Click here to access subscription content at The RTJ Bridge - The Premium Version of The RiskTech Journal

〰️

Click here to access subscription content at The RTJ Bridge - The Premium Version of The RiskTech Journal 〰️

The RiskTech Journal

The RiskTech Journal is your premier source for insights on cutting-edge risk management technologies. We deliver expert analysis, industry trends, and practical solutions to help professionals stay ahead in an ever-changing risk landscape. Join us to explore the innovations shaping the future of risk management.

Strengthening Audit Committee Oversight with Integrated Risk Management

Audit committees are under increasing scrutiny as the complexity and scope of risks facing organizations expand. The 2024 Audit Committee Transparency Barometer from the Center for Audit Quality (CAQ) highlights a growing demand for greater accountability in overseeing financial reporting and emerging areas like cybersecurity and Environmental, Social, and Governance (ESG) risks. To meet these demands and build investor confidence, audit committees must shift toward more strategic and integrated approaches to risk management.

Wheelhouse Advisors' 2025 Predictions: Integrated Risk Management Becomes Non-Negotiable

Risk managers are now more involved than ever in integrating Enterprise Risk Management (ERM) with other risk domains and the business at large. However, the accelerating demands of AI introduce complexities that cannot be ignored. Integrated Risk Management (IRM) technology emerges as a critical tool, providing greater visibility and understanding of risks to drive actionable change.

Transitioning from Fragmented GRC to Integrated Risk Management: A Path Forward

The IRM approach replaces the traditional, siloed GRC model with a unified framework. By transitioning to IRM, organizations can enhance strategic decision-making, increase operational efficiency, and gain a complete view of risks across the enterprise. This transition is not just about adopting a new framework; it's about unlocking the value of risk management as a strategic asset.

ServiceNow and Salesforce Enter the AI Agent Arena: Paving the Way for Autonomous IRM

In my previous article on Autonomous Integrated Risk Management (IRM), I explored how AI agents are driving IRM into a new era of automation. With industry leaders like ServiceNow and Salesforce making significant strides in the AI agent market, we are witnessing a transformative moment for business technology. These advancements signal a shift in automation capabilities and present a massive opportunity to develop AI agents specifically for autonomous IRM capabilities.

Navigating IFRS S1 and IFRS S2: A Pathway for Integrated Risk Management and Sustainability

As sustainability reporting becomes increasingly critical for businesses, preparers are faced with new challenges and opportunities. The voluntary application of the International Sustainability Standards Board (ISSB) Standards, specifically IFRS S1 and IFRS S2, offers a framework for companies to disclose sustainability-related financial information, even ahead of regulatory mandates. To support companies, the IFRS Foundation has published Voluntarily applying ISSB Standards—A guide for preparers. This guide published provides companies a pathway to communicate their progress in aligning with these standards, supporting investor decision-making by offering transparent, comparable, and reliable information on sustainability risks and opportunities.

NYDFS's AI Cybersecurity Guidance Explained: An IRM Approach for Banks Nationwide

On October 16, 2024, the New York State Department of Financial Services (NYDFS) issued groundbreaking guidance addressing the cybersecurity risks of artificial intelligence (AI). The guidance highlights the dual-edged nature of AI in financial services—offering unparalleled opportunities for efficiency and growth while introducing sophisticated cyber threats. As AI technologies evolve, so do the tactics of cybercriminals, necessitating a robust and integrated approach to risk management.

The Exponential Growth of Cybersecurity Risks and Their Impact on Business Operations

The recent UnitedHealth hack, as detailed in a Wall Street Journal article today, serves as a stark reminder of the growing scale and severity of cybersecurity threats. UnitedHealth’s ongoing struggle with this breach reveals the broader business risks that companies face when a cyber incident occurs, particularly as the monetary and operational impacts spiral far beyond initial forecasts.

How Integrated Risk Management Aligns with the DOJ's Updated 2024 Guidance on Corporate Compliance Programs

The DOJ's updated guidance is critically important for U.S. companies right now because it underscores the necessity of a unified and strategic approach to risk management. It emphasizes the design and implementation of effective compliance programs and their practical application and continuous evolution in response to emerging risks. Failure to align with this guidance could result in severe penalties, reputational damage, and loss of stakeholder trust.

Unlocking the IRM Market: A Deep Dive into the 2024 IRM Navigator™ Buyer Persona Guide

In the rapidly evolving technology market landscape of Integrated Risk Management (IRM), understanding the intricacies of buyer personas is paramount for technology providers aiming to make a significant impact. The recently published 2024 IRM Navigator™ Buyer Persona Guide for Integrated Risk Management (IRM) by Wheelhouse Advisors emerges as a crucial resource for Chief Marketing Officers (CMOs), Chief Product Officers (CPOs), and business leaders. This comprehensive guide dissects the complex IRM market and offers actionable insights to tailor strategies effectively.

AI Agents: Steering Integrated Risk Management into the Autonomous Era

The Integrated Risk Management (IRM) market is on the brink of a significant transformation, projected to expand from $56.1 billion in 2024 to $133.2 billion by 2031, boasting a compound annual growth rate (CAGR) of 11.4% according to Wheelhouse Advisors. This explosive growth underscores the escalating demand for advanced risk management solutions.

AI's $19.9 Trillion Economic Boost Signals Rapid Growth for Integrated Risk Management

The digital revolution is accelerating, and artificial intelligence (AI) stands at the forefront of this transformation. Released today, IDC's latest research predicts that AI will contribute an astounding $19.9 trillion to the global economy by 2030, driving 3.5% of global GDP. For every dollar invested in AI, $4.60 is expected to be generated in economic value. These findings not only underscore AI's profound economic impact but also highlight the escalating need for robust Integrated Risk Management (IRM) solutions to navigate the complexities that come with such rapid technological advancement.

The Over-Ambitious ESG Push: Why a Risk-Based Approach to Sustainability is Needed

Many companies now face backlash for juggling environmental, social, and governance goals as inseparable. While these are all important, they represent distinct areas that require tailored approaches. A more pragmatic solution is a risk-based approach to sustainability, where environmental objectives are integrated directly into a company's risk management framework.

Risk Transformation Is Accelerating: Why 68% of Companies Are Integrating Risk Management Systems

With 61% of executives anticipating a significant increase in the level of risk over the next three to five years, the need for a more sophisticated and integrated approach to risk management has never been more pressing.

Why Fortune 500 Companies Are Turning to IRM to Tackle AI Risks Head-On

Given the complex and evolving nature of AI-related risks, traditional risk management approaches may fall short. The fragmented and siloed nature of many corporate risk management strategies can make it difficult to get a clear, holistic view of AI risks and their potential impact across the enterprise. This is where Integrated Risk Management (IRM) becomes critical.

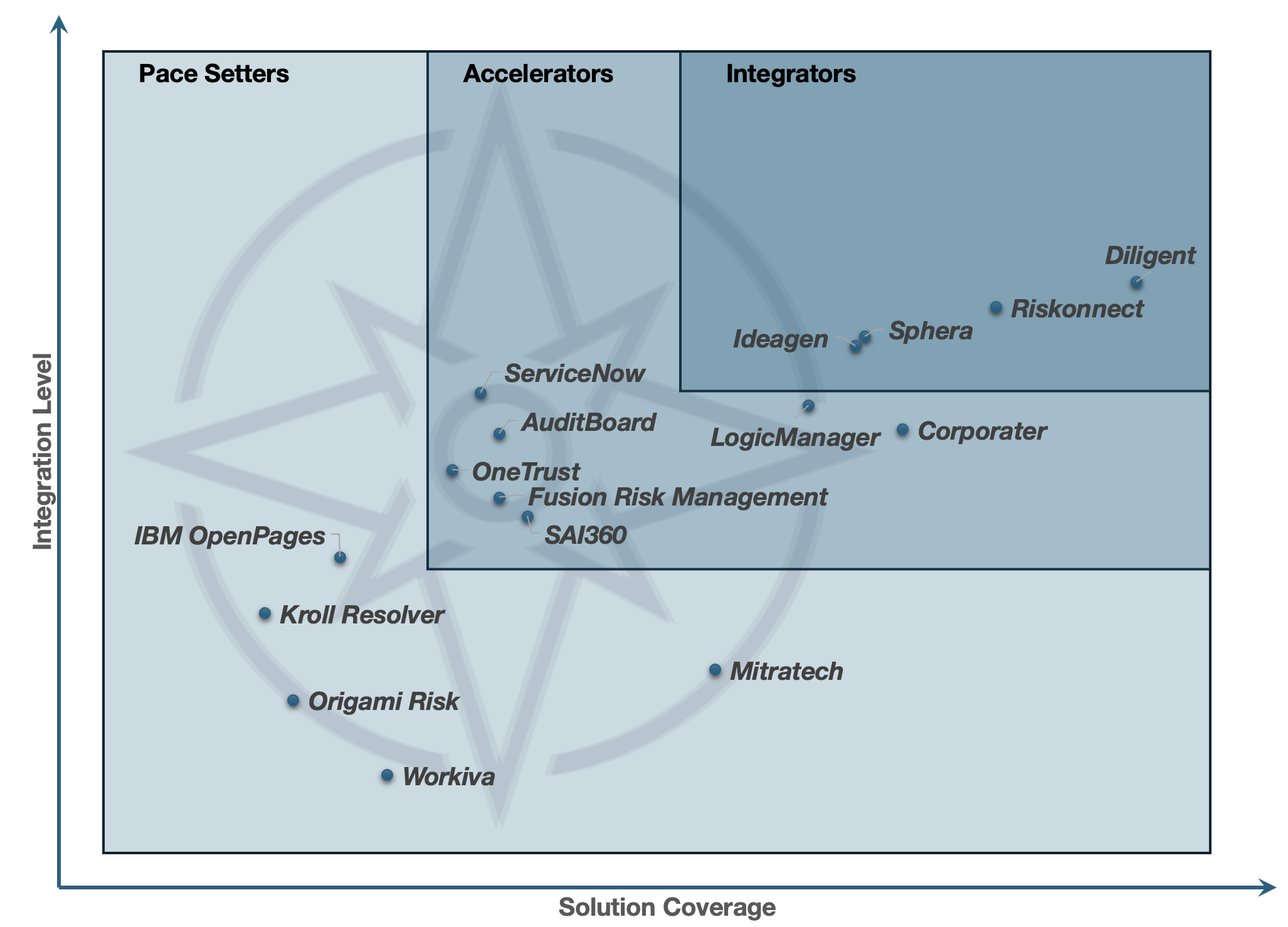

Top 10 Questions Answered in the 2024 GRC Report: Insights from the IRM Navigator™ Vendor Compass

With the IRM market projected to grow to $133.2 billion by 2031 and the GRC segment expected to double, reaching $32.5 billion, understanding this landscape is critical for organizations aiming to stay competitive. To help you grasp the value of this report, here are ten essential questions it answers.

Strengthening Healthcare Resilience: Integrated Risk Management as a Response to the Change Healthcare Cyberattack

The recent cyberattack on Change Healthcare, a pivotal entity in the U.S. healthcare ecosystem, has laid bare the vulnerabilities in the sector's interconnected infrastructure. This incident, which disrupted insurance billing and payments for months, underscores the critical need for a more comprehensive approach to risk management. As the healthcare industry grapples with the fallout, integrated risk management (IRM) emerges as a vital framework to bolster resilience and safeguard against future threats.

Streamlining AI Risk Management with NIST and IRM

The rapid advancement of artificial intelligence (AI) technology has brought about significant benefits and transformative potential across industries. However, with these advancements come inherent risks that must be managed effectively to ensure AI systems are trustworthy, safe, and aligned with ethical standards. The National Institute of Standards and Technology (NIST) has developed the AI Risk Management Framework (AI RMF) to address these challenges. This framework, particularly its recent expansion to include the Generative AI Profile, offers a comprehensive approach to managing AI risks. When integrated with an Integrated Risk Management (IRM) strategy, organizations can achieve a robust risk management posture.

The Siloed Nature of ERM: A Barrier to Comprehensive Risk Management

A recent report by the Association International Certified Professional Accountants (AICPA) and North Carolina State University’s ERM Initiative highlights a critical challenge in enterprise risk management (ERM): its isolation from other risk disciplines. Despite the growing complexity and volume of corporate risks, only 37% of organizations report having complete ERM processes, with 30% rating their risk management “mature” or “robust”.

Beyond Cyber Insurance: Strengthening Risk Management Frameworks

The recent outage caused by a software bug in CrowdStrike's quality-control system has underscored the escalating nature of digital risk events. The disruption, which affected sectors ranging from aviation to banking, has led to insured losses estimated between $400 million and $1.5 billion, according to cyber analytics firm CyberCube. This incident may be the largest single cyber insurance loss to date. Companies must move beyond traditional reactive measures and invest in proactive, integrated risk management (IRM) frameworks encompassing a comprehensive view of potential threats.

How IRM Technology Can Enhance Banking Resilience: Insights from BIS

In his speech titled “An Integrated Approach to a Safer and More Resilient Banking System,” delivered on July 19, 2024, at the Central Reserve Bank of Peru’s 15th Annual Conference in Cusco, Agustín Carstens, General Manager of the Bank for International Settlements (BIS), highlighted the importance of comprehensive risk management in the banking sector. Reflecting on the banking turmoil of March 2023, he underscored how the failures of institutions like Credit Suisse and Silicon Valley Bank (SVB) stemmed from inadequate governance, weak risk oversight, and poor regulatory compliance.