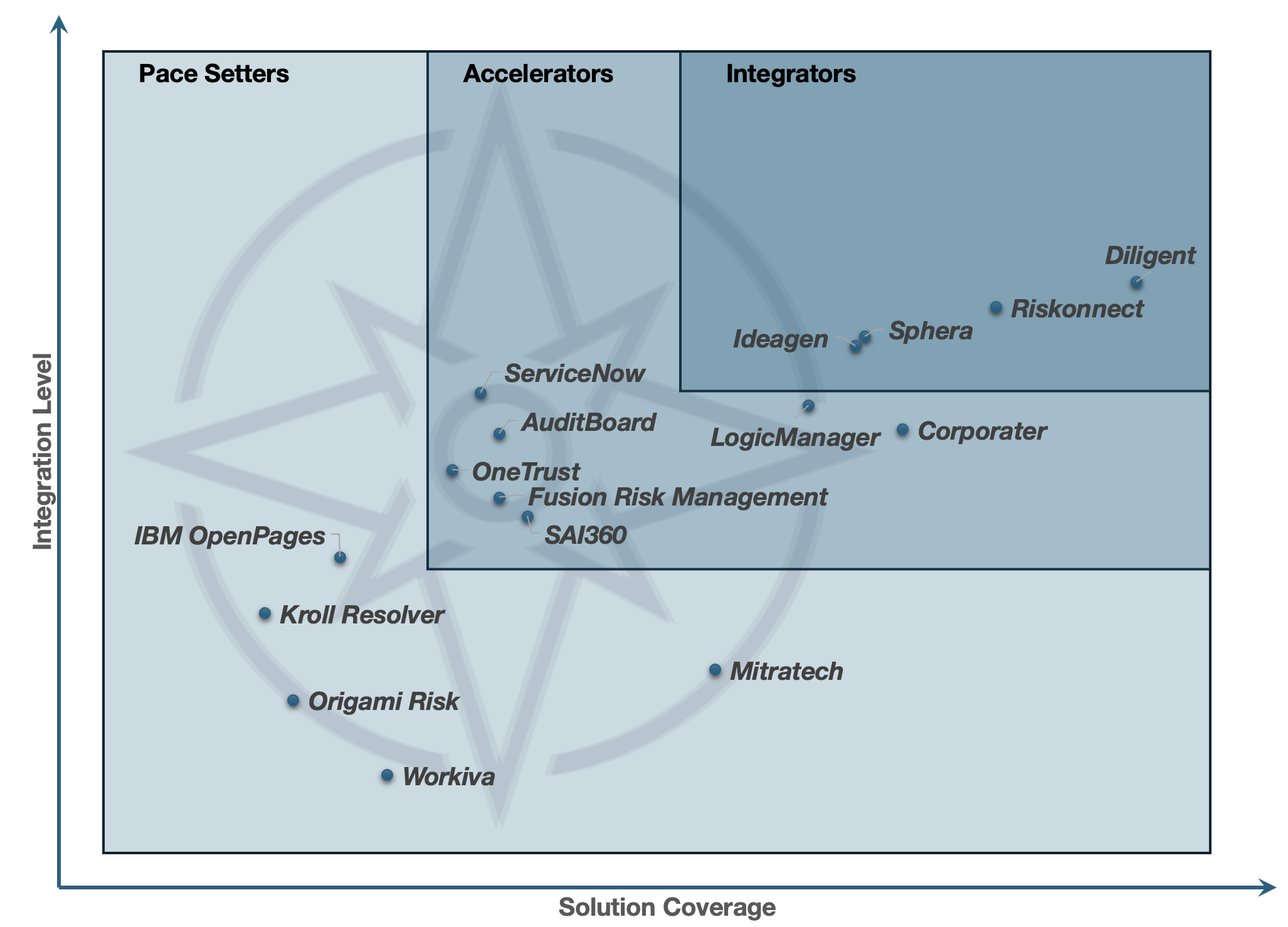

Unlocking the IRM Market: A Deep Dive into the 2024 IRM Navigator™ Buyer Persona Guide

In the rapidly evolving technology market landscape of Integrated Risk Management (IRM), understanding the intricacies of buyer personas is paramount for technology providers aiming to make a significant impact. The recently published 2024 IRM Navigator™ Buyer Persona Guide for Integrated Risk Management (IRM) by Wheelhouse Advisors emerges as a crucial resource for Chief Marketing Officers (CMOs), Chief Product Officers (CPOs), and business leaders. This comprehensive guide dissects the complex IRM market and offers actionable insights to tailor strategies effectively.

AI Agents: Steering Integrated Risk Management into the Autonomous Era

The Integrated Risk Management (IRM) market is on the brink of a significant transformation, projected to expand from $56.1 billion in 2024 to $133.2 billion by 2031, boasting a compound annual growth rate (CAGR) of 11.4% according to Wheelhouse Advisors. This explosive growth underscores the escalating demand for advanced risk management solutions.